The globalisation of business has opened unlimited doors for companies to begin operating on an international scale, unleashing their full potential to grow and create an impact.

In turn, it has made numerous changes in how businesses function and how they can grow. The access to a diverse talent pool, cheaper materials and labour, and an extended market can catapult a business to success.

As a result, it’s no surprise that a growing company would want to tap into these benefits.

But, lurking below the success on the horizon, insolvency lingers and could take out a business at a moment’s notice.

Fluctuating exchange rates, geopolitical instability, and varying regulatory environments can impact a company's receivables. Differences in business practices and legal systems may complicate debt recovery processes, additionally, cultural and language barriers can lead to misunderstandings, affecting the enforcement of contracts.

With the exposure to bad debt and supply chain disruption, it’s crucial to mitigate these risks ahead of time.

Mitigating Global Risk - Balancing Opportunities and Threats

Globalisation exposes businesses to the risk of bad debt due to economic and political uncertainties across diverse markets.

These factors interlink into a potential killer for businesses, as insolvency could impact any company within the complex web of partnerships. They are all facing the potential for economic downturns or market fluctuations in interconnected economies and may struggle with debt repayment.

There are also diverse regulatory frameworks and legal complexities in different regions that can complicate financial restructuring efforts, heightening the threat of insolvency for globally engaged enterprises.

Looking further, it’s clear that economic downturns in one region can trigger a domino effect, impacting connected businesses. Despite globalisation’s offers of expanded opportunities, businesses must carefully assess and manage the associated risks to mitigate the potential for bad debt and financial instability.

Businesses shouldn’t be held back by this risk, but dumping huge amounts of time and resources into prospecting and international monitoring can quickly offset globalisation’s rewards.

Unlocking Global Opportunities with Red Flag Alert's Due Diligence Tools

Global business opportunities are ripe for the taking, but due diligence measures are difficult to follow due to limited data access and local knowledge. As such, reviewing companies for insolvency risk can’t be relied upon, yet chasing foreign debt is also challenging and expensive.

At Red Flag Alert, we have the tools businesses need to be able to confidently open the right doors to success and leave the risky ones locked shut.

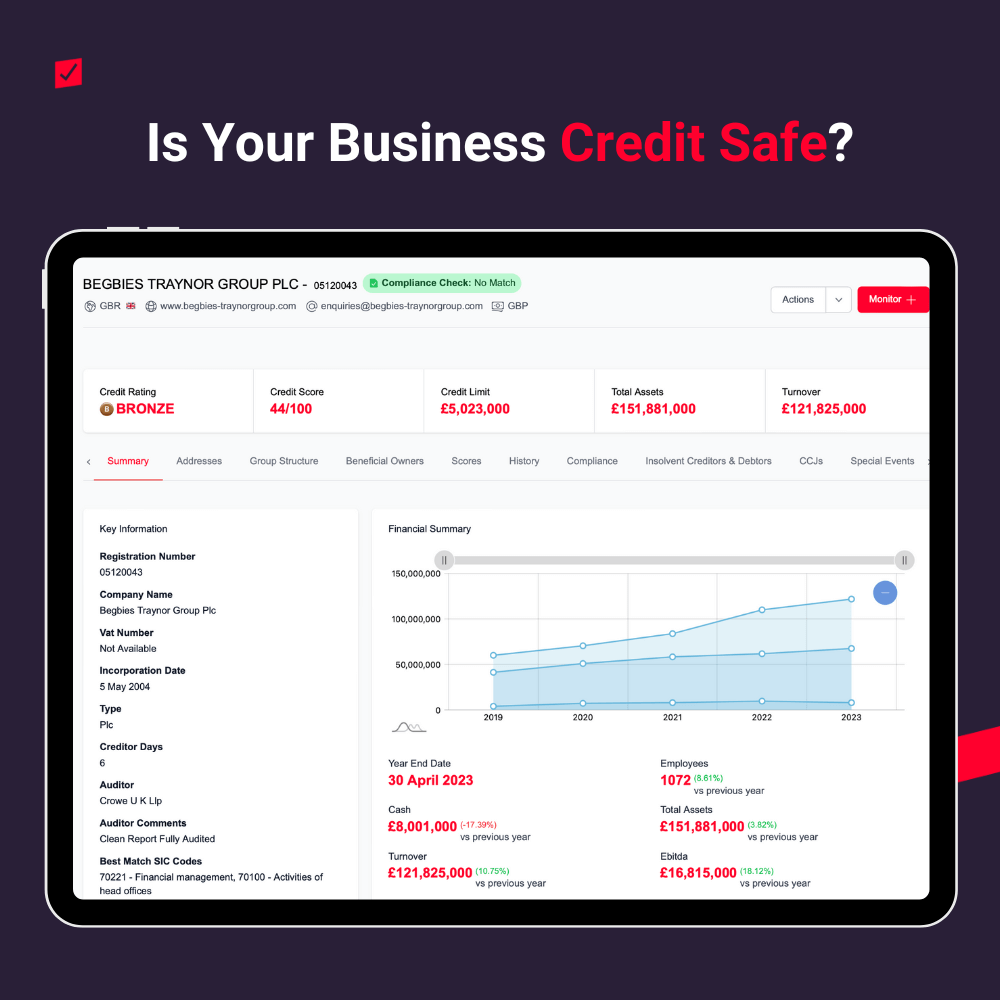

With our database of over 350 million international companies, detailed reports with global data sources are available for accurate due diligence. Instantly accessible through CRM integration, businesses can make well-informed decisions, highlighting stable companies that are provably reliable, and least likely to become insolvent.

Our International Company Reports tool provides comprehensive data that deep dives into businesses across the globe, to give as clear an understanding as possible.

One simple search will give immediate insight into clear credit ratings for actionable insights, Ultimate Beneficial Owner (UBO) data and company structure breakdowns.

UBO data is often difficult to understand, and most people will require special training with room for error still present despite these efforts. In fact, it can often be purposefully or generally complicated, making Red Flag Alert’s unique breakdown of the data a revolutionary way to interact with this valuable data.

When assessing UBO data, it is important to consider individuals who own less than 25%. Legally, for Anti-Money Laundering (AML) purposes, businesses are only required to conduct checks on those with 25% ownership and above.

However, there are advantages to knowing all UBOs. For instance, having comprehensive UBO data allows for the detection of cross-country debentures and identification of group debentures, which often signify financial distress.

Obtaining a complete picture of ownership is crucial. Why settle for half of the picture when you can have it all? From an AML perspective, even if an individual owns just 15% and is involved in suspicious activities, it can still significantly damage reputations and pose public backlash risks.

The FCA has also begun to place renewed importance on the compliance of companies' AML procedures and is actively investigating that the appropriate measures are in place regardless of if a company has been implicated in a money laundering scheme. As a result, the FCA is vigorous in handing out fines, with the regulatory body stating:

“Between January and October 2023, the FCA cancelled 1,266 firms that failed to meet its minimum standards for authorisation. This is double the number of firms cancelled in the previous year. Following enforcement investigations, the regulator-imposed fines totalling £52,802,900 this year.”

Additionally, having access to comprehensive UBO information might uncover opportunities for enhancing and refining AML processes.

Alongside predictive scoring, company history, and clear financial insights, businesses have the power to conduct company credit checks and due diligence on companies across the world.

Once a business has confirmed the potential partnership is a safe and stable option, the work continues.

Any business can be impacted by insolvency, with one company going under immediately putting all of its partners at risk. This is unavoidable, but businesses can protect themselves with enough warning.

Monitoring a portfolio of clients, customers, and more is a simple process with Red Flag Alert's international company monitoring tools.

The benefit of monitoring extends beyond what can be expected from standard providers, with our comprehensive system. Red Flag Alert’s tools offer detailed segmentation and control across limitless portfolios, avoiding the chaos of indiscriminate monitoring.

Customised scalability for bespoke tailored solutions for enterprises ensure international monitoring efforts streamlined to eliminate the need for additional resources to clarify the information and decide what is relevant.

These lists and alerts can also be shared for transparent communication across departments, ensuring nothing falls through the gaps. With tailored alerts, email clutter is reduced so the impact of the alerts is seen and heard. This minimises the risk of oversight and ensures staff absences don’t leave warnings unnoticed.

Red Flag Alert's Mission to Support Business Growth

At Red Flag Alert, our mission is to empower businesses, supporting their growth, by increasing the accuracy of their risk mitigation and prospecting procedures whilst drastically reducing the time they need to spend on these.

By offering market-leading international business data, we streamline the process of mitigating the risks associated with bad debt and fraud. As a result, companies can maximise the potential of globalisation, without looking over their shoulder and living in fear of the impact of insolvency.

With a strategic emphasis on clarity and ease of use, your business can navigate the complexities of international business confidently, fostering an environment where growth takes precedence over administrative burdens. Get in touch and get a free 7 day trial.