When we use the term “Credtech”, typically it refers to credit technology. Generally, that includes technologies to help businesses assess risks involved in doing business with a person or company. These technologies also help determine if a person or company is creditworthy and how much credit to offer.

In the current business landscape, Credtech is indispensable, allowing companies to mitigate risks, steer clear of bad debt, and make informed data-driven decisions amid economic uncertainty. However, this approach doesn’t come without risks – and it’s important to add the correct software to your tech stack, to ensure optimal performance.

The significance of data security

Data is the new oil of the digital economy. Protecting and utilising it effectively is the key to success. Bernard Marr, business performance, data, and analytics expert.

Credtech's data-driven foundation

Credit technology platforms gather and scrutinise data, creating a comprehensive financial portrait for individuals and businesses. Therefore, a reliable data source is the cornerstone of a creditworthiness assessment.

For individuals, payment histories serve as indicators of fiscal responsibility, while business assessments delve deeper into factors like debt payment history, adverse media mentions, financial performance, and legal actions. Intricate Credtech algorithms, like Red Flag Alert’s, predict repayment likelihood and offer businesses a data-backed foundation for smart financial strategies.

However, at the core of Credtech's data-driven foundation lies an invaluable resource — sensitive information. It’s vital to Credtech's predictions, and encompasses both financial histories and personal identities, making data security imperative as these platforms navigate the complex terrain of financial decision-making in today's business landscape.

Data breach dangers

The spectre of data breaches looms large, casting a shadow of potential risks and devastating ramifications. These breaches, which expose sensitive financial and personal information, pose a threat to both businesses and individuals.

One example is the Equifax data breach of 2017, where the personal data of over 147 million people was compromised. This breach not only exposed individuals to identity theft but also had far-reaching consequences for businesses relying on Equifax's credit assessments. It served as a reminder that even giants in the industry can falter in safeguarding data, highlighting the critical need for robust security measures.

The repercussions of data breaches extend beyond the immediate aftermath. For businesses, they can lead to tarnished reputations, loss of trust among clients, and legal battles, while individuals may grapple with identity theft and financial fraud.

In Credtech, vigilance against data breaches is not a mere precaution; it's imperative for safeguarding both financial integrity and personal privacy, something Red Flag Alert takes seriously.

Privacy concerns in Credtech solutions

Data privacy is not a luxury; it’s a necessity in today’s interconnected world. Tim Cook, CEO of Apple Inc.

Privacy in the digital era

In the digital era, the concept of privacy is at a crossroads. The expansion of the digital footprint, coupled with the proliferation of data-driven technologies, has brought the matter of privacy to the forefront of modern discourse.

In an age where every click, transaction, and interaction generate a data trail, individuals and businesses grapple with a growing unease surrounding data security.

This unease is driven by the awareness that our personal and financial lives are increasingly intertwined with digital platforms. From online shopping and banking to social media interactions, the digital realm is an integral part of our daily existence.

As data flows seamlessly through the digital ecosystem, individuals become acutely aware of the vast reservoirs of information amassed by companies and institutions; the result is concern about the sanctity of personal information. This worry can affect all businesses that rely on data for critical decision-making.

In this landscape, privacy takes on a heightened significance, not just as a matter of legal compliance but as a fundamental human right, and a foundation of trust in modern times.

Unique privacy challenges

Privacy challenges carve out a distinct identity, demanding special attention. The sheer volume of data collected, encompassing payment histories, financial records, and legal actions, presents a monumental task in safeguarding sensitive information.

With vast datasets residing on servers and in the cloud, the risks are high. A single breach could have devastating consequences, not only for individuals but also for businesses reliant on credit risk assessments, underlining the need for fortified data storage systems.

Furthermore, the network of data sharing within Credtech introduces its own vulnerabilities. Information is shared between businesses, credit bureaus, and financial institutions, necessitating a delicate balance between secure sharing and privacy compliance. Any misstep in this intricate web could trigger severe repercussions.

Data drives critical decisions; addressing these unique privacy challenges transcends mere compliance; it becomes imperative to preserve trust and uphold integrity between businesses and customers.

Addressing privacy concerns - a Credtech imperative

Privacy is not an option, and it shouldn’t depend on whether you have something to hide or not; it’s a fundamental human right. Edward Snowden, former NSA contractor and privacy advocate.

Fortified data security measures

In the fast-evolving landscape of Credtech, data security is a commitment. Credit risk platforms like Red Flag Alert, employ cutting-edge security mechanisms to protect sensitive information, and at the heart of these measures lies encryption.

Encryption, the conversion of data into indecipherable code, is generally the first line of defence. Credtech platforms utilise state-of-the-art encryption algorithms that render data impervious to prying eyes. This ensures that even if a breach were to occur, the stolen data would be unintelligible to cybercriminals.

Beyond encryption, there are advanced security technologies like multi-factor authentication and biometrics. These technologies fortify access controls, requiring multiple layers of verification before granting entry.

Harmonising with data protection regulations

Firms must ensure all measures are in alignment with data protection regulations like GDPR (General Data Protection Regulation) and the Data Protection Act.

Consumers and businesses entrust their sensitive information to Credtech with the expectation of rigorous adherence to regulations. The consequences of non-compliance are too profound to ignore, both in terms of legal ramifications and trust erosion.

Red Flag Alert navigates the labyrinth of GDPR with a fine-toothed comb. We implement robust data governance frameworks that encompass data collection, storage, and sharing. Our approach ensures that individuals' rights regarding their personal data are upheld, and their consent is sought and respected at every turn.

Non-compliance with GDPR isn't just a legal misstep; it's a trust deficit waiting to happen. The fines levied for breaches are enough to push a business into insolvency. Moreover, the reputational damage can be irreparable.

Red Flag Alert removes a lot of this compliance burden from businesses as we’ll handle sensitive information, streamlining your AML and IDV procedures into a fast, easy, and straightforward process.

Building trust through transparency

Transparency is the cornerstone of trust, especially in the digital financial world. It’s what builds credibility and instils confidence in users. Christine Lagarde President of the European Central Bank.

Transparency initiatives

Transparency initiatives are at the forefront of many Credtech initiatives. This fosters trust and credibility in digital finance.

One notable effort is the open-book approach we adopt at Red Flag Alert. We provide clients with access to comprehensive reports, allowing you to delve into the intricacies of credit assessments. This transparency not only empowers you with insights but also showcases a commitment to honesty and openness.

Furthermore, Credtech enterprises champion data transparency, sharing insights into data sources and methodologies. Clients and partners are offered a clear window into how data is collected, validated, and analysed, assuring all stakeholders that decisions are grounded in data integrity.

Empowering through education

Empowerment extends beyond financial decisions; it encompasses data security education as a basis for addressing privacy concerns. We recognise that knowledge is the most potent shield against data vulnerabilities and are committed to nurturing comprehensive user awareness.

One vital aspect of this educational journey is our user-friendly guides and resources. These resources empower you to navigate the digital financial landscape with confidence, knowing how to protect your data and make informed choices.

Want to try Red Flag Alert for free?

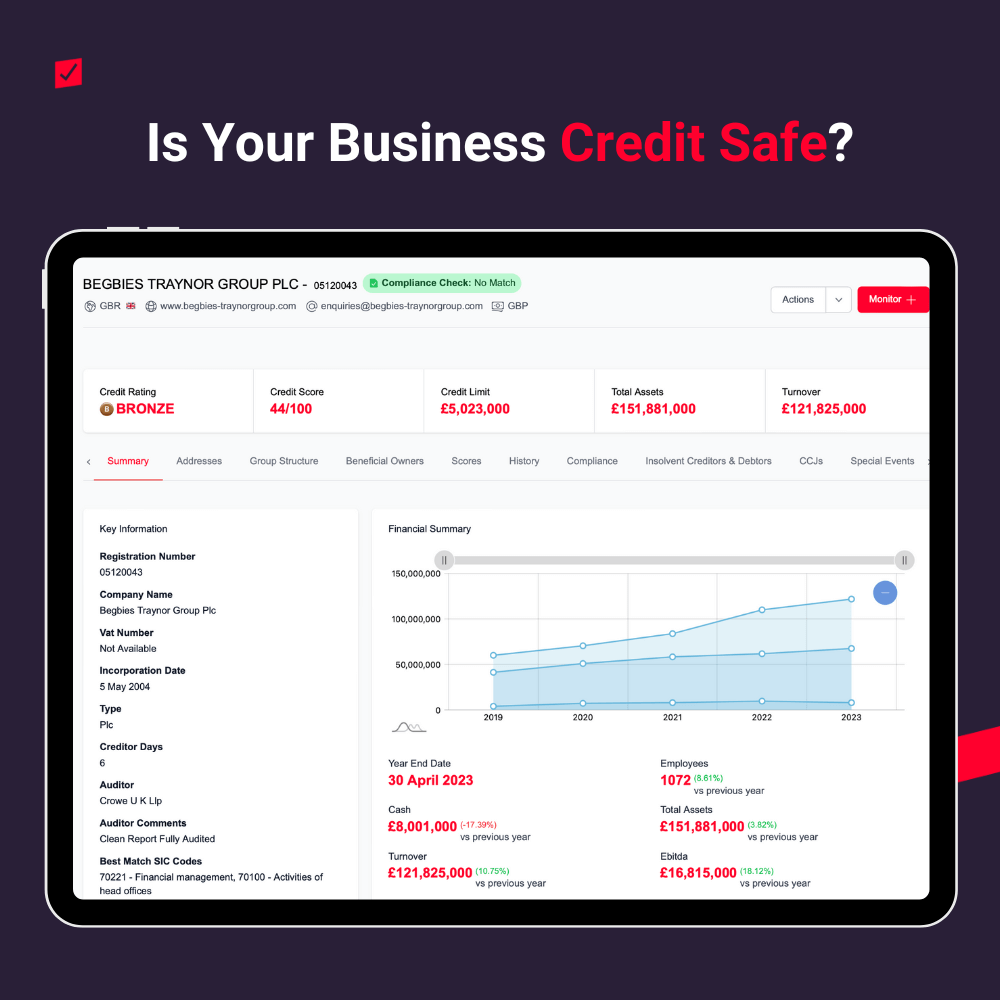

Red Flag Alert was developed by the UK’s largest insolvency company, Begbies Traynor, as a method of identifying future insolvencies. We are the experts in the causes and warning signs of business failure, have the UK’s number one insolvency score, and our quarterly economic reports are the industry gold standard.

Our award-winning platform offers:

- Unique and easy-to-understand company financial health rating

- Easy to understand in-depth reports with instant retro analysis

- In report analysis tools

- Fully user bespoke portfolio monitoring

- Database of every UK company and 350+ million international companies

- International report

- Easy-to-use granular search tool

- Full AML compliance suite including EIDV

- Single sign-on

- Proprietary Growth Score

- Post-COVID scorecard

Red Flag Alert has over twenty years of experience in saving companies from bad debt, remaining compliant and achieving growth. Our platform is available on a seven-day free trial and will immediately protect and empower your business. Or read our comprehensive Guide to Credtech.