A global pandemic, worldwide supply chain issues, sky-high energy costs, rocketing inflation, and an economic slowdown — the challenges facing businesses today are extensive. Perhaps unsurprisingly, the number of business insolvencies over the coming months is the highest it has been for years and is expected to be similar to that seen following the 2008 financial crisis.

Businesses must ensure they are as stable as possible to survive. There are three ways to do this:

- Maximise revenue.

- Avoid regulatory fines.

- Minimise credit risk.

Gaining new customers is a sure-fire way to ensure a steady pipeline of revenue, but it's a careful balance to manage credit risk. Maximising sales may sound like the perfect solution to growth, but working with financially unstable companies increases the risk of associated bad debt. This can lead to unpaid invoices or other future issues, and even lead to insolvency.

What is credit risk?

Purchasing goods or services on credit is not an uncommon business practice, but it can be risky. When we talk about 'credit risk', it is the probability that your company will experience a loss from a borrower's failure to repay its debts or fulfil its contractual obligations.

The combined credit risk posed by a company’s clients is called its ‘credit risk profile’. Ensuring your organisation only works with companies that are reliable and have a low credit risk is a good way to protect your business from defaults or unpaid services.

Why is high credit risk a problem?

Most businesses are exposed to credit risk in one form or another. If you offer services or goods on credit or some form of financial loan, there is always a possibility that these may be defaulted upon. This chance can be minimised by investigating a business' credit risk beforehand and finding out about its credit risk profile. The higher the risk, the more likely you are to experience financial losses.

Here are four ways this can happen:

1) Customers fail onboarding

Traditionally companies perform credit checks when onboarding new customers. Performing these checks makes sense — credit checks are a great way to ensure that a company’s credit risk profile is low and that it works with financially sound businesses.

Companies that fail these tests become problematic. The sales team will have put much effort into getting the customer to the onboarding stage:

- Marketing generated the lead.

- Sales Development reps qualified the business.

- The sales team led pitches and sales meetings.

So, if the company fails a credit check, your business loses money through the amount of time and resources expended.

2) Failure to pay invoices

This is the big one. If your clients have poor financial health—such as cash flow issues—they may struggle to pay their invoices. This will potentially leave you out of pocket, impact your cash flow and put your finances under pressure. If large losses occur, it could even impact growth, investment opportunities or damage inventory.

With this in mind, you should always pay your own invoices on time, and lead by example.

3) Insolvency

Even worse, your customer might become insolvent. If this happens and they owe you money, it is unlikely that you will get any of it back. That’s because there is a legal order in which creditors are repaid.

- First, secured creditors are repaid. The insolvent business will repay banks and anyone with a charge over assets.

- Next, preferential creditors like HM Revenue and Customs (HMRC), company employees and those with legal action against the company will all be repaid first.

- Then, unsecured trade creditors—companies owed money on invoices—will be repaid.

The problem is that most or all the money has gone by the time the process gets to trade creditors. The average loss to UK trade creditors per insolvency is £24,000. And it gets worse: businesses that experience this kind of insolvent loss are three times more likely to become insolvent within 12 months.

4) Less profit

Your business will be less profitable if your clients can’t pay invoices or go insolvent. But even if they pay invoices on time, you’ll struggle to grow the account if your customer faces financial difficulties.

It’s therefore a good idea to aim to work with businesses that aren’t only in a good financial position but also show promising growth potential.

How to avoid credit risk in your client base

By assessing your clients’ financial situations, you can predict which businesses will most likely default on their obligations and limit any losses you might experience.

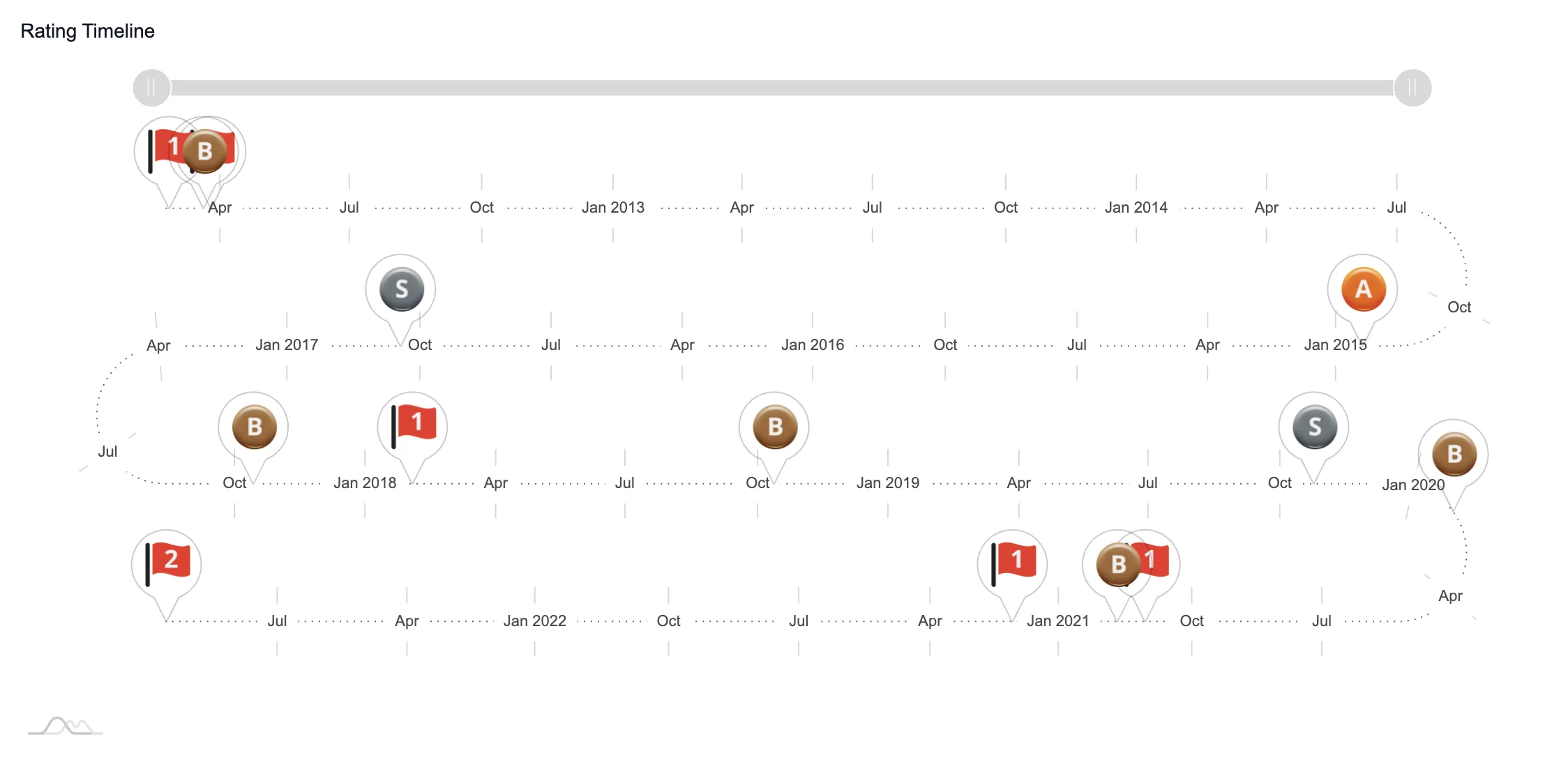

It's essential to find a reliable source of real-time business data to do this. At Red Flag Alert, we have detailed information on over 15 million businesses, including all U.K. companies. We update our data every fifteen minutes, guided by more than 200 official sources worldwide. You can rely on our data to alert you to problems and inform your decisions; we often spot risk signs that our competitors miss.

Here are three ways data can help you avoid credit risk:

1) Perform credit checks during prospecting

One of the best ways to avoid credit risk and problems with onboarding is to ensure that your sales team only speaks to companies with robust financial health.

This starts with your ideal customer profile (ICP). This represents your perfect customer, using data from the customers you best serve. For example, you might find that your most profitable customers are based in a particular area, with a certain number of employees and a specific turnover.

Your sales team can use your business database to find customers that precisely match this ICP during the prospecting phase. So how does this help you avoid financial risk?

Simple: by building financial health criteria into your ICP criteria, you ensure that your sales prospecting lists only consist of financially sound businesses. This way, credit checking becomes a formality and the customer is more likely to be stable for longer.

2) Set clear terms

Another great way to avoid credit risk is to set clear terms and expectations early in the business relationship. For example, you might explain that you will withdraw credit if unpaid invoices reach a particular value. The benefits of doing this include:

- The customer understands that timely payment is important to you and so will be encouraged to pay bills on time.

- If the customer does experience financial difficulties, they might use your services less so they don’t incur invoices they can’t pay.

- If the customer reaches the unpaid invoice limit, they are less likely to be offended when you withdraw credit.

Ensure your terms are as precise as possible and that your client has read them, understands them and agrees to them.

3) Monitor your clients

Just because a customer is healthy today, doesn’t mean that won’t change months or years down the line. You must closely monitor your customers’ financial health for any credit risk warning signs. You could do this manually, by performing new credit checks on customers once or twice per year, or by looking at their data.

But a more efficient approach is using a system like Red Flag Alert to automatically send you monitoring alerts that inform you whenever a customer’s data exceeds acceptable parameters. You can then take proactive action to avoid the problem getting worse or losing money.

Some of the steps you can take if a customer’s risk level becomes unacceptable include:

- Closer monitoring

If the increased risk is negligible, you may wish to monitor the client more often to see if the problem gets better or worse.

- Speak to client

Your client’s problems could be caused by factors they can’t control or are irrelevant to their ability to pay invoices. It’s therefore worth contacting the customer to understand their situation.

If they are facing financial difficulties, then there might be something you can do to help—for example, enabling temporary longer payment terms.

- Send reminders

If your client has failed to pay invoices, consider sending reminders. A company that sends reminders is more likely to be paid. Equally, the customer may be busy, and they may welcome a friendly reminder.

- Reduce or withdraw credit

If you are very concerned about your customer’s financial health, you could reduce or withdraw credit. Bear in mind that if the company faces financial difficulties, this could worsen them. If they can’t afford to pay invoices, then there is a good chance they can’t pay upfront.

- Call in invoices

This is when you ask the customer to pay everything they owe to you. This is usually more effective if the company is poorly managed and forgets or delays payment. If they are facing genuine financial difficulties, the company may not be able to afford to pay you anyway.

- Withdraw services

This is an extreme measure. Companies should only use it for serial non-payers where all other routes have been exhausted. Withdrawing services reduces the risk the customer poses to zero, but it likely means the end of your business relationship.

Financial Health Indicators to Consider

Many financial health indicators are used to reduce financial risk when prospecting and monitoring. Some common ones include:

- Liquidity

This is how easily a business can access cash. This includes money in the bank or assets that directors can sell quickly. Poor liquidity can lead to cash flow problems and therefore increased credit risk.

- Cash flow

Healthy cash flow is when the money coming in exceeds the money going out. If the amount of money going out is higher than that coming in, the business may be unable to pay its bills and is effectively insolvent.

- Missed or delayed account filing

Changes to accounting periods are a common feature of businesses facing financial difficulties.

Sometimes it means the business is poorly managed. But in other cases, the company faces cash flow difficulties and is trying to mask them.

- Changes to directors

This isn’t necessarily a sign of credit risk, but it’s worth monitoring. A business that has paid on time in the past may not be so reliable under new management. Research the new owners and check they are experienced.

- Legal action

Statutory demands for payment, winding up petitions and county court judgements (CCJs) all indicate that a business is being pursued in the court to pay debts.

It’s a big warning sign if a company faces court action over its obligations. It could even become insolvent if it fails to pay 21-day statutory demands for payment of £750 or more.

- Fixed charges

This is when directors get paid first if the company becomes insolvent. It often means that the directors may run the business differently and take more risks. As a result, businesses like this are nearly three times more likely to fail and present a heightened credit risk.

- Bad debt

As mentioned, companies that experience bad debt are more likely to enter insolvency. A company with a turnover of millions that experiences a £25,000 loss is unlikely to go out of business. However, a business with a turnover of £60,000 would be more likely to fail.

- Tight margins

Businesses with tight profit margins are more exposed to financial headwinds. For example, they may be unable to cover the additional costs if energy prices suddenly increase.

Make better business decisions with Red Flag Alert

Red Flag Alert gives companies a competitive advantage using the power of data. Our business intelligence platform captures and enriches information on every UK company.

Our clients use these insights to make decisions on sales, credit risk and compliance. Book a free demo to discover how Red Flag Alert can help your business become data driven.