If you’ve worked in sales as long as I have, you’ll know the frustration of poor data.

Rather than spending your time selling, you find yourself chasing leads which have moved on, sifting through reams of irrelevant data or updating databases full of obsolete or inaccurate information.

The truth is that CRM systems are only as good as the data that is put into them – so when you use low-quality, out-of-date information, it hampers your team’s efficiency.

At the same time, accurate data needs to be supported by intuitive functionality and automation – otherwise, it will drain time.

Red Flag Alert helps in both of these areas, enriching your CRM with current, high-quality data, as well as providing a range of features that help drive sales.

Accurate, Real-Time Data

Our API integrates all of our data into your CRM in real time, providing you with 180,000 updates every day on each of the UK’s six million companies.

For each business, you’ll have the latest financial information, up-to-date details of key decision-makers and an accurate company health rating, allowing your sales team to work efficiently and with confidence.

Here are five benefits to adding Red Flag Alert data to your CRM:

1 – Save Time

As previously noted, updating a CRM system takes time – time that could be spent selling.

Human error is another significant drawback, and constant manual updates will soon cause the number of inaccuracies in your database to increase.

By regularly and automatically updating your systems with accurate information, we save your teams the hassle of following up on out-of-date information, as well as the time spent laboriously entering details.

You can also choose exactly what information you need to see, meaning less time sifting through irrelevant data.

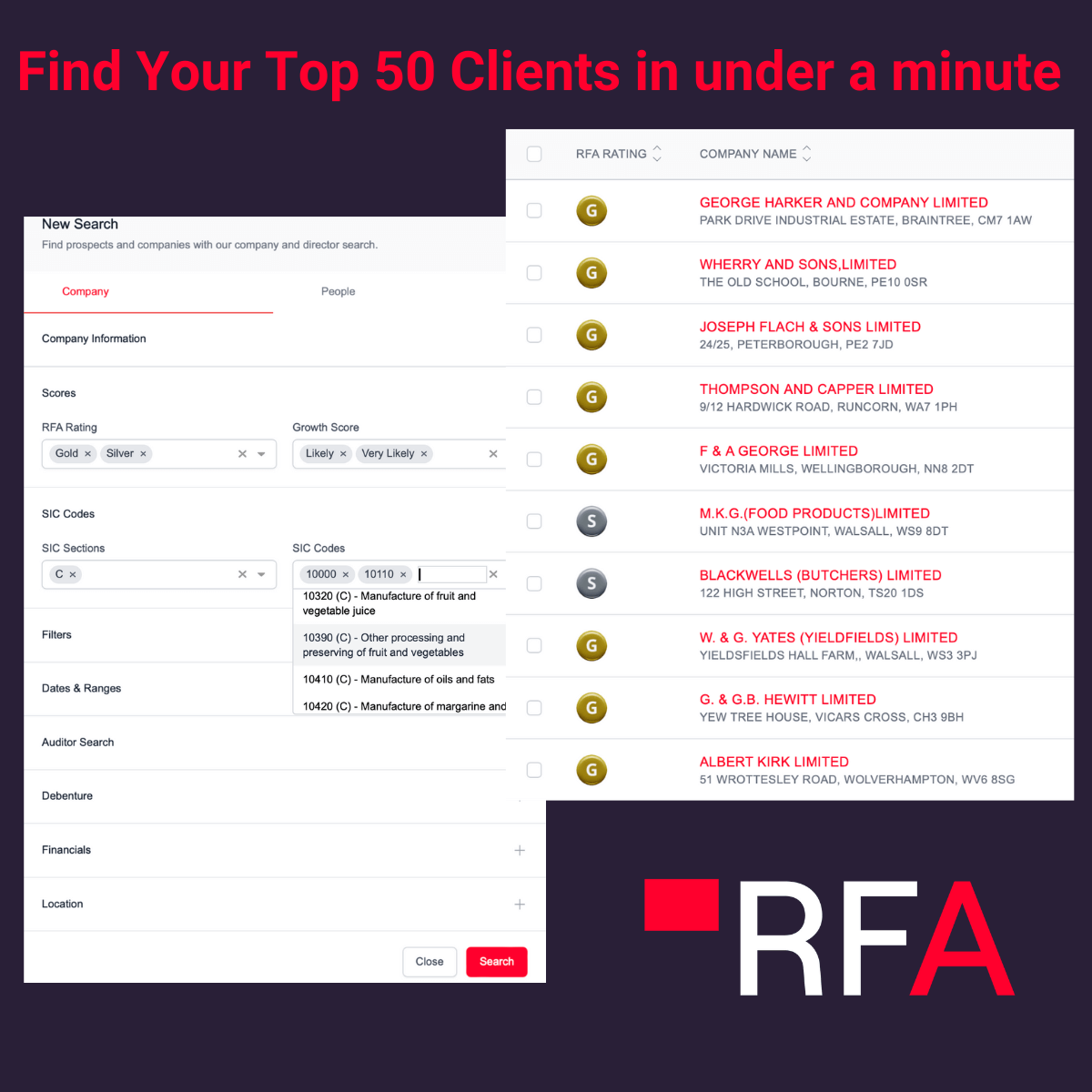

2 – Build Specific Customer Segments

Red Flag Alert’s rich data enables you to create highly specific customer segments.

Customers can be grouped by factors such as location, turnover, profit, growth, net assets or cash reserves, allowing you more control over which customer profiles you target.

These tightly defined segments allow your sales and marketing teams to focus on prospects that are well-positioned to buy your services, or to experiment with different sales strategies.

For example, you may typically target businesses of a specific size that work in a particular industry.

However, if your business plan is to diversify your client base, you can set parameters for similar-sized companies in different industries and test which ones are successful.

3 – Empower Your Sales Team

One-to-one prospecting meetings require sales teams to tailor their value proposition to the customer’s needs and situation.

Red Flag Alert helps your sales team to plan sales presentations by providing insight into the challenges facing your potential customer.

For example, ratios indicate a company’s financial performance. This will help your team choose which products or services would be most relevant to the prospect.

A business that has recently acquired a lot of bad debt may need financial products such as insurance, loans or even business rescue packages.

Alternatively, a business with strong growth and high cash reserves may be interested in investments, acquisitions or marketing services.

4 – Proactively Manage Risk

In the current financial climate, companies can go from ‘stable’ to ‘in distress’ overnight.

This is especially the case in sectors with long, complex supply chains or for companies that have underperforming clients.

Our financial health ratings are updated daily, taking into account the latest publicly available information.

Moreover, our detailed algorithm allows us to go further and make accurate predictions on a company’s future financial health.

This enables you to take preventative action if one of your customers begins to pose a credit risk, such as setting credit limits or asking for guarantees.

However, a more efficient and proactive solution is to build credit checks into your prospecting process to ensure that your company only seeks to work with financially stable businesses.

5 – Use Triggers

There are hundreds of thousands of changes to the information in our database every day and each change can represent a sales opportunity.

Getting in touch at the right time is critical – our system allows you to set up triggers that alert your sales team immediately when a company’s data changes in a way that makes them a prospect.

Not only does this allow you to strike faster than your competitors, but by following up on a change immediately, you reach the customer at a point when the situation is still fresh in their mind. This means they will be more open to potential solutions.

Let us help you connect your CRM to our best in class business data, why not request a free trial today ?