Accountants provide an essential service to UK businesses, with few businesses maintaining their own internal accountants. Not only do they maintain their client’s financial records but they are often who they turn to if they are looking to expand or are facing difficulties.

Many professions rely on building and maintaining strong relationships with accountants to both better understand their wider business environment and win business. This is especially true of insolvency practitioners and credit brokers.

Accountants are a lucrative source of work as they approach companies on behalf of their clients that have a need of their services. This becomes an income stream that requires minimal maintenance but at the same time reduces the need to market and prospect for new business.

But before this can take place, a company must first establish relationships with suitable accountants.

This is a time and labour intensive process which can often become expensive, so it is vital that companies ensure that the resources they dedicate to this will deliver maximum value.

What problems do companies face when building relationships with accountants?

- The first problem is simply finding the accountants in their operating area that could possibly feed them business. Effective prospecting relies on having a complete picture of all suitable businesses, but this is almost impossible to achieve without specialist software and can lead to prime opportunities being missed and time and resources being wasted.

- The process is time consuming and potentially expensive.

- Knowing if an accountant has a large enough client base to deliver a decent amount of work. It is hard to know what is going on below the surface of a business, a large office does not necessarily mean a large client book and vica versa.

- An accountant may have similar relationships with creditors. It’s highly likely that an given accountant will have relationships with multiple insolvency practitioners and credit brokers, to whom they will feed work. To maximise on these relationships, companies need to know exactly when there might be work for them to do.

- It’s difficult to know who you should contact at a business. The perennial problem of sales and marketing is ensuring that you are contacting a decision maker who can award you business.

How Red Flag Alert solves these problems and allows for more effective relationship building

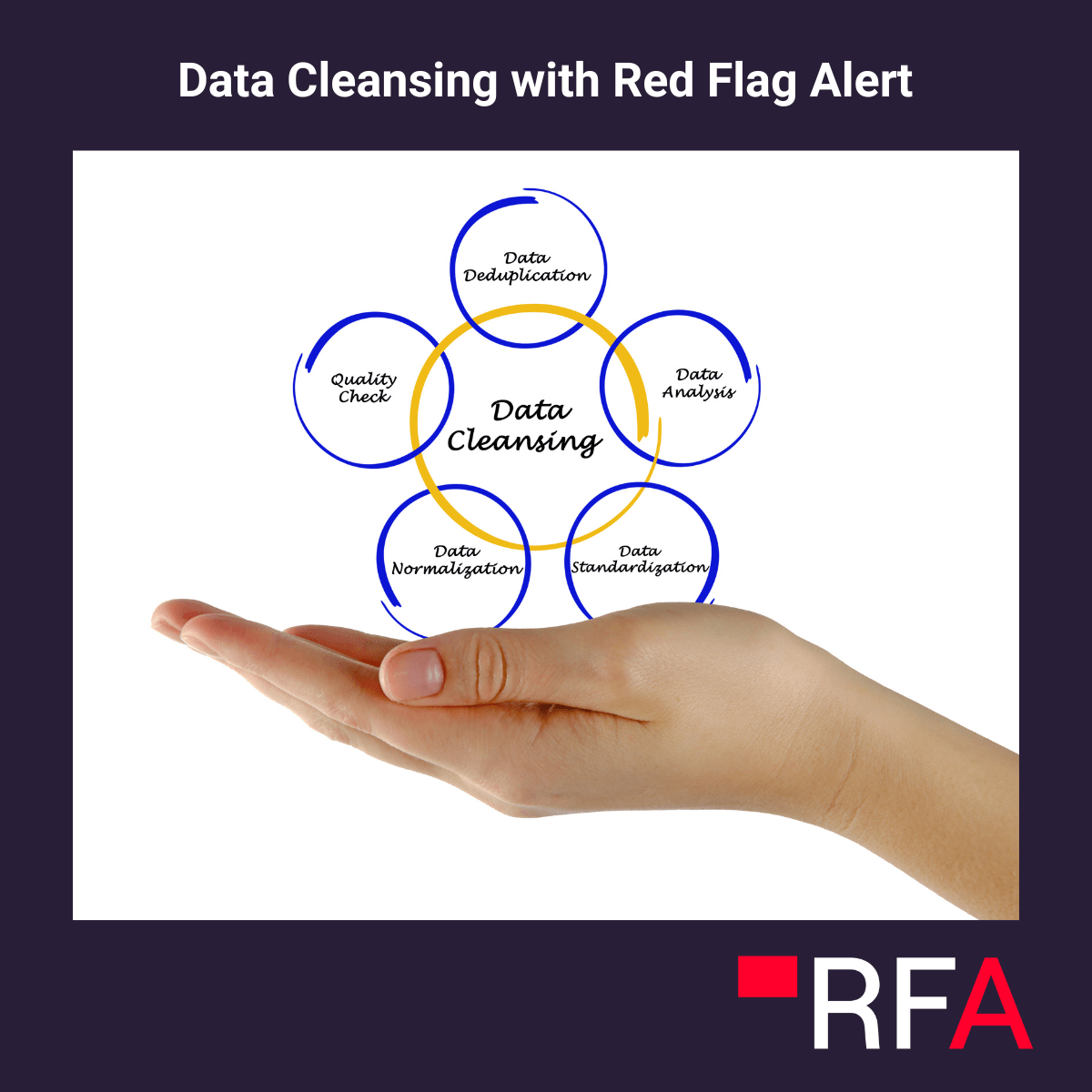

Red Flag Alert for Accountants is the ultimate relationship building tool seeking to perform outreach to and win work from accountants. Our system lets you easily identify and target the accountants that will be a reliable and lucrative source of income; as well as monitor their client lists to allow you to proactively win their business.

Our powerful B2B Data tool will completely revolutionize the way that you win business and is the perfect tool for identifying accountants for outreach.

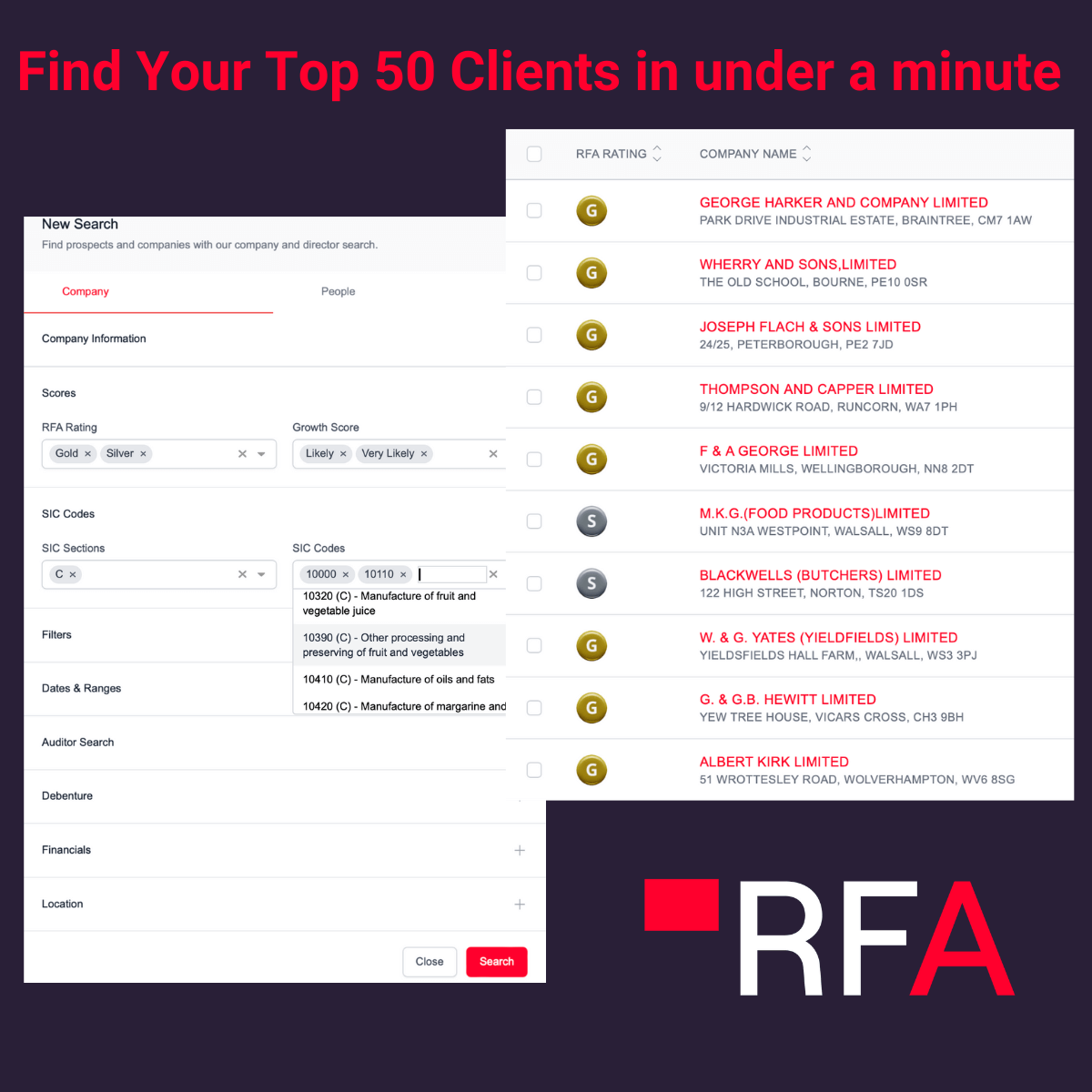

- Over 100 filters to set your search by; including sector and financial health – Our platform allows you to quickly and easily perform granular searches so your prospecting list does not include anyone unsuitable to do business with. Filters include: growth score, financial health score, SIC code, location, turnover etc.

- Search by health score – you don’t want to waste your time approaching a struggling business that may not be around long enough to be a reliable source of work. Red Flag Alert has developed a unique health score that clearly defines a company’s financial health. By including this in your search you are able to create a prospecting list of only financially healthy companies.

- See accountants’ clients with auditor search – Our revolutionary auditor search allows you to see the companies on an accountant’s client book along with their financial health. Our platform even includes an analysis tool that lets you instantly run detailed sales and risk analysis on these companies.

- See who needs finance with our debenture search – Our debenture search feature allows you to see who has taken out finance and if/when the debt has been satisfied.

- Create targeting marketing – Cold marketing is difficult and expensive. By creating targeted outreach lists of only highly suitable accountants you can create customized and targeted marketing, which is not only more effective but also cheaper.

- See company directors – As well as including every UK business our database also includes complete lists of company directors. So you can easily see who are the decision makers that you need to be in touch with.

Once you have built relationships with accountants you still need to make sure that you win business before any other of their partners. Normally it would be near impossible to know when their clients need your services, but with Red Flag Alert’s cutting edge monitoring tool it becomes easy. So you know when it’s time to approach before your competition.

- Customisable monitoring lists – Traditional company monitoring platforms are not business friendly and do not allow you to segment monitored companies or choose what alerts you want to get. Leading to your inbox being clogged by irrelevant and confusing alerts. With our platform you can create individual, segmented monitoring lists and customize which alerts are relevant to you. So your inbox stays clear and only receives critical and actionable alerts.

- Instant alerts – Our platform allows you to receive instant alerts on business critical events, so you’ll always be the first to act.

- Share lists and alerts with your team – Align your business and eliminate the risk of an alert going missing and you lose business. You can share access to all monitoring lists and alerts with anyone at your company.

Win more business with less effort using Red Flag Alert

The reason that we are the perfect solution for this task is because it was one of the primary reasons we were founded. Originally born from Begbies Traynor, the UK’s largest insolvency practitioner, Red Flag Alert was developed as a way to identify companies at risk of failure and to win any future insolvency work.

Now fully independent and significantly more advanced than we were 20 years ago, we remain the preeminent platform for insolvency and credit finance professionals.

With our background in the business world we understand not just the financial health and signs of future business failure better than traditional credit reference platforms but because we also understand the needs of business to make their risk data actionable and effective.

Red Flag Alert believes that to be actionable, data needs to be understandable, up to date and you shouldn’t have to work hard to get it.

This ethos has led to our platform being specifically designed to be easy and quick to use and meet the needs of modern business. Whist we are constantly pushing the boundaries of how quickly we bring data to market and are constantly innovating in the ways we present information so no specialist risk training is needed to understand data.

Tired of wasting time fruitlessly chasing accountants for business? Try Red Flag Alert and fill your pipeline