Company monitoring is an essential process for businesses. By keeping track of their suppliers, customers, and contractors, organisations can mitigate risk and maintain security. Without this practice, disruptions can land at the doorstep of a business, without a moment’s notice.

Reduced cash flow, a drop in staff, or defaults on payments all present a red flag that could indicate future impacts on businesses adjacent to the struggling company. In the worst circumstances, signs of an incoming insolvency may be spotted on the horizon.

Periodically reviewing debtors is often a large part of the monitoring process, opening the door for businesses to deploy protective measures.

But, if a business can spot a volatile situation that indicates potential insolvency within its partnerships, how can it lessen the impact?

How to Spot Potential Risk/Insolvency

It is never easy when a business faces losing a client to insolvency. But when it happens, being in control is the priority.

By being aware of the insolvency warning signs, identifying the potential for risk or incoming insolvency is much more straightforward, putting the power back in the hands of the business.

Warning Sign #1 - Negative Cash Flow

Continuous negative cash flow, where a business consistently spends more money than it's generating, can be a clear sign of financial distress. Insolvency is more likely if a company struggles to meet its day-to-day financial obligations due to insufficient cash flow.

Warning Sign #2 – Experienced a Bad Debt

If a debtor has experienced a significant bad debt, they are three times as likely to become insolvent themselves. In turn, this has a knock-on effect to the businesses awaiting payment from the insolvent company, potentially triggering a domino effect of insolvencies.

Warning Sign #3 - Declining Profit Margins

Consistent declines in profit margins or a series of unprofitable periods may suggest financial distress. A reduction in profitability can be caused by various factors, including increased competition, rising costs, or an inability to adapt to changing market conditions.

Warning Sign #4 - Liquidity Issues

Difficulty in meeting short-term obligations, such as paying suppliers, and creditors, or meeting payroll, is a red flag. If a company struggles to convert its assets into cash quickly or faces delays in collecting receivables, it may indicate liquidity issues that could lead to insolvency.

Warning Sign #5 - Legal Actions and Creditor Pressure

Legal actions, such as County Court Judgments (CCJs) or winding-up petitions, can be strong indicators of financial distress. If creditors are taking legal action to recover debts or if the company faces persistent pressure from creditors seeking payment, it may suggest insolvency.

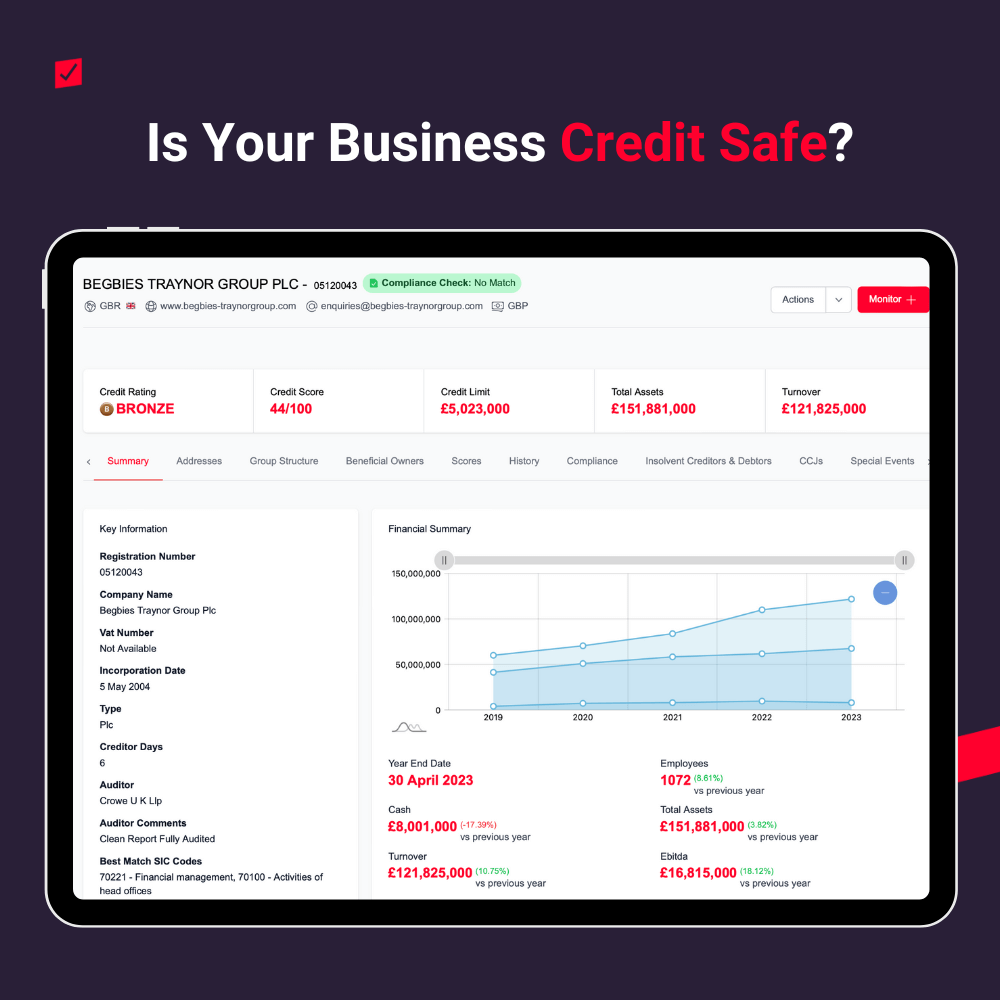

Monitor in Seconds With Red Flag Alert

Business owners, investors, and stakeholders must monitor these indicators closely if they are to navigate the impact of insolvency within their portfolio of businesses.

Red Flag Alert has revolutionised the monitoring process with specialist-powered tools, including:

Optimised organisation with customisable portfolios. Businesses can tailor their lists, ensuring no company slips through the net, whilst analysis tools within the portfolio gives clear indicators for prospecting, risk mitigation, and health checks, alongside general trends.

Tailoring the company monitoring experience with Red Flag Alert also allows businesses to create custom event triggers, ensuring that only pertinent alerts are delivered to inboxes.

Removing overwhelming, spammy emails reduces the chances of overlooking critical data points, instead providing concise and actionable daily reminders for each portfolio exclusively when triggered events occur.

The tools also facilitate the sharing of alerts and list access effortlessly across departments.

By aligning team members, businesses can enhance visibility, reducing the risk of delayed critical alerts due to staff absence or human error.

Do not settle for standard monitoring solutions – elevate your capabilities with RFA and redefine your monitoring experience.

What now?

With the right monitoring procedures in place, businesses can respond to insolvency warnings swiftly. Once a business has spotted a relevant company entering hot water, following these five steps will place it in a more favourable position.

1. Redefine your terms of business

Opening a dialogue with the company of concern is more likely to lead to a positive result for your business, in contrast to simply ignoring the issue. These conversations should outline the business’ expectations, and reaffirm the preferred handling of payments, delivery, returns and any possible points of conflict.

2. Monitor their suppliers

Monitoring the health of the companies a business deals with is one part of the puzzle. Going further along the chain can reveal where the cause for concern originated. For example, a business’s manufacturer may be struggling due to its own supply chain being hit by insolvency. If this is spotted in time, it can signal to begin searching for a new manufacturer.

3. Negotiate

If the company facing trouble hasn’t yet raised any concerns with a business, instigating a formal negotiation before the issue develops is paramount. Speak to the company and gain a clearer idea of the bigger picture, and the elements that are affecting them.

Throughout this conversation, ask if there is anything reasonable you can do to help alleviate their financial difficulties. From here, a strategy based on the facts can be developed, protecting your business whilst potentially reducing pressure on the struggling company.

4. Mitigate risk

In a broader sense, mitigating the risk the business is exposed to should be handled across all elements, including:

- Reduce your reliance on that company and look for other suppliers.

- Find other suppliers. This way, you’ll still be able to source the goods and services you need if one of them becomes insolvent.

- Only work with financially healthy suppliers. Build insolvency risk into your requirements next time you look for a new supplier.

5. Ask what guarantees they can provide

It is in the interest of any company facing insolvency to maintain positive relationships with their business partners, suppliers, customers, and others. Asking for their capacity for guarantees will give the business a clearer idea of what to expect. In turn, a plan of action can be formed to protect ongoing projects and plans as much as possible.

Protect Your Business from Insolvency Risk with Red Flag Alert

Experts have predicted that Britain is likely to see over 7,000 businesses becoming insolvent, per quarter in 2024. - source

With these threats looming, businesses must bolster their monitoring and protective procedures if they are to side-step the oncoming impact of insolvencies.

Red Flag Alert provides the UK’s best insolvency risk services. Our database features:

- B2B Data on every UK company

- AI algorithm that uses 15 years of company data to identify business insolvency

- Real-time data updates from global sources

- Monitoring and alerts tools to assess risks

- Additional AML checks and sales prospecting tools

- Companies use Red Flag Alert’s insolvency risk services to check which clients and potential clients pose a credit risk.

Spot insolvencies before they land at your doorstep, take the necessary steps to protect your business and get a free trial today.