At Red Flag Alert we are passionate about data and how we can empower our customers to do better and safer business. This has led us to be the industry leaders in accurately analysing and reporting company financial health, as well as predicting future growth and insolvency (which we do with a unmatched 92% accuracy rate).

But we are just as passionate about demystifying data and pioneering new and innovative ways our customers can interact with it and gain additional insights. So that anyone, regardless of if they have financial or risk training, can quickly and easily gain deep and powerful insights into their business space.

This comes from our background in business and understanding the ways businesses work and how their needs that can be solved by our data.

One tool we have introduced to do this is our Analysis tool. This allows our customers to choose any given group of businesses and instantly see the opportunity and risk possibilities within them, all with a single click of a button.

Below we will look at some of the ways that Red Flag Alert Analytics can help you unlock the potential in your business and marketplace.

How to better understand your clients and where your business excels

Most directors will assume they understand their client base and where the sweet spot for their product offering is; but this is usually not based on any empirical analysis and can range from completely inaccurate to preventing the discovery of areas you sell well to but do not actively target.

This can result in a tightening of the ideal customer profile (ICP) but companies discovering they are actually servicing, or are perfectly positioned to service, an unexpected part of the market upon analysing their customers and revenue streams is actually surprisingly common.

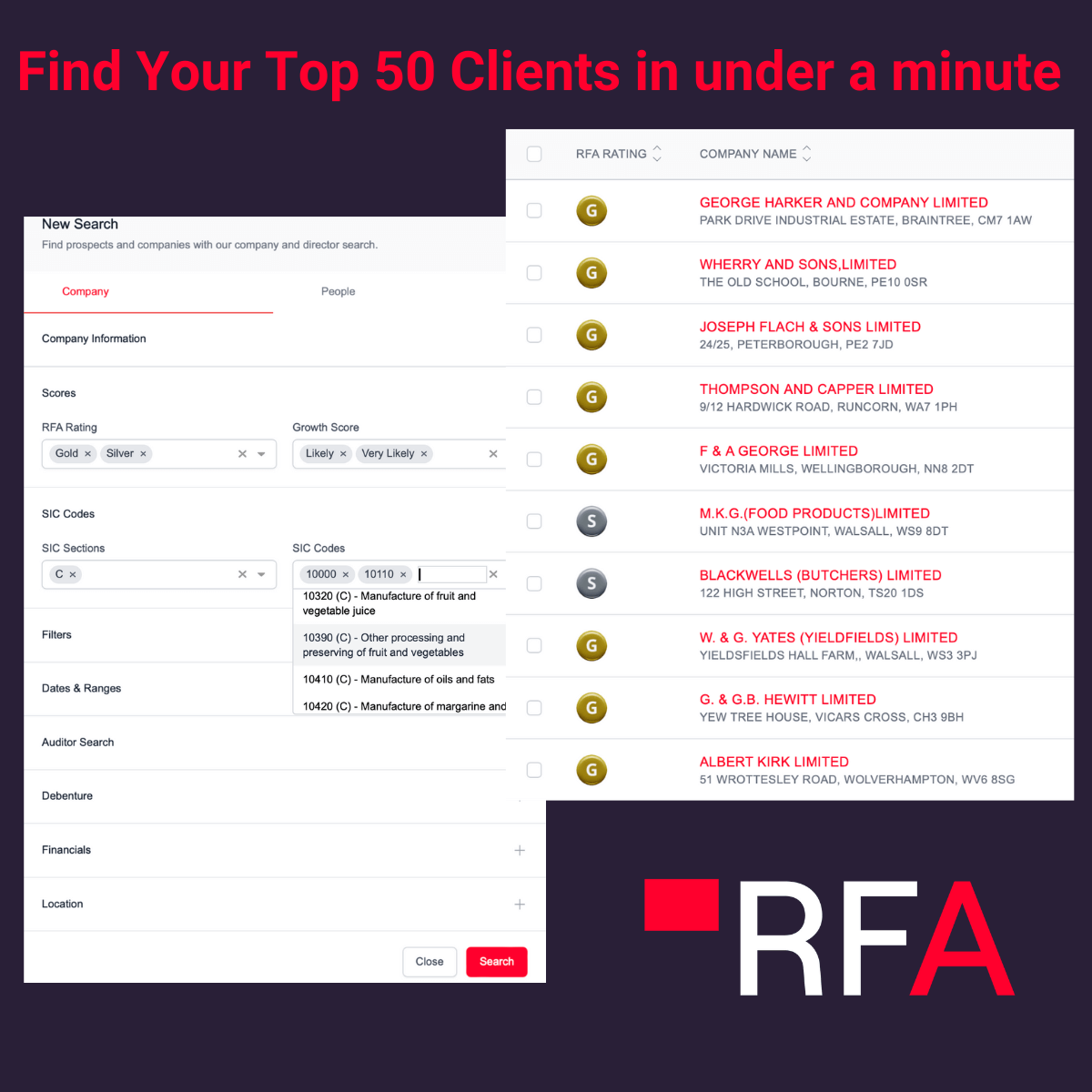

Red Flag Alert Analyse industry breakdown

Famous examples include Youtube’s founding as a dating website where users could post videos of themselves but discovering their primary customers, Playdough discovering that their wallpaper cleaner had a larger potential market as a children’s toy and McDonalds realising their primary source of revenue was real estate.

By uploading your client list into a monitoring list (using our simple drag and drop feature) you are able to run complete risk and opportunity analytics on your clients.

You are able to see:

- A breakdown of your clients by industry

- A breakdown of your clients by financial health

- How turnover has changed over the last five years

- How the average balance sheet has changed over the last five years

- A breakdown of growth potential

- A heat map of client location

- Average days late paying

- Much more

By analysing this information you are able to see where your company is doing best and if this aligns with your current targeting strategies and also if your client book is financially healthy or if you are exposed to the risk of bad debt.

-1.png?width=844&height=387&name=image%20(1)-1.png)

Red Flag Alert Analyse balance sheet summary

For example a company providing IT services to mid-sized companies turning over £2-5 million, but specialising in manufacturing companies, may find that their manufacturing clients do not represent as much of their business as they thought and that furthermore, these companies are generally in financial distress. Whilst on the other hand, discover that their second most common clients are accountants and these have much more solid finances.

With this information they could then start to actively target new customers in the less risky accountancy space and employ targeted marketing strategies to make customer acquisition cheaper but more effective.

This exercise does not need to lead to any sort of major pivot to be successful or worthwhile. By better understanding the levels of distress present in their client base a company is able to see their exposure to risk.

This can help a business understand if they need to try to take on new financially healthy clients and review their credit practices.

Whatever the result of a running analysis on your clients, it is always a positive to have a thorough understanding of them and your offering.

How to better understand your supply chain risk

After years of enjoying efficient and cheap global supply chains companies began to neglect their supply chain management. When COVID struck, the restrictions placed on global shipping resulted in the breakdown of supply chains and these effects are still being keenly felt today.

The result of unpredictable supply has resulted in high failure rates amongst suppliers and an ever reducing capacity to meet the demand of businesses. This in turn is resulting in the failure of these suppliers’ customers as the struggle to find replacement resources available before their business process is interrupted.

-1.png?width=558&height=468&name=image%20(2)-1.png)

Red Flag Alert Analyse RFA rating breakdown

Due to this, supply chain management is becoming increasingly important to businesses. Our platform offers many tools to aid in this; from our advanced B2B Data Tool to our customisable monitoring.

Our Analytics tool is able to give you an instant overview of your supply chain risk by supplying:

- A breakdown of your suppliers by financial health

- How turnover has changed over the last five years

- How the average balance sheet has changed over the last five years

- A breakdown of growth potential

- A breakdown of CCJs

By running this simple check you have all the information you need to understand your current supplier risk, if you need to take any immediate action and a solid foundation to build your supply chain risk management strategy on.

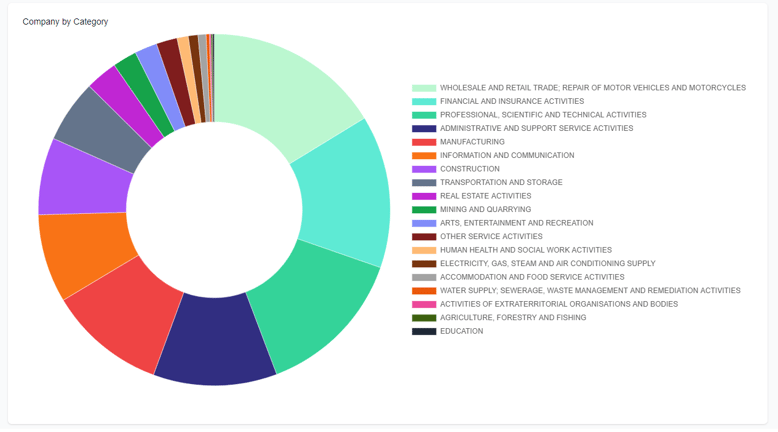

How to understand your marketplace

Few directors have visibility over every company that fits their ICP, let alone the levels of potential risk or opportunity they contain. Without this information, strategy has to be constructed on a substantial amount of guesswork which commonly results in unoptimised strategies that rely on false assumptions.

For example, if a business has strong plans for growth and is preparing to invest heavily to achieve this, they need to know if there is enough potential business to be won within their ICP to fuel that growth.

If there is not, then they need to broaden their targeting to or else risk failing to generate the revenue needed to grow.

.png?width=211&height=342&name=image%20(3).png)

Red Flag Alert Analyse summary of analysis cohort

Our B2B Prospector Tool allows you to use over 100 filters to define all aspect of your marketplace and then use Analytics to understand the risk and opportunity there.

Companies can use this as stated in the example to understand the potential business available in their ICP, to see the levels of business distress and potential risk of bad debt they are exposed to, if there are lucrative adjacent marketplaces that can be easily targeted etc.

.png?width=562&height=336&name=image%20(4).png)

Red Flag Alert Analyse growth score breakdown

Our database includes every company in the UK and gives complete visibility over every marketplace so whether you are trying to strategise for the short, mid or long term you can do so on rock solid data and whilst in possession of the complete picture. This allows you to make better decisions and gives a significant competitive advantage over those operating on assumption and guesswork.

Traditionally the ability to run these analytics and have this amount of oversight has been reserved for only the biggest and most well-funded companies, that could afford to employ a full team of analysts.

Red Flag Alert Analytics gives directors of any sized business access to rich insights and rock solid data on which to make decisions and build strategies.

This is just one of the tools provided by the Red Flag Alert platform that allow you use data in new and innovative ways to unlock your businesses potential.

If you would like to see exactly what Red Flag Alert can do for your business and gain advantages over your competitors, request price today.