For nearly half a century, Silicon Valley Bank (SVB) was a key player in the US and UK startup sectors. Known for its technological prowess, they were responsible for investing in some of the most disruptive tech companies the world has ever seen; Etsy, Roblox, and Vox Media were among its well-known clients.

As the 16th largest bank in the US, and dealing with companies from around the world, markets were rocked by the news that a series of ill-fated decisions had led SVB down the path of no return. Devastatingly, the bank was in imminent collapse.

The ongoing turmoil within the bank caused chaos, as customers desperately tried to withdraw their deposits. This sent the stock prices plunging, and bad news continued to pour out of the institution. Leaked stories of a failed $2.25bn funding attempt, simply to cover their losses, whipped around the financial services industry. The bank commenced a desperate, and ultimately futile, search to find a buyer and save itself from insolvency.

How did this happen?

All this amounted to the second-largest banking failure in all of US history, coming only behind the 2008 collapse of Washington Mutual, at the height of the financial crisis.

The issues within Silicon Valley Bank can be traced back by several years. In a bid to tackle inflation, interest rates have been steadily rising globally. This increases the price of borrowing for everyone, making investors more risk-averse when raising capital for tech startups, one of SVB’s main clientele.

As private fundraising started to slow, money was pulled from the accounts of Silicon Valley Bank in order to increase liquidity within these startups. But the money, quite simply, wasn’t available, and SVB had to look for additional ways to meet their customer’s withdrawal demands.

The bank had also ploughed billions into US government bonds, to take advantage of the period of historically low interest rates. However, as inflation crept up and interest rates followed, their bond portfolio started to erode. In general, it was a worrying time for the bank, as their credit options and asset values started on a steep decline.

The problem grows for startups in the UK and USA

As the bank collapsed, fears started to grow for the delicate and sometimes turbulent startup ecosystem, and about the wide-ranging impact on the UK’s tech sector. Both early-stage startups and more established scaleup companies were heavily reliant on Silicon Valley Bank through the lender’s UK arm, based in London.

There are an estimated 3,000 UK-based SVB customers, ranging in size and equity. When many struggled to access funds needed for payroll and other financial commitments, it poured fuel on the fire of the bank’s imminent collapse. In the UK, the Financial Services Compensation Scheme ensures the first £85,000 of deposited cash is covered by insurance, but with bills running much higher than that for many, the organisations involved were at serious risk.

Tech leaders from around the UK and beyond voiced their fears and concerns over social media and implored action from Chancellor Jeremy Hunt to prevent the huge loss of innovation, talent, and jobs. With the government’s help, HSBC stepped in to acquire the UK operations, pulling those businesses back from the brink of potential collapse. This move secured the deposits of thousands of British tech companies and saved a huge number of jobs.

Why this was no surprise to Red Flag Alert

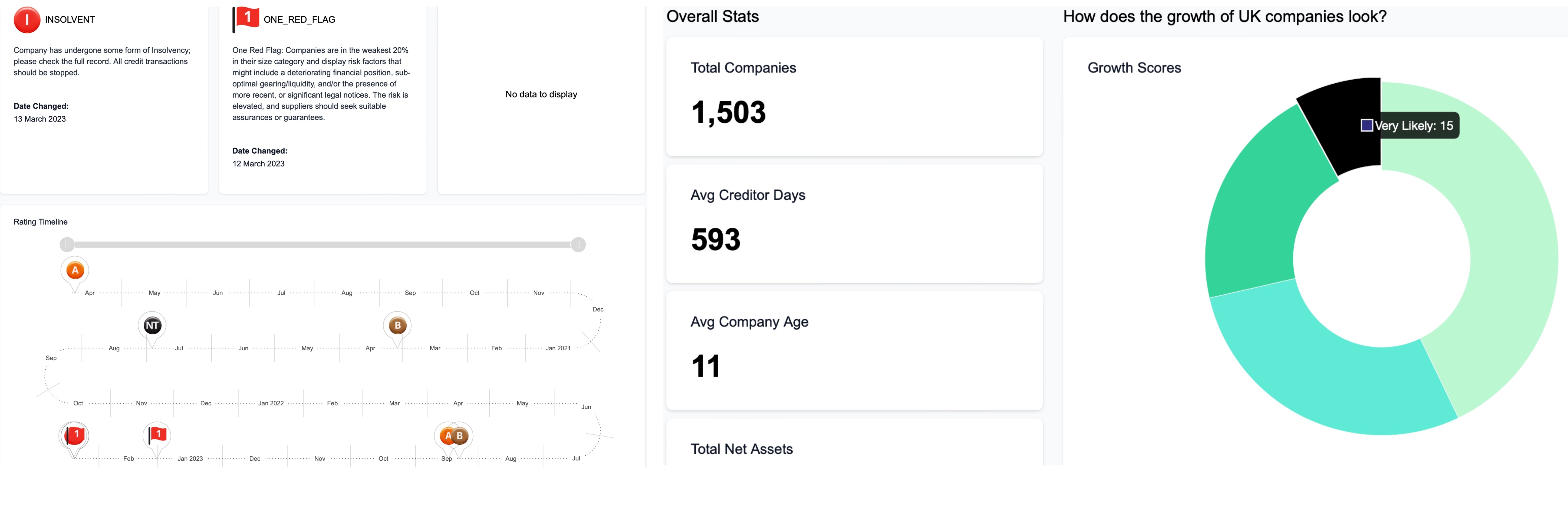

Using our Credit checking and Portfolio management tools, Red Flag Alert were alerted of the issues at Silicon Valley Bank in early February as the bank moved into our insolvency risk category, and users of our software were notified of six concerning alerts way back in September 2022. Red Flag Alert's advanced Debenture Search shows that 1503 businesses in the UK currently hold a live charge with SBV, and of these businesses, only fifteen qualify for a positive Growth Flag score of 20% growth or more. Therefore, sadly, the news of SVB’s incoming insolvency was of no surprise to the team.

Silicon Valley Bank insolvency timeline and SVB 's UK Debentures Growth Score

Silicon Valley Bank insolvency timeline and SVB 's UK Debentures Growth Score

Dr. Nic, Chief Economist at Red Flag Alert, said the writing was on the wall with the problems at the failed bank.

“We started to notice the decline and the step towards potential insolvency in February, as the business slipped down the insolvency metrics within our software. Whilst other competitors still held the bank in high regard, Red Flag Alert were one of the few to notice the slump. We watched closely as our predictions came to fruition.

There are other ways to predict such a decline for an organisation too. With our Growth Flag platform, monitoring businesses that our software predicts to grow 20% or more is a key indicator for future-proofing your investment and ensuring robust investment opportunities within the sector.”

Discover how Red Flag Alert’s experienced team can help you mitigate risk and protect your business. Why not get a free trial today and see how Red Flag Alert can help your business?