Having a healthy business credit score is the key to accessing vital funds for growth and optimisation. But, if a business’ supplier, customer, or client is hit by insolvency, the credit score is immediately jeopardised.

Once an insolvency’s ripple effect begins, the ensuing financial repercussions will impact a business’ credit score. So, how can companies grow and foster healthy relationships, without running the risk of bad debt?

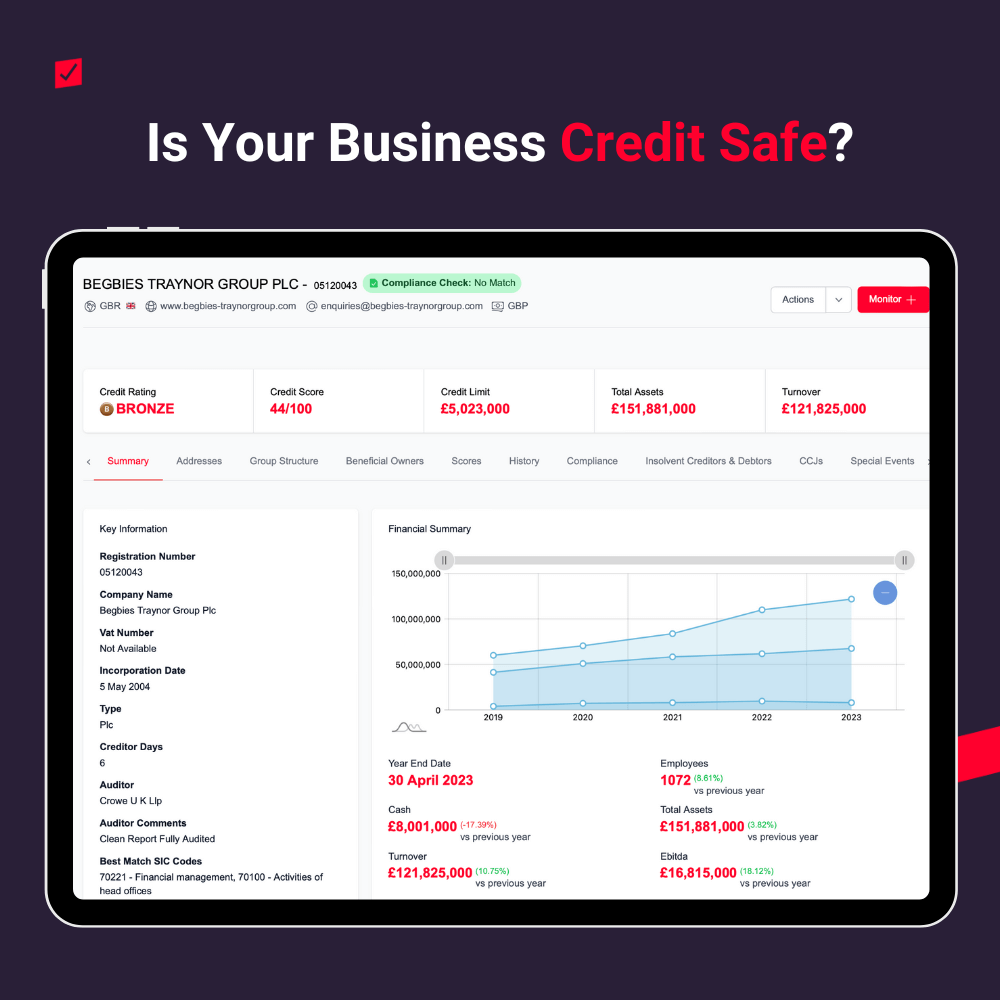

Is Your Business Credit Safe?

It’s important to know the current standing your business has. If you don’t have a clear answer to the question ‘Is your business credit safe?’, then you may be at risk.

Identifying potential risks before they become a threat will support mitigation processes, protecting finances and key relationships.

Learn how to spot insolvency before it strikes and keep your business credit safe with Red Flag Alert.

8 Pre-Insolvency Indicators to Keep Your Business Credit Safe

- Legal Action

- Difficulty meeting financial obligations

- Fixed charges

- Suffering unsecured losses

- Changes to accounting periods

- Poor liquidity

- Little or no reserves

- Tight profit margins

Red Flag Alert users were given a pre-warning time of up to 16 months, with an average of 110 days' notice before the insolvency occurred.

This powerful usage of data is done through carefully analysed factors that have been proven by our experts to indicate an incoming insolvency. Using our monitoring system, you can be updated as soon as one of the following ten pre-insolvency indicators is flagged:

Legal Action

Companies facing legal actions such as statutory demands for payment, winding-up petitions, or county court judgments (CCJs) are likely struggling to fulfil their financial obligations. These legal actions indicate financial distress and potential insolvency.

Difficulties Meeting Financial Obligations

A company's inability to meet financial obligations in a timely manner, resulting in delays in payments to creditors, can be an early warning sign of insolvency. This may manifest as prolonged payment periods, decreased service quality, or falling behind on work due to financial pressure.

Fixed Charges

Companies, where directors or shareholders hold fixed charges over assets, may indicate a higher risk of insolvency. Such arrangements prioritise certain creditors in the event of insolvency, potentially leaving others with limited or no repayment.

Suffering Unsecured Losses

Being an unsecured creditor in an insolvency procedure can lead to significant losses for businesses. Companies facing unsecured losses are at higher risk of insolvency, as they may struggle to recover from financial setbacks.

Changes to Accounting Periods

Overdue accounts or frequent changes to filing periods can be signs of financial trouble. Some companies may adjust their accounting dates to conceal financial difficulties, indicating potential insolvency issues.

Poor Liquidity

Companies with poor liquidity face challenges in managing cash flow, which can lead to constant financial strain. Inadequate liquidity increases the risk of insolvency, especially during economic downturns or unexpected expenses.

Little or No Reserves

Businesses without sufficient reserves to weather financial challenges are more vulnerable to insolvency. A lack of reserves may force companies to resort to emergency borrowing, further exacerbating financial pressures.

Tight Profit Margins

Businesses operating with tight profit margins are more susceptible to financial distress. Any unexpected increase in expenses, loss of customers, or changes in market conditions can push these companies toward insolvency.

Quick Tests to Screen for Pre-Insolvency

Cash Flow Insolvency Test: Determines if a company can meet its debt obligations with available cash flow.

Balance Sheet Insolvency Test: Compares a company's assets to its liabilities to assess solvency.

Scorecard Insolvency Test: Utilises Red Flag Alert’ insolvency scorecards, to predict a company's likelihood of insolvency based on various data points and trends.

By understanding these indicators and conducting relevant tests, businesses can identify potential insolvency risks early and take proactive measures to protect their interests.

How Red Flag Alert Can Keep Your Business Credit Safe

At Red Flag Alert, we have over 20 years of experience in predicting insolvency and maintaining the most accurate insolvency score on the market.

Bypass the mistakes made by traditional credit reference agencies who often miss incoming insolvencies, such as Buckingham Group and Jeffrey Osbourne insolvencies.

Red Flag Alert assigns every UK business a financial health rating that accurately predicts which ones are at risk of insolvency. These ratings monitor the financial health of current and prospective clients and suppliers with the most up-to-date information, including various financial metrics and trends.

This real-time data provided by Red Flag Alert is updated in real-time, enabling accurate risk predictions, so any changes in a company's financial health can be quickly identified and assessed for potential insolvency risk.

Our users receive company alerts as soon as there are changes in their clients’ risk profiles. This proactive approach allows businesses to take necessary steps to mitigate risks, long before the bad debt comes rolling in.

Using these insights, our insolvency scorecards are able to allocate a rating of either gold, silver, bronze, and amber for healthy businesses, and one, two, and three red flags for companies at risk of insolvency.

Try Red Flag Alert today to generate your free rating for your biggest customer, client or supplier.

Unlock a comprehensive understanding of the financial health and insolvency risk of your clients and suppliers, and keep your business credit safe with Red Flag Alert.