Over 3,000 manufacturing businesses are showing signs of severe financial distress, including many high-turnover companies. In addition to these severely distressed companies, a further 26,000 are showing signs of some level of distress.

The UK continues to suffer from economic turmoil and rising insolvency rates. The fallout of COVID, global supply chain issues and an unprecedented series of economic shocks have created a perfect storm for business failure.

The manufacturing industry is one of the worst affected and makes up 8% of all UK insolvencies, which are projected to exceed 26,000 for 2023, with a top-end estimate of around 28,000. Contributing to the sector's difficulties are the struggles of construction companies, an industry manufacturing is heavily linked to, that makeup 18% of UK business failures. With finances already stretched by COVID, many companies’ recovery was hampered by global supply chain issues, that persist to this day. This meant that businesses did not have the reserves to absorb the economic shocks that quickly followed the pandemic.

Whilst the sharp increase in materials and wages, along with labour shortages, has played a significant role, it was the soaring energy costs following Russia’s invasion of Ukraine that the industry succumbed to. As a sector reliant on heavy energy consumption, manufacturing was especially vulnerable to these price rises, and weak government support for business energy bills compounded the problem.

As more companies struggle with insolvency, it adds to the growing threat of snowballing bad debt within the sector. When a company fails, the majority of its creditors are left to try to absorb the bad debt, which is much more difficult in times of economic hardship. Many are unable to do so and go insolvent themselves, a company that has suffered a bad debt is three times more likely to fail itself, and its creditors are then left with bad debt. In this way, insolvency can be seen to have a ripple effect and bad debt is often said to ‘snowball’ through an industry.

It is typically higher turnover companies that can absorb these bad debts and in turn shield other companies. This is especially important when bad debts and insolvency rates are high as it will theoretically in time restore equilibrium to an industry. However, should one of these larger companies fail, they can amplify the effects of insolvency, due to their generally large numbers of creditors.

Unfortunately, numerous large, high-turnover UK manufacturing companies are showing signs of severe business distress and are at risk of failure and present a credit risk.

Examples are:

ALBION COSMETICS (UK BRANCH) – The UK branch of the Japanese cosmetics company last posted results in March 2021, and based on their filing history would have been expected to post their 2021/22 results in March 2022. It is usually a warning sign of disappointing results if a company breaks its filing convention and delays posting results. Adding to the warning signs for Albion is the 118.03% drop in post-tax profits recorded in 2021.

REGAL BELOIT AMERICA INCORPORATED – Part of the American giant Regal Rexnord, Regal Beloit is another company yet to file results for 2022. The previously filed results show a decrease in assets and profits, though an increase in cash may offer some hope. Though until their filings are up to date, offering credit is not recommended.

LAKELAND DAIRIES (N.I.) LIMITED – Dairy giant Lakeland Dairies is yet to submit its most recent set of financials, which would have been expected in January 2023. Their previous filing shows a decrease in post-tax profits of 11.07%. As food and drink manufacturing companies are showing even higher levels of distress than the rest of the sector, a late filing is cause for concern.

MONAGHAN MUSHROOMS LIMITED – Another struggling food manufacturer, Monaghan has yet to submit its financials for the 21/22 and 22/23 financial years. This would suggest disappointing results and a potential credit risk.

ESTERFORM PACKAGING LIMITED – Manufacturers of injection moulded PET packaging are yet another firm yet to file their 2022 accounts. The last filed accounts showed a post-tax loss and a 15.575 drop in net worth.

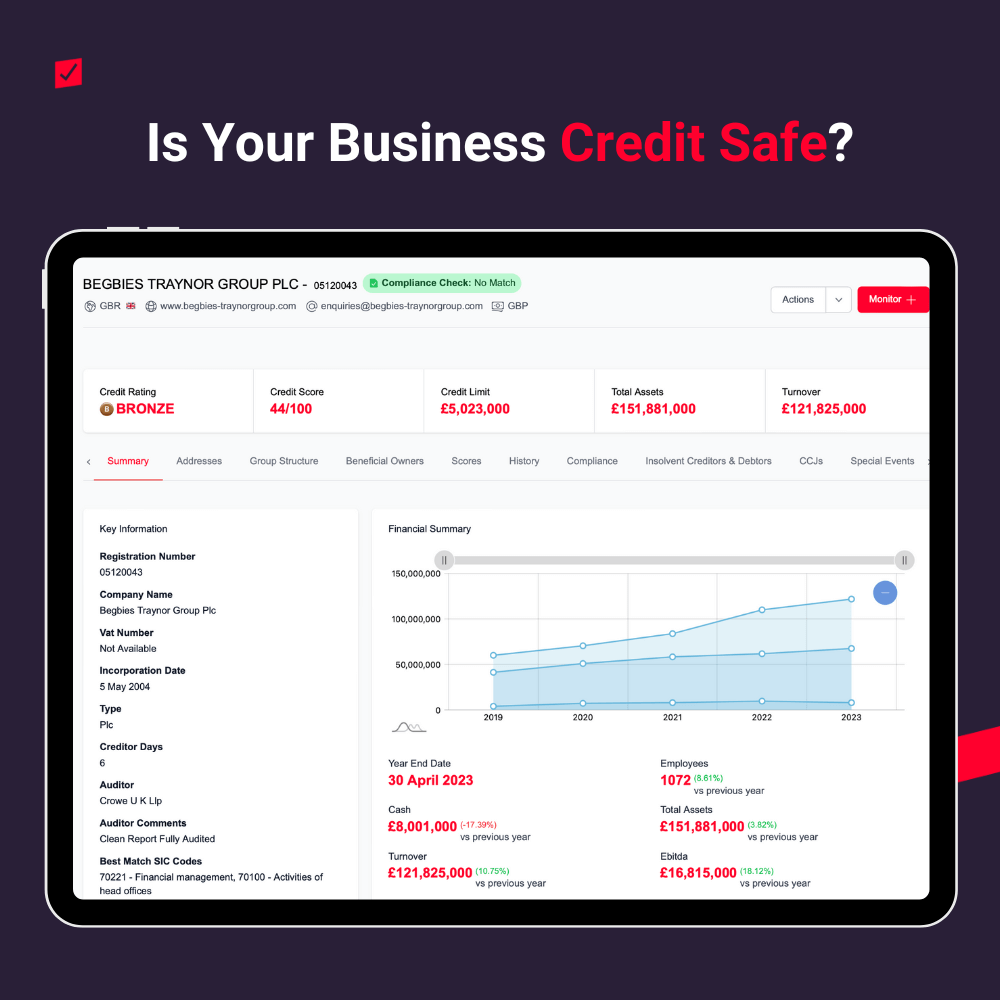

Download company reports for free and exclusive to Red Flag Alert readers.

Despite the difficult business environment facing manufacturers, there are many things that directors can do to protect their business. An important one is practising excellent credit risk and supply chain management. By leveraging technology in the form of a business data and credit check platform you will be able to gain an in-depth understanding of a potential customer's financial health and creditworthiness. You will also be able to monitor those clients for early signs of financial instability.

As we wait for economic conditions to settle and become more amenable to doing business, avoiding bad debt and failed suppliers you will give your business the best chance of not just surviving but thriving.