UK Company Credit Checks

When your customers default on their invoices it puts your business at risk. Accurate company credit checks are vital.

Understanding the financial health of potential customers enables you to make informed credit decisions and control your company’s risk exposure.

Red Flag Alert allows you to conduct fast and accurate credit checks on any company thanks to its real-time data and detailed financial health scores.

9000

users worldwide

120000

updates per day

25

years' experience

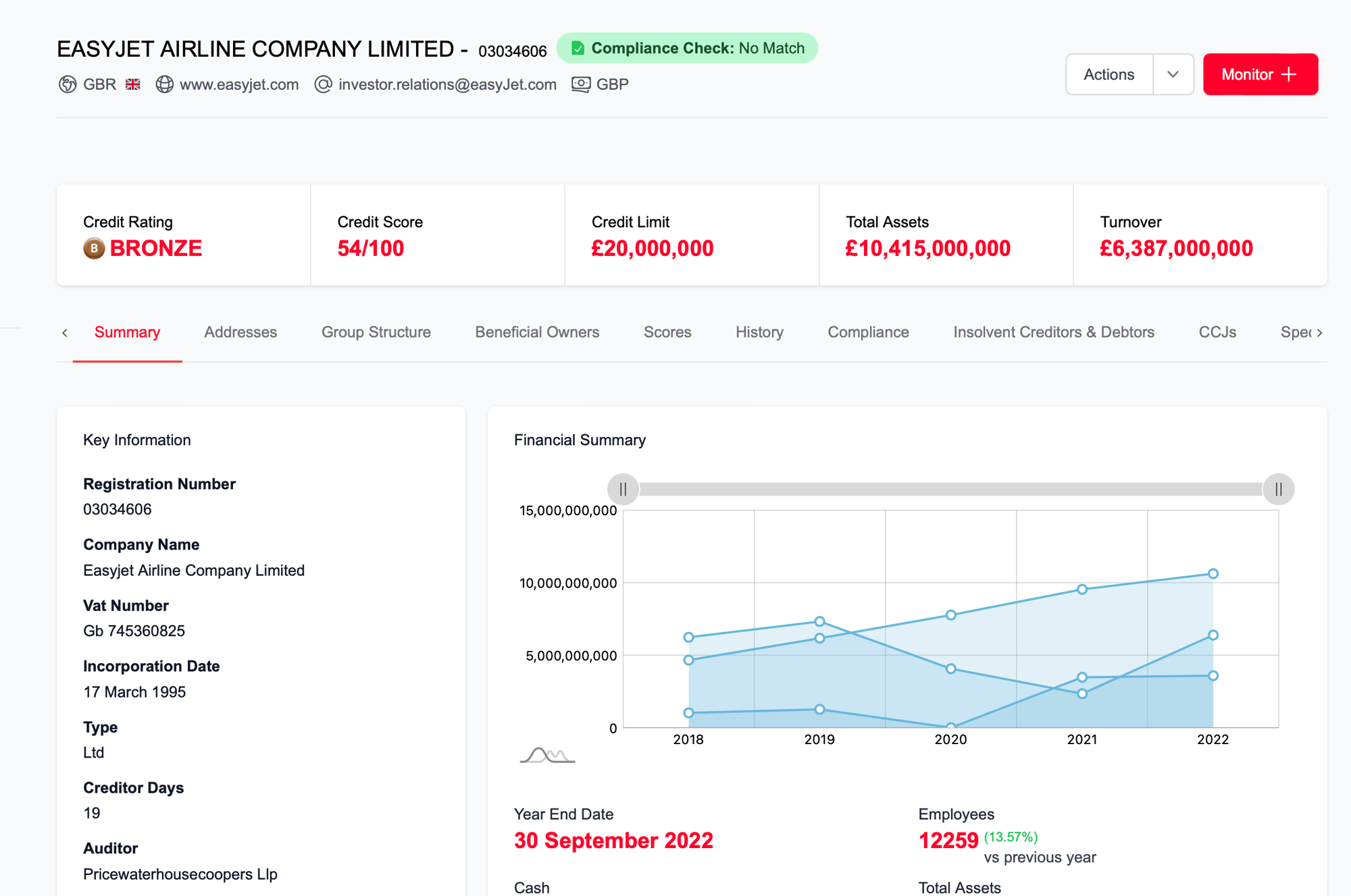

Credit Check Any UK or International Company

Red Flag Alert collects and enriches detailed data on every UK and international business.

Our credit checks provide accurate insights into the financial health of these companies.

Instant Access

Our API plugs into your CRM, giving you instant access to detailed, accurate company financial health information. This allows your team to quickly make well-informed credit decisions.

Real-Time Alerts

Most credit scores use out-of-date information. Our data is updated in real-time, allowing you to make better credit decisions. Set up alerts and you’ll immediately know when your customers’ creditworthiness deteriorates.

Reliable Data

Our credit scores use over 100 data points for every UK company. These include factors such as number of CCJs, date of latest accounts filed, cash on balance sheets, P&L account reserve and much more.

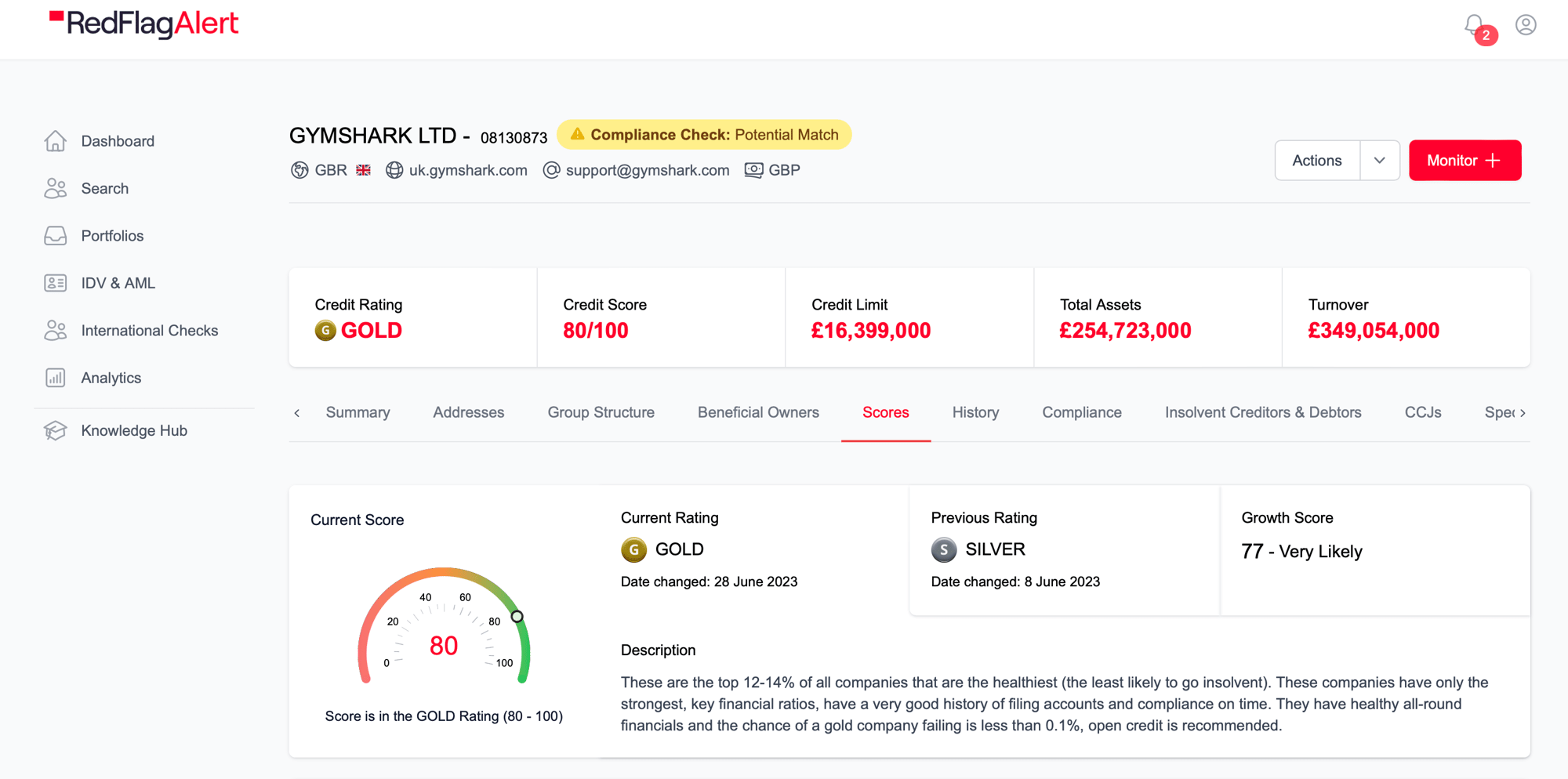

Clear Credit Ratings

We assign every business a rating, including gold, silver and bronze for healthy companies and one, two or three red flags for businesses at risk of failure. This allows you to take action to protect your company from financial risk.

Predictive scoring

Our scores are calculated by an innovative AI algorithm that uses 20 years of business data to predict each company’s future financial health.

Red Flag Alert creates sales lists that only include companies that would pass your credit checks. This means sales only pursue financially healthy companies.

This avoids wasting time pursuing customers that fail a company credit check at onboarding, and creates a smoother customer experience.

What’s Included in Red Flag Alert’s Business Credit Rating Reports?

Our company credit scores provide the following information on each company.

- Financial health rating

- Red Flag Alert rating description

- Recommended credit limit

- Number of CCJs

- Liquidity

- Net worth

- Number of employees

- Turnover

- Accounts filed

- Last Red Flag Alert data update

- SIC code and description

- Company details

- Contact details

- Director details

Listen to how we have helped our customers

We love working closely with all our customers, helping them integrate and use data in their businesses. Hear what some of them say.

“Allows us to evaluate our customers credit score – particularly given the energy crisis... there has been a lot of value-added solutions they’ve brought to our sector. We want to make sure our customers are around in the next 2/3 years because our business projects itself on renewals.”

KI

Exchange Utility

“Real time data is important when it comes to winding up petitions or legal action... looked at an account and it will say it was fine on Creditsafe but the next day there’s a problem. RFA gets their court information long before, every 15 minutes from the London Gazette. It is more current which helps us out... we are more confident rejecting slightly earlier.”

MH

Parker Steel

How It Works

Red Flag Alert’s credit scores follow a simple three-stage process.

1. Enter company details

Search for the business on Red Flag Alert and click on their registered company name.

2. Identify risk

You’ll be presented with a credit report including a risk rating and credit limit recommendation.

3. Make a decision

You can approve or reject the company depending on whether it meets your credit threshold.

Start Protecting Your Business from risk with the UK's number one insolvency score

One of the biggest risks facing a business today is taking on bad debt. With a company that has recently taken on a bad debt being three times more likely to fail than one who has not.

Credit risk processes are some of the most important when it comes to safeguarding your company's financial future.

Best in class risk processes need best in class data and Red Flag Alert are the experts at not only accurately assessing business financial health and risk, but delivering this as clear and actionable data that needs no specialist knowledge to understand.

- Trust in the UK's leading insolvency score

- Reports on all UK businesses

- Credit score and unique Red Flag Alert Health Rating makes understanding level of risk easy

- Live data feeds

- Unadvertised petitions

- Full company history

- Easily unravel complex group and ownership structures

Get Started

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at anytime. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, check out our Privacy Policy.

Why Choose Red Flag Alert?

Boost Your Sales

We help sales teams find leads by creating lists of companies that fit your ideal customer profile and risk tolerance.

Our database has over 120 filters including sector, geography, turnover and number of staff. This allows you to precisely target the type of company you approach.

Stay Compliant

We ensure you stay compliant with the latest GDPR, anti-money laundering (AML) and know your customer (KYC) regulatory requirements. Connecting our API to your CRM immediately ensures you have the latest customer data to perform effective due diligence.

Free Company Report

Just looking for a Company Snapshot?

Enter a company name and click Free Report to see:

- Credit Rating

- Accounts

- Key Financials

- Key Contacts

Knowledge Base

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more