MANAGE RISK

Business Intelligence for Credit Risk

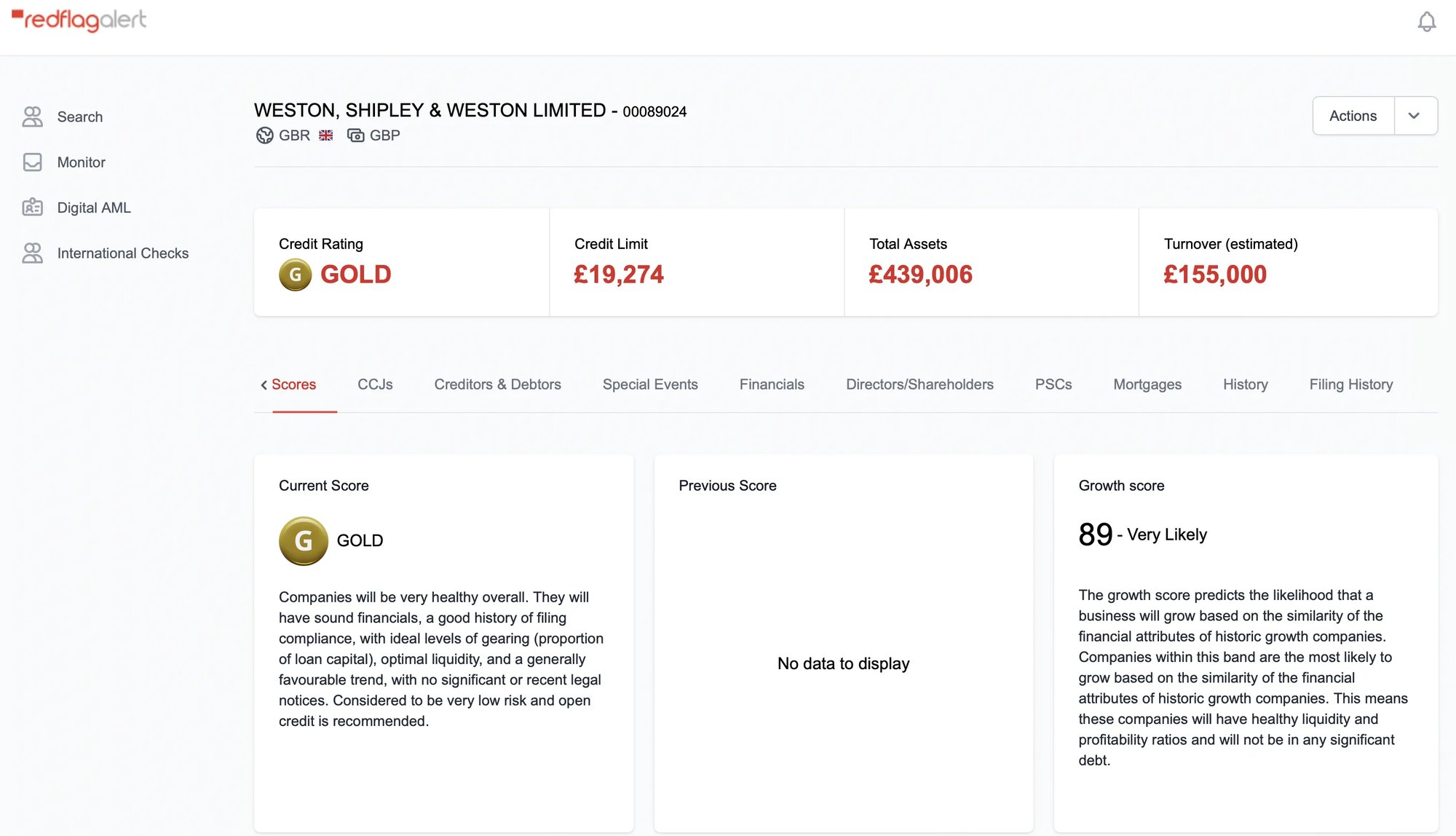

Red Flag Alert provides a solution for credit risk management which enables you to make effective credit decisions across your organisation by using real-time data.

Financial health rating for every business in the UK, incorporating 142 key financial indicators and giving an early view on the likelihood of insolvency with our proprietary algorithm. Looking at the financial health of a business alongside red flags gives you detailed information on the risk level associated with it. Where further clarification is required you can search on over 40 individual business criteria.

IMPROVE EFFICIENCY

Automate Your Credit Risk Activities

By plugging your CRM into our API you’re able to access real-time alerts into your inbox, giving you information on critical changes in credit risk. Alerts can be tailored to your needs; some users look at financial health levels whereas some are looking for specific changes in the business or signs of specific financial distress. Getting detailed information early allows you to plan and structure the measures you’re putting in place to minimise risk.

Integrations & Apps with Leading CRMs

Generate even more insights by seamlessly integrating Red Flag with your own CRM. Feed in data to power up your sales and marketing teams so they can work better and more productively.

From Our Customers

Listen to how we have helped our customers

“We were looking for a partner to enhance the data offering to our clients, and Red Flag Alert have done just that. They understood our business, our culture, and our aspirations for the future. We’ve seen some great feedback on our integration, and we are very happy with both the solution and team at Red Flag Alert.”

Rob Mead

Strategic Software Projects Director

“We use the search tool to identify businesses in specific geographic areas, with the right number of staff, the right turnover, and a low risk of non-payment. Now we have experienced the benefits of Red Flag Alert, we could not be without it.”

Mark Bryan

NSL Telecoms

“From a business development perspective, our brokers are benefiting greatly from the additional information that Red Flag Alert supplies – we’re able to zero in on ideal prospects and build effective marketing lists.”

Ben Robert-Shaw

Power Solutions UK

See Why Companies Use Red Flag Alert to Manage Risk & Stay Compliant

- Access to the platform

- Discover company search & portfolio management

- Ongoing support for queries during the trial period

Request a Trial

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.