There are 484,000 UK businesses in significant financial distress as average debt soars, with the property, leisure and tourism sectors badly affected.

- Number of businesses in significant distress is now 484,000 – that’s 14% of all active UK businesses.

- Average company debt increases by 122% in past three years to £66,000.

- Businesses in ‘critical’ financial distress increases by 5%.

Red Flag Alert data for Q2 2019 found that 14% of all UK businesses were experiencing ‘significant’ financial distress at the end of June 2019, with the average debt of a company doubling to £66,226 a year, from £29,872 in 2016. There was also a worrying increase in the number of businesses in critical financial distress during the same period – often a precursor to formal insolvency – with a rise of 5% year-on-year.

Low consumer spending impacting business

Businesses reliant on consumer spending continued to be hit hard, with real estate and property businesses most affected by the weakest consumer spending since records began in the mid-1990s. This sector alone saw a 15% year-on-year increase in the number of companies in significant financial distress, rising from 43,085 in Q2 2018 to 49,342 in Q2 2019.

The property/real estate sector experienced a 2% quarter-on-quarter increase in significant financial distress (48,309 in Q1 2018 to 49,342 in Q2 2019) – the highest quarterly percentage increase across any sectors measured in the Red Flag Alert data.

Other industries seeing an increased number of businesses experiencing significant financial distress between Q2 2018 and Q2 2019 were:

- Hotels & accommodation: 8% increase - 5,095 (Q2 2018) to 5,516 (Q2 2019).

- Sport & health clubs: 5% increase - 8,481 (Q2 2018) to 8,940 (Q2 2019).

- Leisure & cultural activities: 4% increase - 12,524 (Q2 2018) to 13,069 (Q2 2019).

Additionally, online retail is also suffering. There was a 12% increase in significant financial distress for retail businesses making sales via mail order or internet from 5,243 in Q2 2018 to 5,871 in Q2 2019.

Financial Services Sector

This latest research also reveals increased levels of significant distress within the financial services sector, with 12,666 businesses affected, an increase of 5% compared to Q2 2018.

Significant financial distress within the finance sector and a cooling of the real estate sector has affected the overall performance of London. More than 5,000 businesses in the capital have slipped into significant financial distress in the last year – the highest of any region in the Q2 2019 research, and an increase of 5% on the same period last year (117,683 in Q2 2018 to 123,196 in Q2 2019).

Even though it has shown some recovery with a decrease of 1% from Q1 2019 (12,758), the sector continues to be affected by the uncertainty surrounding Brexit. The sector awaits clarity - once the outcome becomes clear, stability should return as the fundamentals of this sector remain reasonably strong.

Mark Halstead, Partner at Red Flag Alert, said:

“The latest Red Flag Alert figures highlight the impact of economic and political uncertainty. Historically consumer spending has driven the UK economy, so the recent decline in spending leaves businesses vulnerable. Certainty needs to be restored, so consumers and businesses have the confidence to start spending.

An average debt of £66,000 is a huge increase and is placing pressure on the many SMEs which support more than 16 million jobs.”

Ric Traynor, Executive Chairman of Begbies Traynor Group plc, commented:

“Aside from the ongoing uncertainty surrounding Brexit and rising distress within both the Capital and the property and construction sectors, there are other more serious economic headwinds facing UK business. The spectre of protectionist economic policy and trade wars are a real threat to the global economy, with even the most respected economists fearing they could ‘shipwreck’ growth and drive the UK towards recession.

We have already seen this with faltering economic performance within the Eurozone economies –and talk of a cut in interest rates in the US. These are not other countries ‘problems’ but will affect many SME’s who trade internationally or simply import goods from abroad.”

Please click here to view the full report

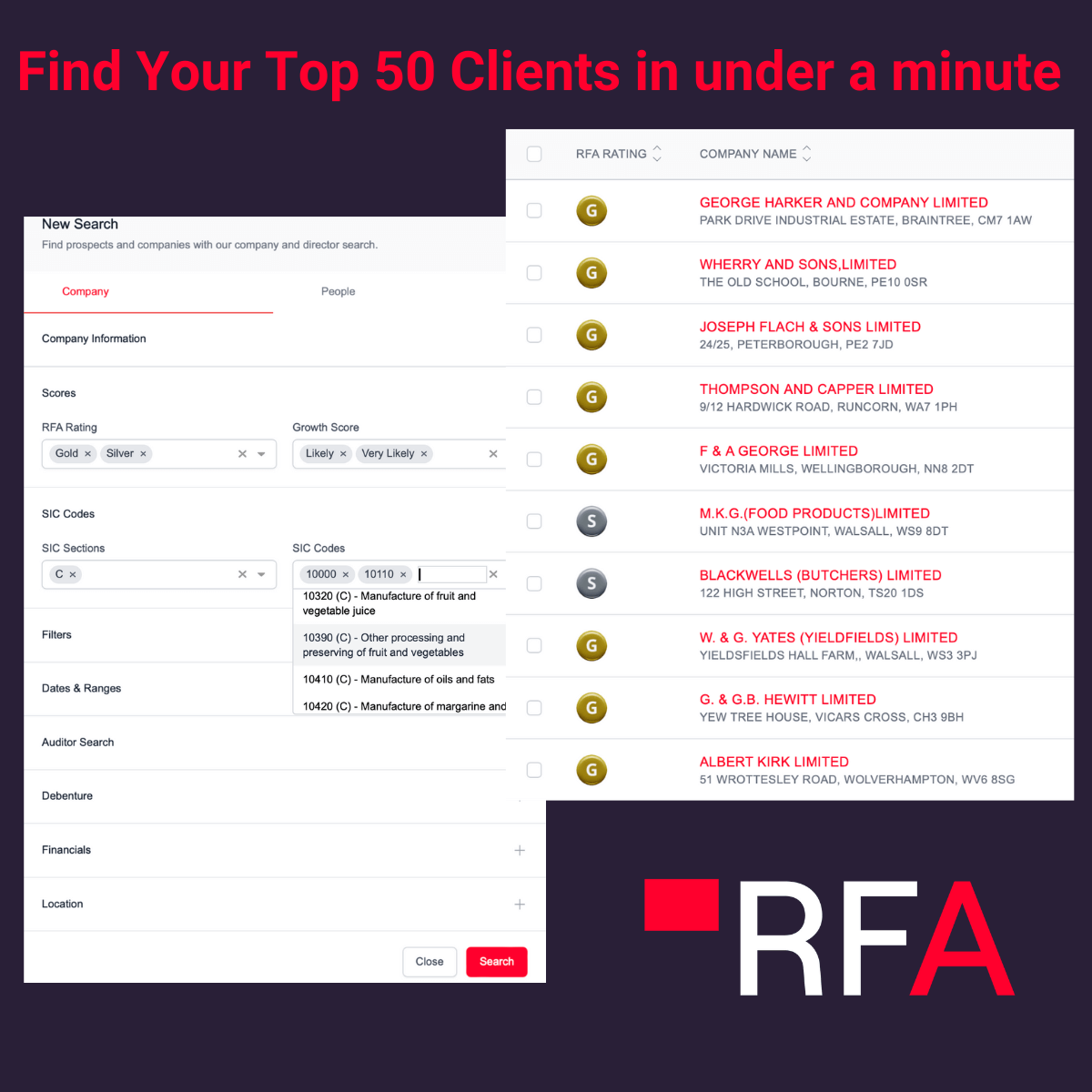

To see how Red Flag Alert can help you keep updated on the stats of UK business in real-time, click here to start a free trial.