The credit checking sector is dominated by a handful of well-established large players. These companies have stuck to the same tried and tested systems for years or even decades.

Red Flag Alert has the same industry-leading expertise; however, our agile approach means that we’re continually improving our data analysis without disruption to customers.

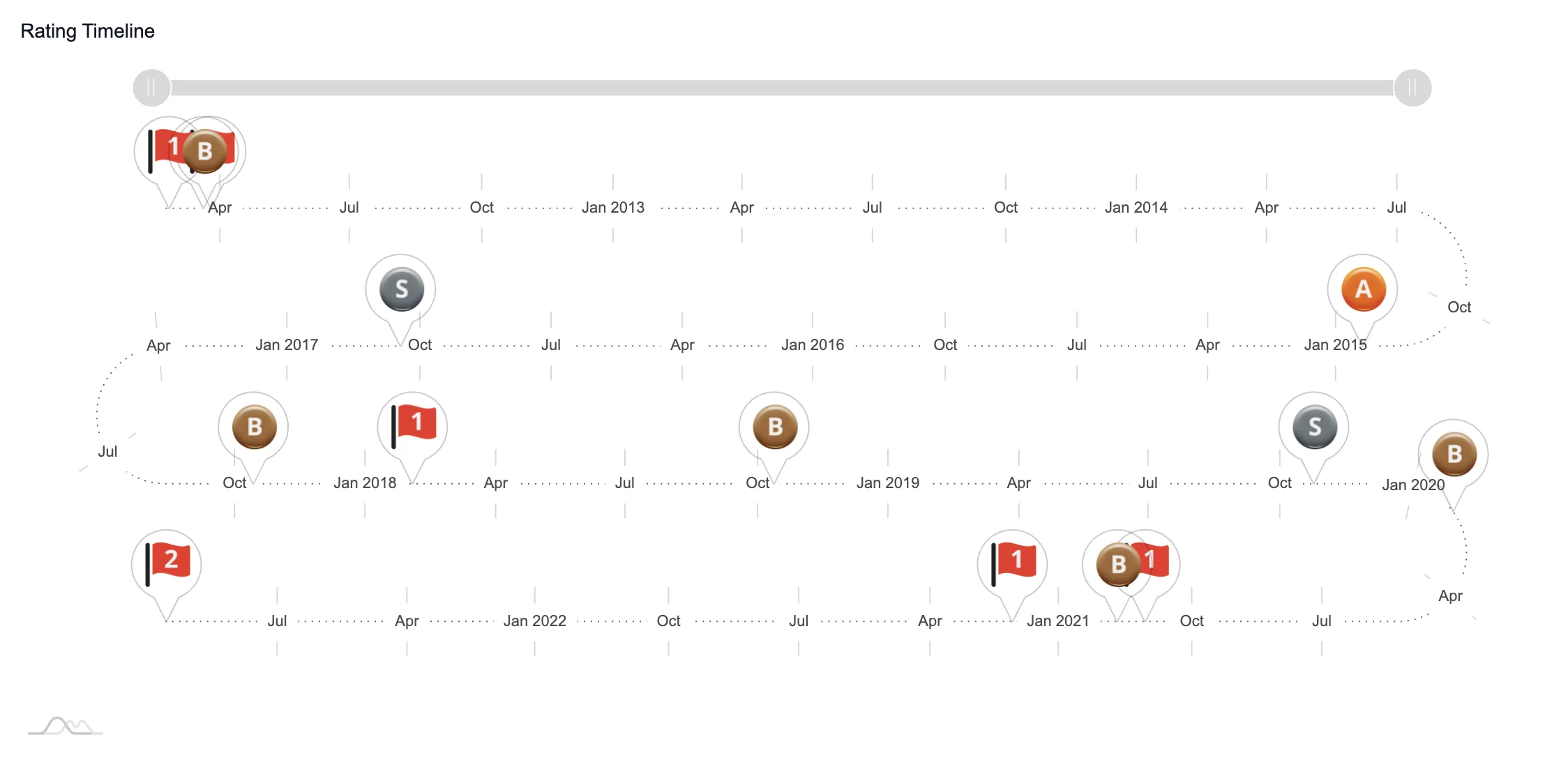

Constant innovation and regular updates keep our customers on the cutting edge of business financial health data. That’s why we’re confident that we offer the UK’s best insolvency scorecard.

In this article, we’re going to look at what makes us different and the benefits that our customers enjoy.

Insights for Accurate Scoring

Red Flag Alert uses an innovative machine-learning algorithm to generate health ratings. Here are just a few of the advanced techniques we use to calculate these scores:

Fixed charges: Fixed charges are when company owners or shareholders are the first to be repaid in the event of an administration.

It’s a serious warning sign when business directors are not willing to invest in their own business – in fact, companies that have fixed charges are almost three times more likely to go out of business than those which don’t.

Changes to accounting periods: Accounting period changes are a common precursor to administration.

Businesses under financial strain often lengthen and then shorten these periods to avoid filing accounts that reveal the scale of their difficulties – this usually happens shortly before going into administration.

Liquidity ratios: The value of a company’s stock is often subjective, depending on market factors.

We use a liquidity ratio that discounts stock, giving a more balanced picture of the company’s financial position.

Creditor Services: Our Creditor Services feature shows you companies that are entering administration and the unsecured creditors that will be left with unpaid invoices.

The scale of any bad debt is put into context of each company’s situation to indicate whether it can survive the financial shock.

UAPs: Unadvertised Petitions are winding up petitions that don’t get publicised in The Gazette.

Our data comes directly from court records and, therefore, accounts for all legal action taken against businesses.

Micro entities: Micro entities are small businesses that are exempt from filing detailed accounts, which can make it difficult to assess their financial position.

Our algorithm can input what little information is available in the context of the company’s current situation to arrive at a credit score.

This information includes VAT registration, balance sheets, late filing of accounts and any bad debt the company may have.

Constant Evolution

Unlike some of our competitors, we are constantly evolving our system using the latest cutting-edge technology.

We continuously strive to provide the most up-to-date and accurate UK business data – which is why we’ve spent the last two years developing Red Flag Alert 2.0.

Red Flag Alert 2.0 offers our customers even more value and provides a range of new features, including:

Improved navigation and design: We’ve enhanced the user experience, making RFA 2.0 intuitive and straightforward.

Better visualisations: Data can be presented in a range of graphs, allowing you to quickly spot trends.

More detailed search: We’ve made it easier than ever for you to find company data by adding new filters on factors such as turnover, employee numbers and profit.

More specific segmenting: Our advanced filtering system enables you to build precise customer segments and find more relevant companies.

Identify more events: Our advanced data and additional filters enable detailed multi-variable searches – allowing you to spot more adverse events at customer businesses.

LinkedIn integration: Speed up your prospecting by searching LinkedIn profiles with just one click.

Real-time insolvency data: We provide the latest creditor services data on £4bn of bad debt caused by company administrations.

Precise SIC codes: We’ve made 1.4m SIC codes more specific using our AI algorithm.

Direct access to Companies House: Our integration with Companies House allows you to read documents from its register in RFA.

Even faster data: We help you identify risk faster by integrating CCJs on the same day.

More prospects: We’ve added 8 million new contacts, giving you more visibility on key decision-makers, including 1.2 million new email addresses.

Enhanced scorecard: New data has made our financial health ratings even more accurate.

Discover how Red Flag Alert’s experienced team can help you mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?