View the financial health of businesses in seconds with Red Flag Alert

Credit Check Companies in the UK and Abroad

Gain valuable insights into the businesses you're dealing with, locally and globally.

Uncover clear vital data in just a few clicks

Find global business insights and clear in-depth reports with our powerful platform.

With a diverse & unique range of datapoints on UK businesses, the RFA platform uses various sources to enable its users to run UK and global credit checks.

- Worldwide coverage

- Market Leading Insolvency Score

- Financial Analysis

- Insolvent Creditors & Debtors Data

- Rating & Event History

- LinkedIn Integration

- Ultimate Business Ownership

- Credit Rating & Limits

9000

global users

120000

updates per day

25

years' experience

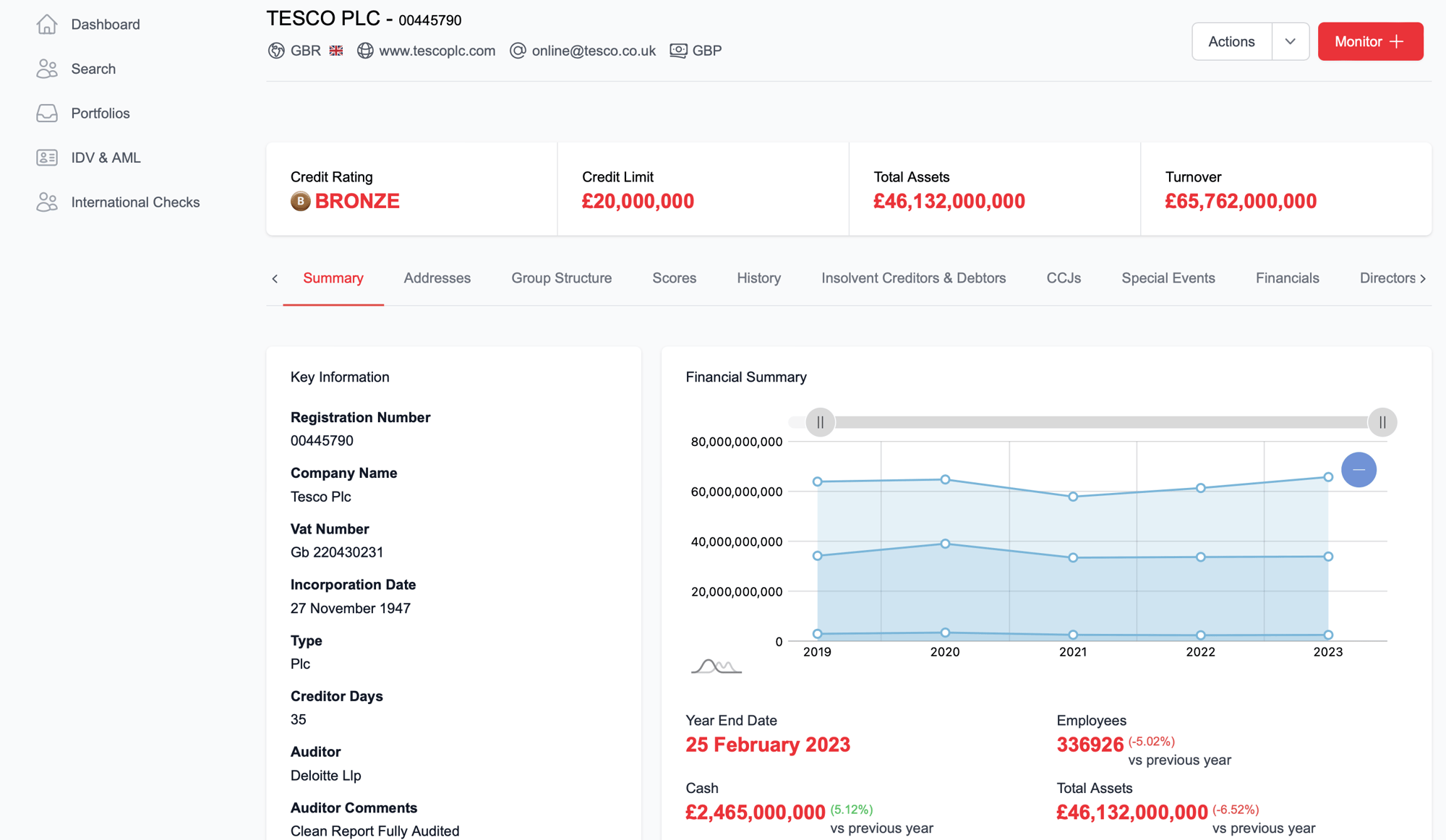

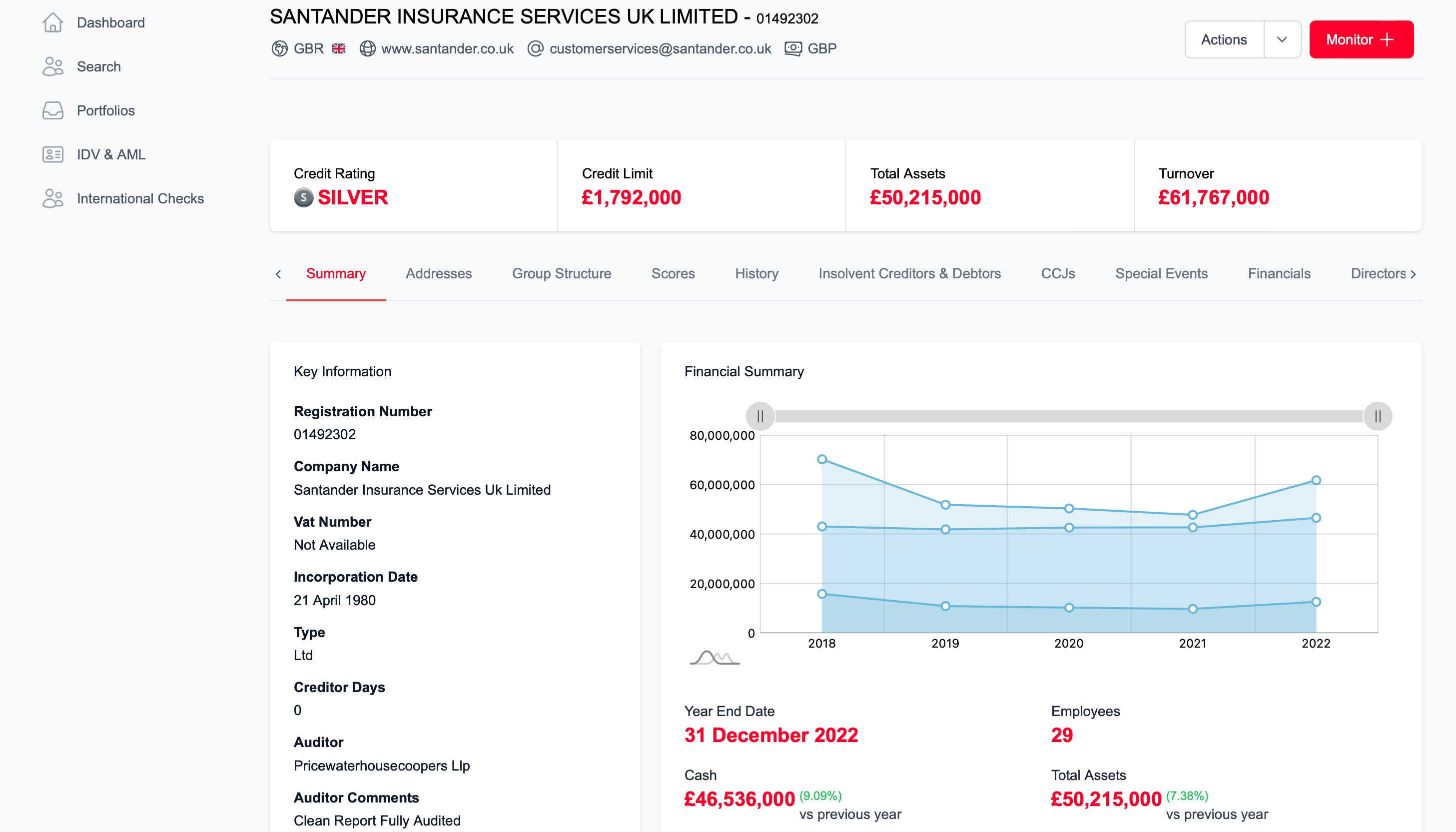

Gain a thorough understanding of the financial health and history of any business, to complete a thorough risk assessment.

Stay one step ahead with our cutting-edge tools and comprehensive database, with easy to understand visualisations. Confidently make informed decisions to drive success, and access the financial standing of every UK business.

- Entire History

- Market Leading Insolvency Score

- Over 9,000 global business users

- 25 years' experience in business intelligence

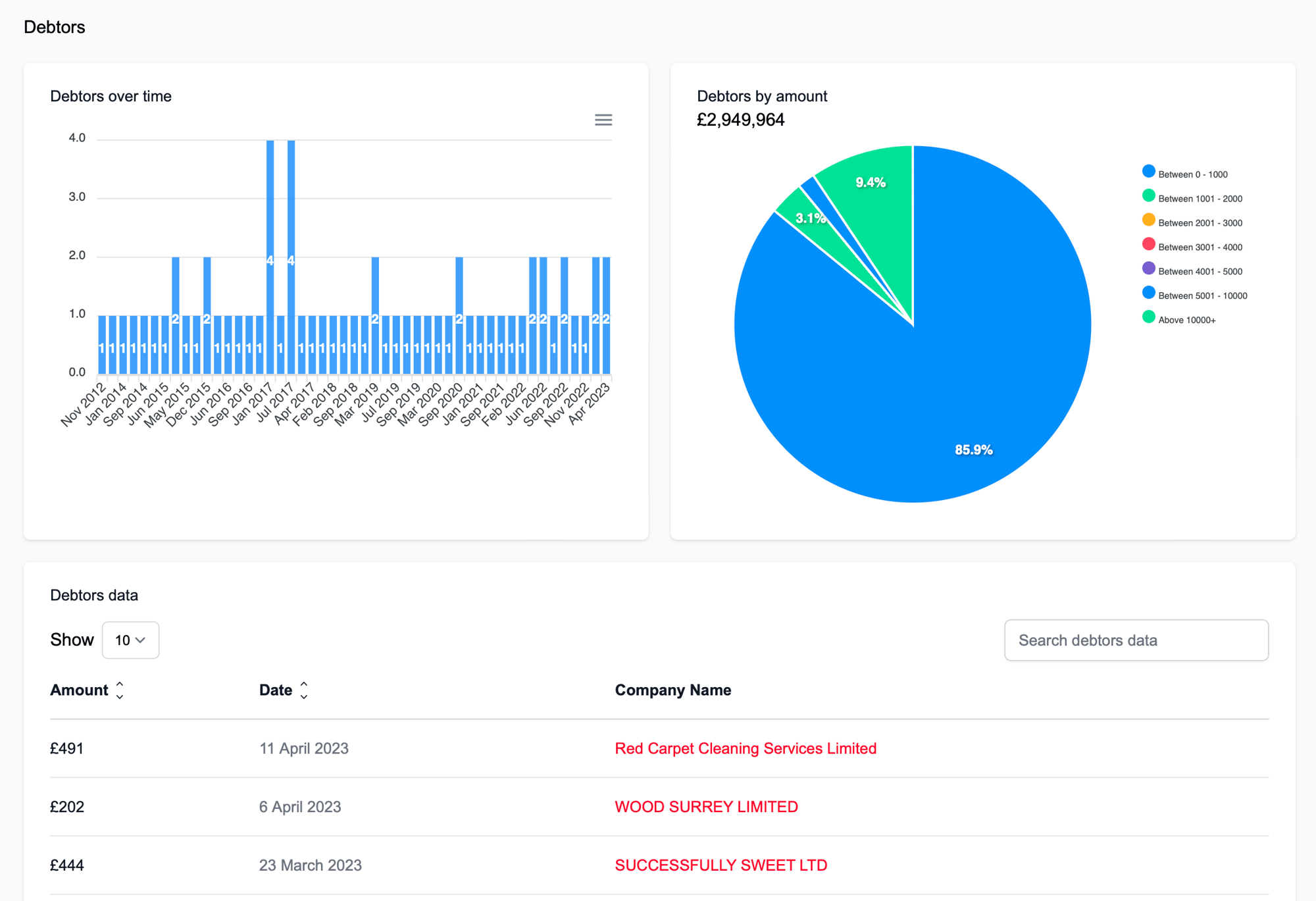

Insolvency Creditor & Debtors

Uncover the bad debt that could impact your business

Protect yourself from the risks of bad debt by undertaking due diligence on any business that you work with. Unlock the power of our vast database from trusted sources, allowing you to conduct thorough checks on any company in the UK in seconds.

Understand the financial history of an organisation and mitigate risks, and gain valuable insights into your potential customers, suppliers or partners.

Over1000+ UK businesses

trust in Red Flag Alert including…

REAL-TIME DATA

Helping your business with comprehensive, real-time financial information

Red Flag Alert help your business minimise risk by providing detailing financial health data on your clients. The RFA algorithm collates billions of financial data points to help ensure accurate predictions and provide real-time data on businesses across the UK.

Red Flag Alert are a leading UK supplier of credit scoring and decisioning systems, using internationally recognised analysis methods combined with our own algorithm designed by insolvency experts to produce real-time financial health scorecards for over 15 million UK businesses.

Our proprietary creditor services data source gives you valuable in-depth insights into company finances, giving you a clear picture of their financial help and assisting you in setting the right credit terms and take action where necessary to protect your business interests against financially unstable or corrupt organisations.

Get Started

Discover how our platform works by requesting a free trial with our team.

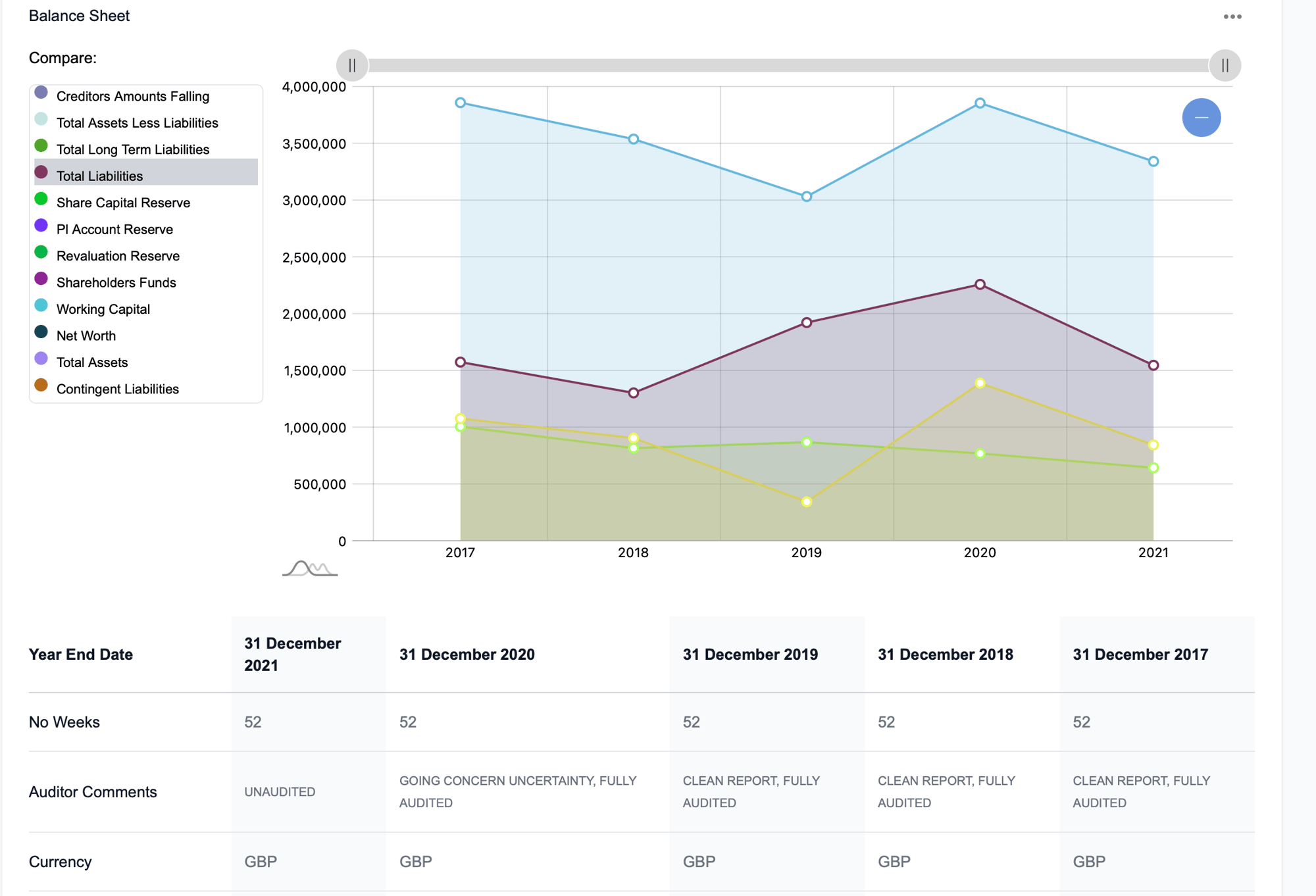

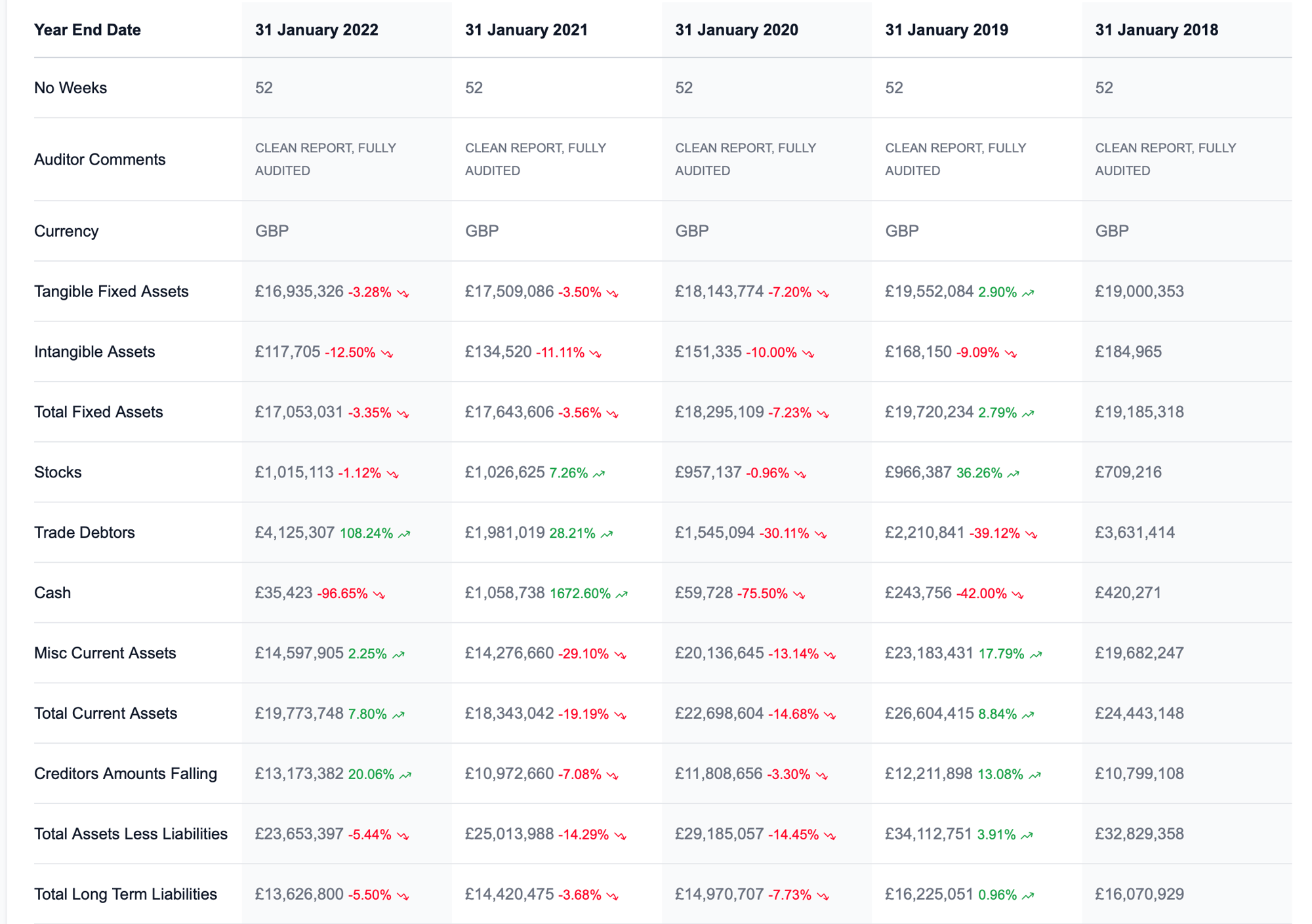

Financial Analysis

Deep dive into the financials of a business

Understand a company’s performance by examining its financials in order to arrive at a decision or recommendation.

Determine its creditworthiness, profitability and ability to generate income, but also provide an in-depth look at how well it operates internally.

- Entire History

- Market Leading Insolvency Score

- Over 9,000 global business users

- 25 years' experience in business intelligence

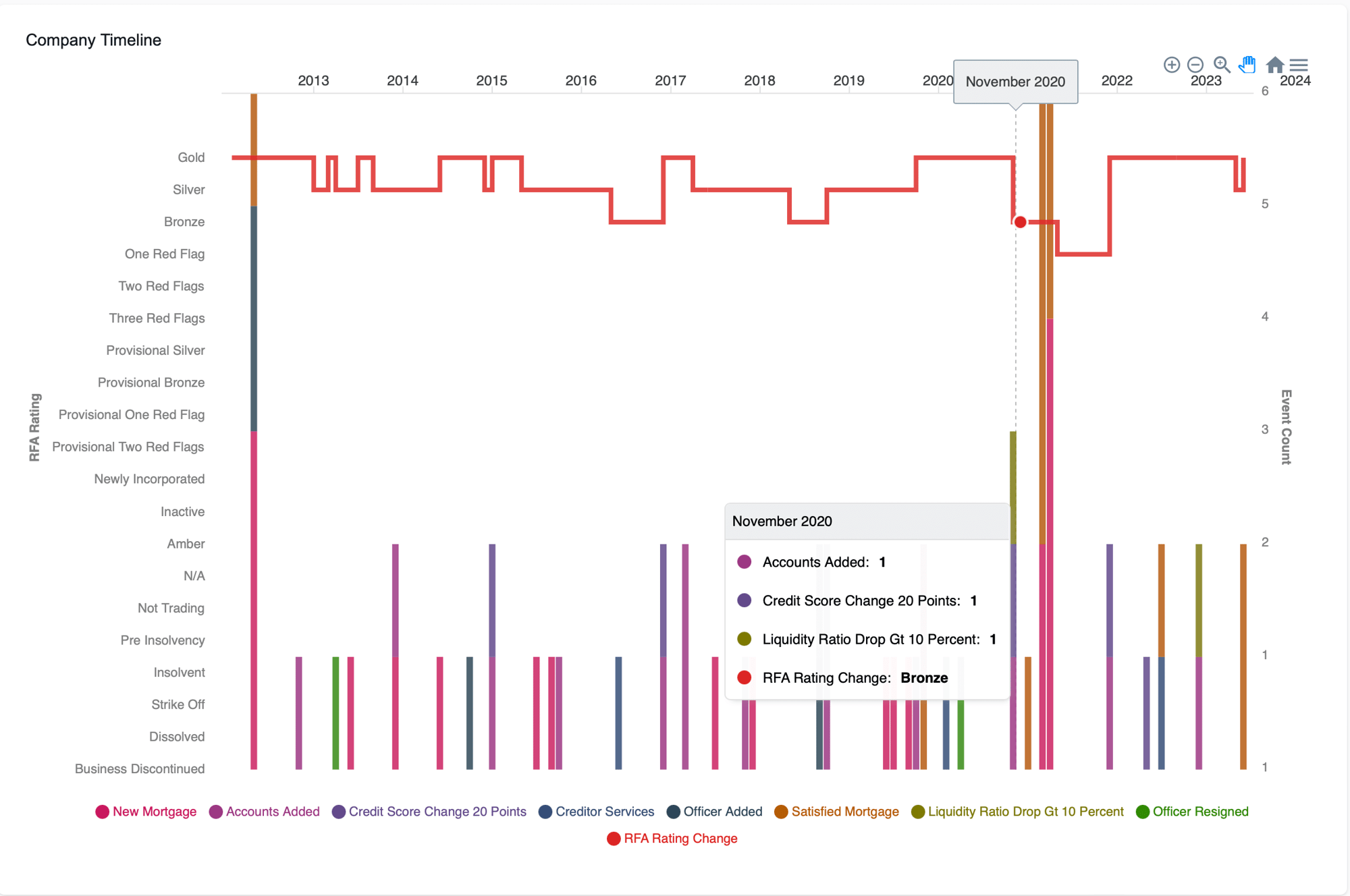

Event data

All business history in one report

See the business events that have led to changes in its health.

Respond quickly to events that happen in the businesses you work with. Understand what impact they have on health and credit limits.

- Entire History

- Market Leading Insolvency Score

- Over 9,000 global business users

- 25 years' experience in business intelligence

How do we help you protect yourself against risk?

Get started on website and landing pages right away with little to no learning curve.

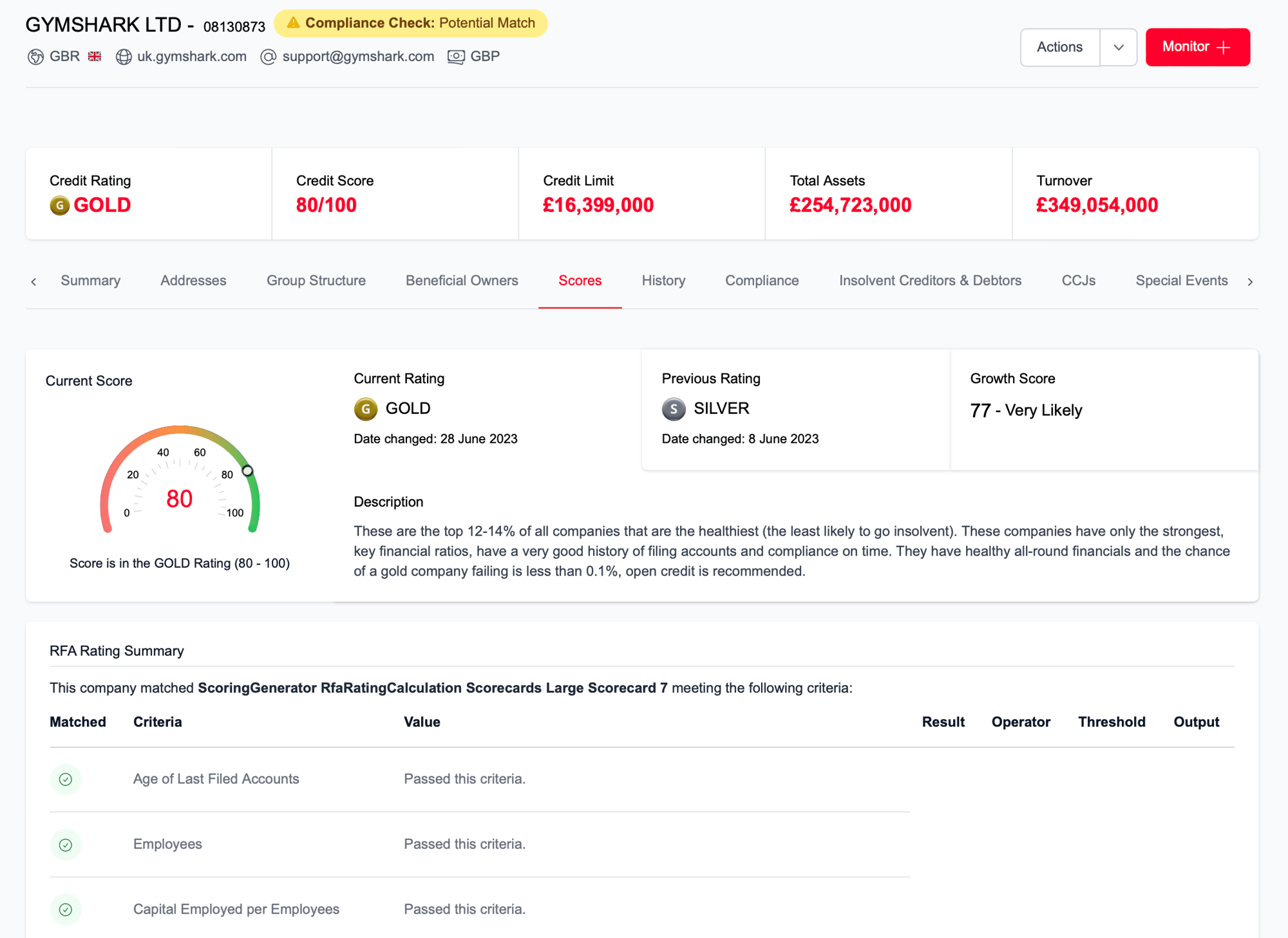

Detailed financial health ratings

We allocate every business a financial health rating that accurately predicts insolvency. Our clients use this to monitor their clients, set credit limits and ensure onboarding is smooth.

Unique expert insight

Our experts are always adding new data points, looking at every angle from accounting period changes to bad debt exposure; anything that gives us an insight into what’s really happening in a business.

Efficient onboarding

Make quick risk assessments in your onboarding process, avoid companies that don’t meet your criteria and set appropriate credit limits for those that do.

Real-time monitoring

Our data points are updated daily so you can monitor businesses and be alerted the moment any change happens to their financial health. This early warning system means you can proactively manage risk.

Client Management Through Risk Control

Red Flag Alert provides all this data and more to create events to drive daily, weekly or monthly alerts direct to your inbox as an email or CSV.

We help businesses proactively protect their assets, providing real-time information on:

New CCJ data

Gazette - Unadvertised petition to wind up

Gazette - Winding up order

Gazette - Striking off application

Business health rating change (via our unique health rating algorithm)

Current directors and changes in key appointments

Individual directors’ other business interests

Business assets and turnover

New mortgage data

Get Started

Discover how our platform works by booking a demo with our team.

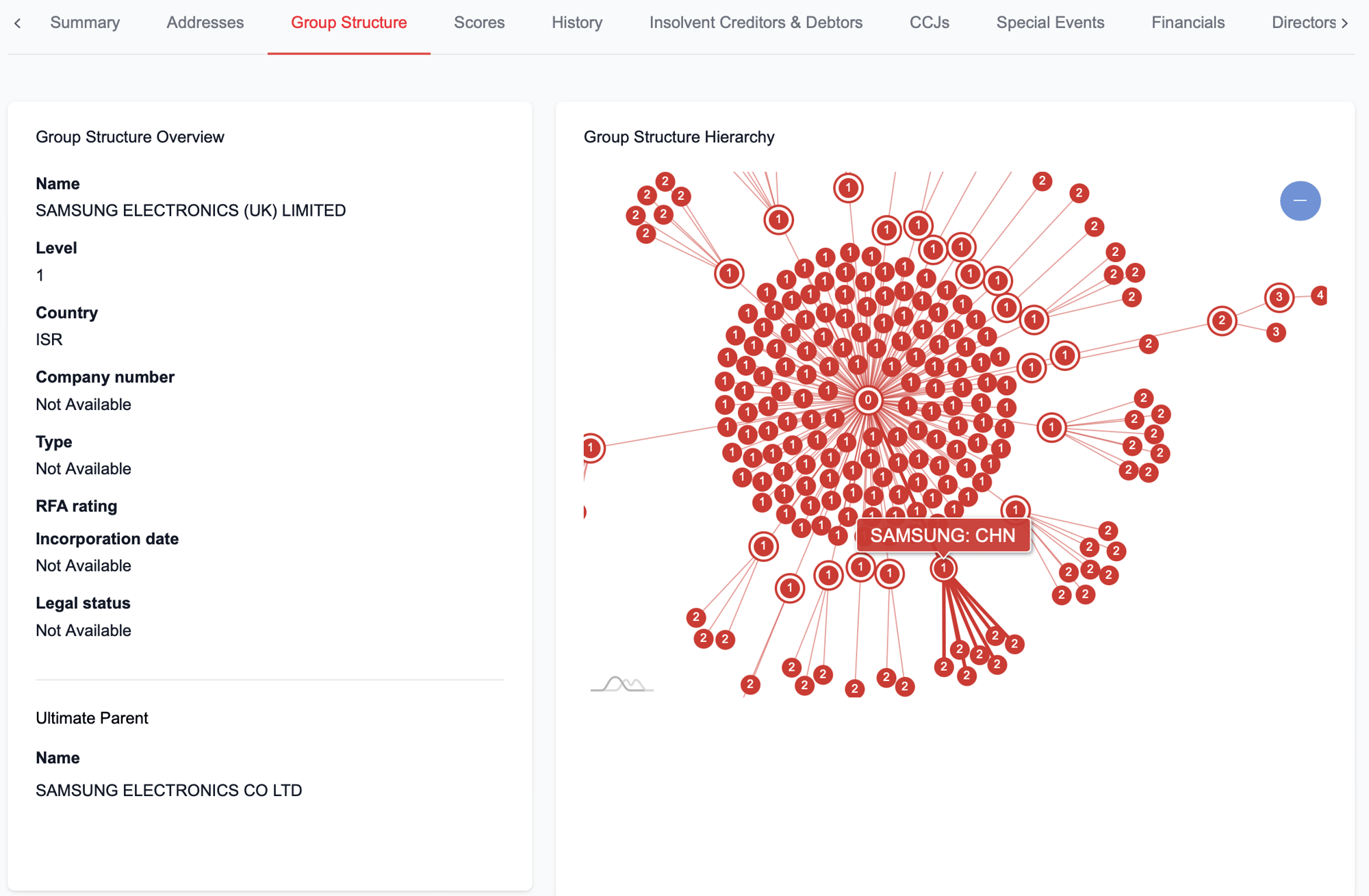

Ultimate Business Owner

Globally connect the dots between entities

Our Global data source gives you valuable in-depth insights into company finances, giving you a clear picture of their financial health.

Assisting you in setting the right credit terms and acting where necessary in order to protect your business against financially unstable or corrupt organisations.

- Entire History

- Market Leading Insolvency Score

- Over 9,000 global business users

- 25 years' experience in business intelligence

Focus on prospects who will pay

Our financial health rating system is one of the most detailed on the market, providing an end-to-end financial health tool using 142 separate indicators of the financial health of a business. Our company search function allows you to search for companies using over 100+ filters including their financial health score.

Review company credit information and assess their viability as a client using our assessment tool. Check company financial information and determine their rating using our unique system.

From Our Customers

Listen to how we have helped our customers

“One advantage that RFA has over its competitors is the health rating – this becomes key when you haven’t got stability in the market. It allows you to be more strategic, utilising the health rating to be proactive and focused in targeting potential customers

AN

Energisave Online

“Allows us to evaluate our customers credit score – particularly given the energy crisis... there has been a lot of value-added solutions they’ve brought to our sector. We want to make sure our customers are around in the next 2/3 years because our business projects itself on renewals.”

KI

Exchange utility

“Real time data is important when it comes to winding up petitions or legal action... looked at an account and it will say it was fine on Creditsafe but the next day there’s a problem. RFA gets their court information long before, every 15 minutes from the London Gazette. It is more current which helps us out... we are more confident rejecting slightly earlier.”

MH

Parker Steel

Protect your business with a free trial of the industry's most accurate credit risk platform

- Avoid bad debt with the UK's leading insolvency score

- Get real-time financial information on every UK business via detailed but easy to understand company reports

- Easily unravel complex group and beneficial ownership structures

- Red Flag Alert Health Score makes it clear what a company's level of risk is

- Our proprietary lets you find the high performing customers that will help you company grow

Request a trial

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at anytime. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, check out our Privacy Policy.

Knowledge Base

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more