Companies fail for many reasons – but when you look closely, there are patterns.

At Red Flag Alert we’re obsessed with finding those patterns, so we can spot risk early and help our customers avoid large losses due to bad debt.

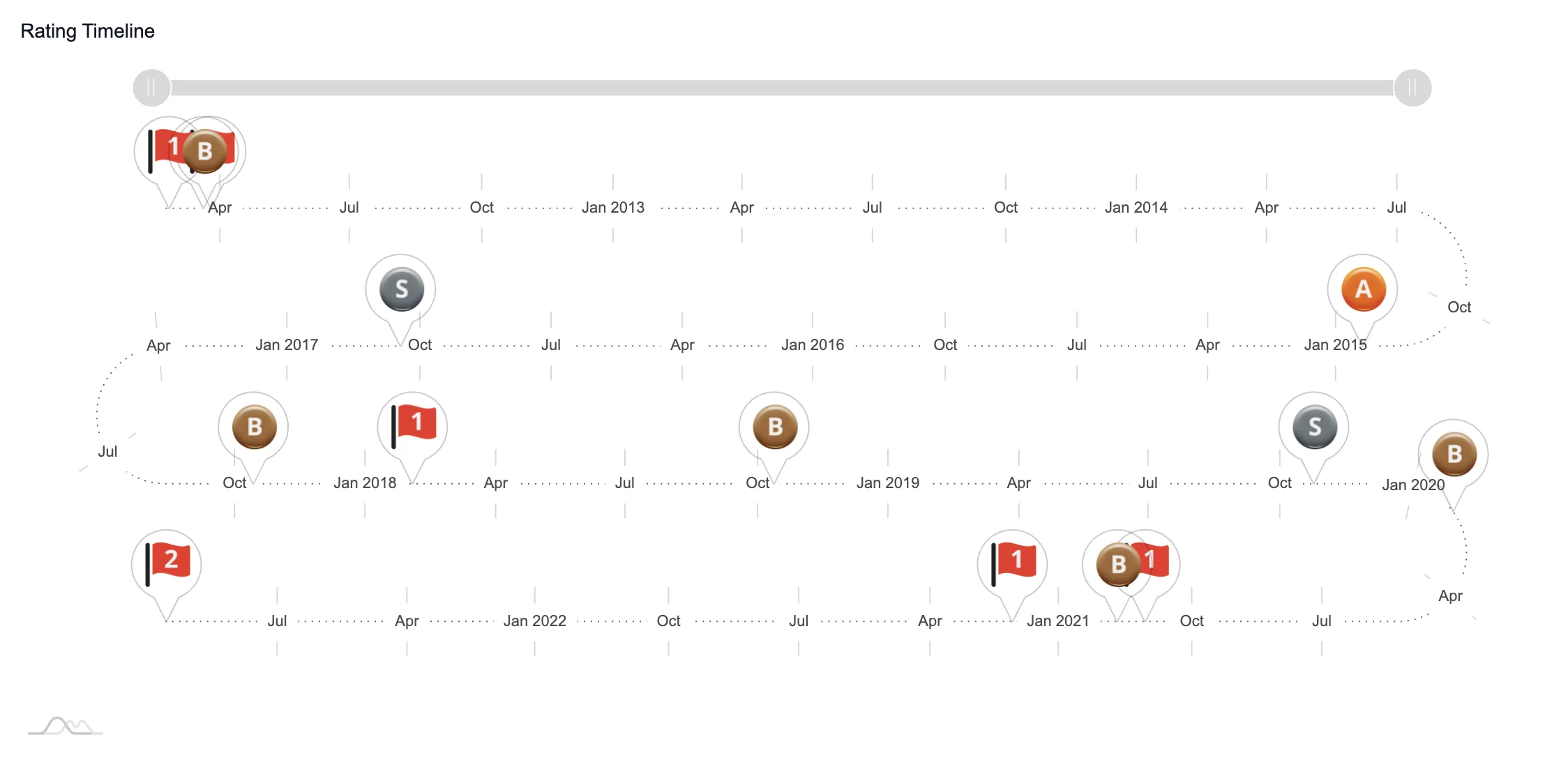

Our insolvency scorecard is continually evolving, and we always feed in new factors. Let’s look at how we’re staying ahead of the game.

Ilec Ltd – Our Algorithm Got it Right

The high-rise mechanical and electrical systems company, Ilec Limited, declared a £7.6 million turnover in 2019, while banking a pre-tax profit of well over £230,000.

This was a steep decline from the previous year (£16.7m t/o and £522k profit). Still, alarm bells didn’t ring for many credit referencing agencies – two recommended six-figure credit limits the day before the company entered administration.

Now in the hands of administrators, Ilec Limited reportedly blamed Brexit and the Covid-19 pandemic for its insolvency.

Our scorecard told a different story: four months before insolvency we classified the company with one red flag.

One Red Flag Definition

Companies are in the weakest 20% in their size category and display risk factors that might include a deteriorating financial position, suboptimal gearing or liquidity, and the possible presence of recent or significant legal notices. The risk is elevated, and suppliers should seek suitable assurances or guarantees.

When the company entered administration, 103 unsecured creditors were owed £2.7 million.

If any of those suppliers had been using Red Flag Alert, they would have been warned that Ilec Ltd was in difficulty and had a potential four months to reduce their exposure.

How Red Flag Alert Predictions Are So Effective

Red Flag Alert’s agile approach to insolvency, risk and fraud detection means that we keep up to date with new data and develop new methods to improve performance.

We assign every UK company with a financial health rating based on our innovative credit scoring algorithms.

We pay particular attention to companies that are overburdened with debt or have asset-stripped and leveraged their balance sheet.

Our machine learning algorithms use data from the UK’s most comprehensive business information database, allowing us to continually derive insights about what drives a company into insolvency so we can help your business spot financial risk.

Here are just a few of the methods we use to uncover risk.

Fixed charges: In the event of administration, fixed charges ensure that the shareholders and company owners are repaid before other debts are settled. It’s a red flag when directors are not willing to invest in their own business. Our research shows that companies with fixed charges are three times more likely to end up insolvent.

Accounting period changes: Lengthening and shortening accounting periods is sometimes used as a tool to avoid filing accounts that reveal the scale of a company’s difficulties. A change in their accounting period warrants further analysis.

Liquidity ratios: We use liquidity ratios that discount stock, giving us a more accurate indication of a company’s financial position.

Micro-entities: Small businesses are often exempt from filing detailed accounts, making it difficult to gauge their financial position. Our algorithms can create a credit score with very little information. We use data like VAT registration, late account filing and records of bad debt.

London Stock Exchange profit warnings: Every public company failure in the last two years was preceded by at least two profit warnings.

Unadvertised petitions (UAPs): These are petitions that aren’t published because they are still winding up. Our data comes from court records, so it accounts for any legal action taken against a business.

We stay ahead of our competitors by evolving our credit scoring system and implementing new data to create real-time updates on financial health ratings. Red Flag Alert provides insights into 6.5 million UK companies, allowing you to assess your financial risk in every onboarding situation.

In the case of Ilec Ltd, the accounts show that although the profits were shrinking, the shareholders withdrew dividends that exceeded profits: a big red flag.

Our experts continually update data points, allowing you to avoid companies that don’t meet your criteria and set safe credit limits for the companies that do. To find out more about Red Flag Alert's company credit checking solution, book a demo today.