Data Empowerment: How SMEs Can Leverage Big Data for Big Results

Big data isn't exclusive to corporate giants. It’s a common misconception that can leave small and medium enterprises (SMEs) without the means to tap into data’s transformative potential.

Red Flag Alert offers a gateway for SMEs to tap into the realm of data analytics, empowering them with insights for informed decision-making, robust risk management, and strategic growth initiatives.

Let's delve into how SMEs can leverage this powerful tool to navigate their business landscape with precision and agility.

SMEs Big Data Challenge - Why the Worry

SMEs face a pressing challenge: accessing crucial information for informed decision-making, effective risk management, and sustainable growth strategies.

Unlike their larger counterparts, SMEs often grapple with limited resources and access to comprehensive data. The concern deepens when you begin to assess the disparity in data availability, where larger corporations possess the means to source and leverage extensive datasets, leaving SMEs at a disadvantage.

This discrepancy poses a significant hurdle for SMEs striving to compete in an increasingly data-driven marketplace. Without access to relevant data insights, SMEs risk making decisions based on incomplete information, hindering their ability to mitigate risks and capitalise on opportunities.

Being able to address this data challenge is key to enabling SMEs to unlock their full potential and thrive across all aspects of business.

Why do SMEs Need Big Data?

The limitations SMEs face can lead to serious consequences, often felt by everyone within the organisation.

Not utilising big data can be profound, leading to missed opportunities, heightened risks, and less efficient strategies.

SMEs operate in environments where every decision counts and the consequences of uninformed choices can be detrimental to their growth and survival. For instance, SMEs assessing their client base to identify key indicators of financial distress to mitigate risk will need complete information on the state of the businesses.

However, the absence of comprehensive data analysis can increase the likelihood of unforeseen risks and challenges.

SMEs may miss potential threats to their business, such as market shifts, competitive pressures, or financial vulnerabilities, leaving them vulnerable when navigating turbulent waters.

Without access to comprehensive business data, SMEs also risk missing out on valuable insights that could drive innovation, identify emerging trends, and uncover untapped market segments.

This lack of data-driven decision-making leaves SMEs vulnerable to making choices based on intuition or incomplete information, potentially leading to missed opportunities for expansion or investment in the wrong areas.

For example, when considering entering new markets or expanding operations, SMEs will require data on market demographics, consumer behaviour, competitor analysis, and regulatory landscapes to formulate an effective entry strategy.

This extends to the need to know customer preferences, emerging trends, and gaps in the market to effectively identify potential opportunities and tailor offerings to meet customer needs.

Internal strategies are also reliant on accurate and instant data, especially when streamlining operations and reducing costs. SMEs will require access to data on supplier performance, inventory levels, demand forecasts, and logistics efficiency to optimise the supply chain, minimise disruptions, and bolster risk mitigation efforts, whilst improving overall efficiency.

Furthermore, data is key to managing finances effectively and ensuring sustainable growth. Insight into cash flow, revenue projections, profitability analysis, and budget allocation to make informed decisions, identify potential risks, and allocate resources strategically.

In each of these scenarios, access to comprehensive business data enables SMEs to make informed decisions, mitigate risks, and develop strategies that are aligned with their business goals and objectives.

Embracing big data is not just a competitive advantage for SMEs - it's a necessity for survival and sustainable growth in today's data-driven economy. By leveraging big data analytics, SMEs can level the playing field, make smarter decisions, mitigate risks, and unlock new opportunities for success.

Empowering SMEs across Strategic Growth and Risk Mitigation

Red Flag Alert's robust suite of features offers SMEs invaluable tools to drive business strategy, mitigate risks, and foster growth across various fronts.

Refined Prospecting and Personas

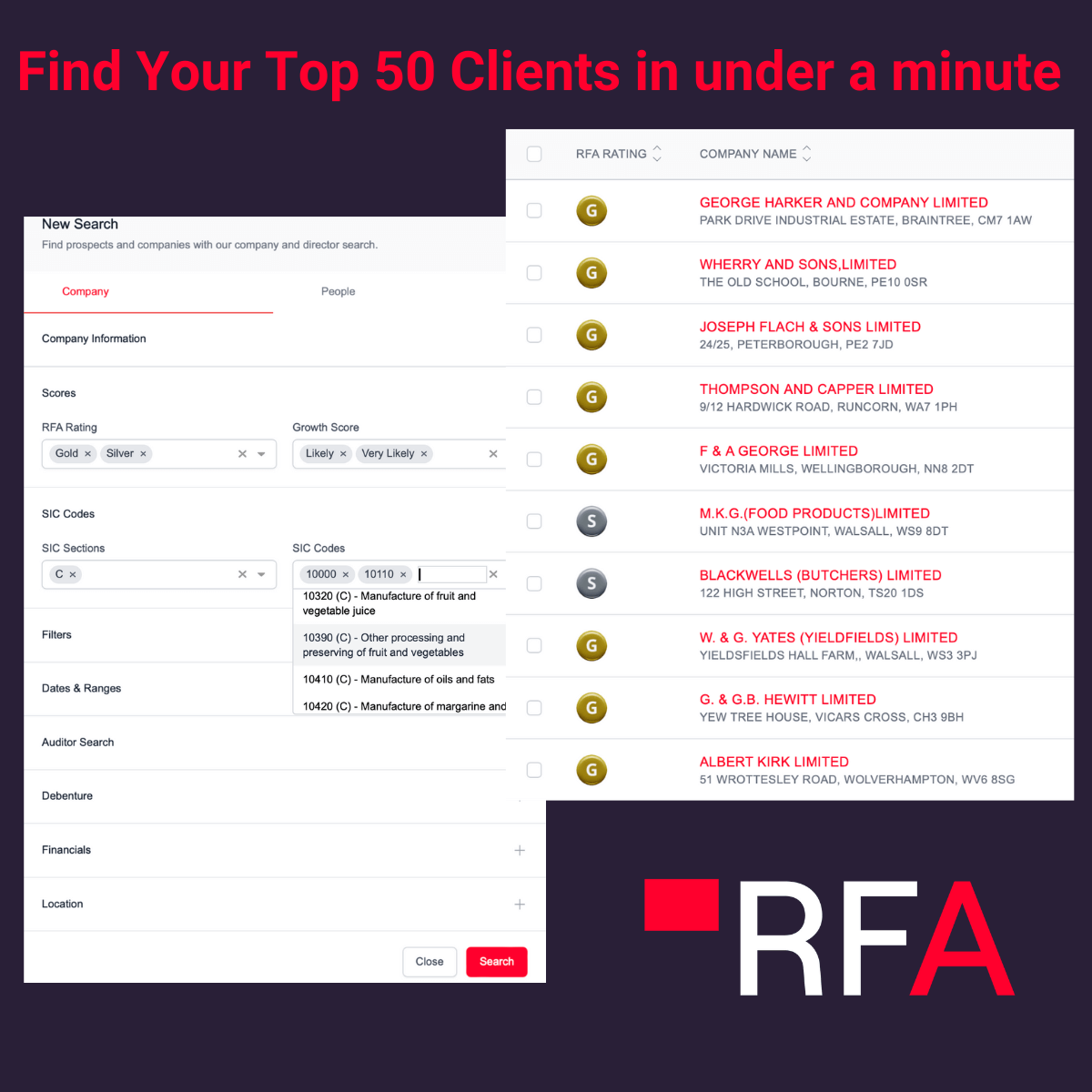

Armed with Red Flag Alert’s comprehensive business-to-business data, any member within SMEs can easily and quickly identify potential clients, partners, and market opportunities, enabling targeted marketing campaigns and strategic alliances that fuel growth.

Time is precious when resources and funding are stretched, so for SMEs, conducting company searches with Red Flag Alert is not only effortless but is easily slotted into ongoing strategies and budgets. SME users can immediately access detailed company information, facilitating market research, competitor analysis, and partnership evaluations to refine their business strategies.

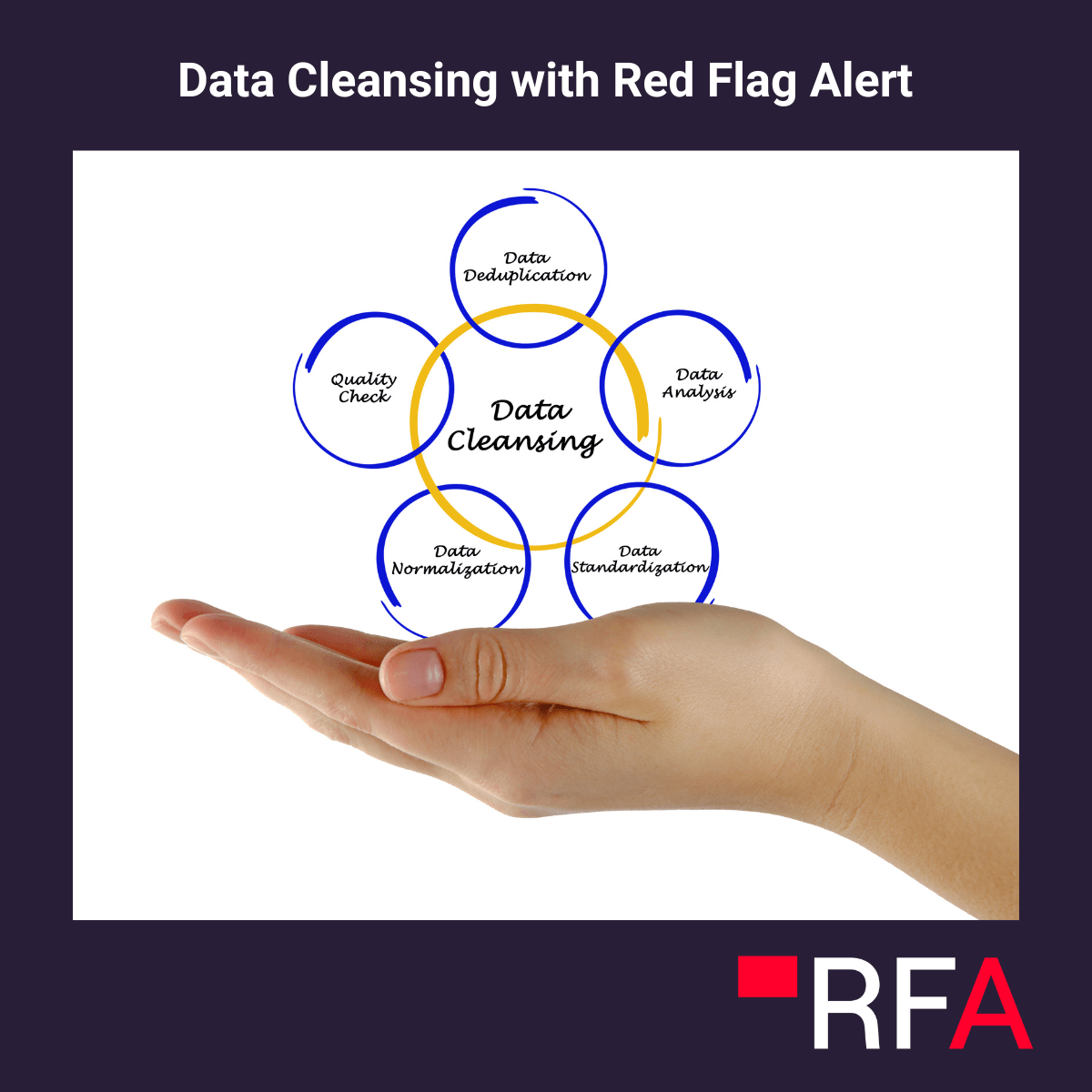

Not only is this data instant, but it is also reliable, drawing in from multiple data sources and consistently cleansed and enriched. SMEs can enhance the effectiveness of their marketing efforts, improve customer segmentation, and make data-driven decisions with confidence.

SMEs are also able to save time and money on interpreting confusing credit scores and financial data with Red Flag Alert’s unique business health score, and Growth Score.

Smaller businesses are often more vulnerable to risk due to their often lower levels of reserves. By leveraging predictive analytics, SMEs can assess growth potential, identify emerging risks and opportunities and pivot their strategies accordingly. Allowing SMEs to leverage insights usually available to only large enterprises and reap the competitive advantages they bring.

Remaining Compliant and Protected

The director search feature enables SMEs to evaluate the backgrounds and track records of key decision-makers. This empowers these businesses to know exactly who to communicate with, allowing for smoother negotiations, and building new partnerships and collaborations with reputable entities, further bolstering their credibility and mitigating operational risks. It also allows

Proactively monitoring media sources for adverse mentions through the Adverse Media feature enables SMEs to protect their brand reputation and mitigate risks associated with negative publicity, thereby maintaining stakeholder trust crucial for long-term success.

The Ultimate Beneficial Owner (UBO) feature plays a vital role in ensuring compliance with regulatory requirements. SMEs can verify the identities of ultimate beneficial owners, safeguarding against potential risks associated with illicit activities or unethical practices.

Beyond beneficial partnerships, SMEs are under the same pressure as their larger counterparts to remain compliant and complete the necessary checks to keep themselves protected.

However, with less time and resources available, these checks quickly become an inconvenience despite their benefits. Red Flag Alert’s company credit checks feature is crucial for SMEs as it allows them to mitigate financial risks by assessing the creditworthiness of clients and suppliers in a matter of seconds.

For SMEs eyeing international expansion, Red Flag Alert’s international credit reports feature is invaluable. It equips them with essential information on overseas partners, enabling secure transactions and minimising risks associated with cross-border operations.

Red Flag Alert's AML tools also allow SMEs to utilise the benefits of big data with minimal effort, allowing them to follow regulatory compliance measures. By streamlining this process, SMEs can mitigate risk associated with financial crime, fostering trust among stakeholders and ensuring sustainable growth.

Similarly, the digital ID verification feature enables secure transactions and regulatory compliance as SMEs verify the identities of individuals and businesses digitally, ensuring the integrity and legitimacy of their operations and transforming previously exhaustive onboarding processes.

Additionally, features such as Insolvency Risk Scoring give SMEs the ability to anticipate and mitigate financial risks by assessing the risk of insolvency among their counterparts, ensuring proactive measures that safeguard against disruptions and ensure business continuity. Red Flag Alert maintains the UK's leading insolvency risk score with an accuracy rating of 92%.

SMEs benefit from features like enhanced due diligence, which empowers them to conduct comprehensive due diligence on potential partners and clients. This mitigates risks associated with fraud, corruption, and unethical practices, fostering trust and stability in business relationships.

Choose the Power of Data With Red Flag Alert

Are you an SME ready to harness the transformative power of big data? It's time to debunk the misconception that big data is only for corporate giants and seize the rewards it offers.

Red Flag Alert offers a gateway for SMEs to tap into the realm of data analytics, empowering them with insights for informed decision-making, robust risk management, and strategic growth initiatives.

Access your free trial and begin feeling the impact of instant, reliable business data today.