Have access to Global AML, PEPs, Sanctions, and Adverse Media

Simplify your Compliance and Onboarding Processes

Verify and Gain in-depth knowledge of the people you deal with

Streamline the complex landscape of diligence and onboarding

Keep your business on track by adhering to the right standards and guidelines. Whether you're navigating Anti-Money Laundering (AML) regulations, conducting Know Your Customer (KYC) checks, or undertaking due diligence, Red Flag Alert provides the tools you need.

- Multibureau analysis

- Accepts 16,000 ID documents

- AI facial recognition technology

- Document validation

- 98% match rate

- Client friendly digital checks in your branding

- Fully compliant

- Bulk upload

- Ongoing PEPs, sanctions and adverse media monitoring

100

up to 100 checks at a time with bulk

250

points of checks for documents

25

years' experience

Don’t waste time with costly and outdated processes. Verify customers in seconds with our digital process, available completely remotely, saving time and reducing customer attrition.

Red Flag Alert’s secure self-serve identity process enables you to navigate complex compliance challenges effectively and efficiently, enabling you to confidently onboard new clients while mitigating risks.

AML Compliance

Improve your customer journey

Why should staying complaint mean inconvenience for you and your customers? We say it doesn’t.

We use the most advanced compliance check technology on the market along with our white labelling offering to start your customer relationships off on the right track.

Send checks directly to your customers device in your branding, that they can complete in as quick as a minute without the pain and delay of scanning and send over sensitive ID documents.

Giving them a smooth and seamless journey and great first impression and you a more accurate and secure compliance process, that also reduces your time to revenue!

Trusted by1000+ professional

SME & Enterprise busineses, including:

Start your 7 day risk free trial today

Get Started

Try our new AML checker now tool to see how seamless the AML process is

AML Compliance

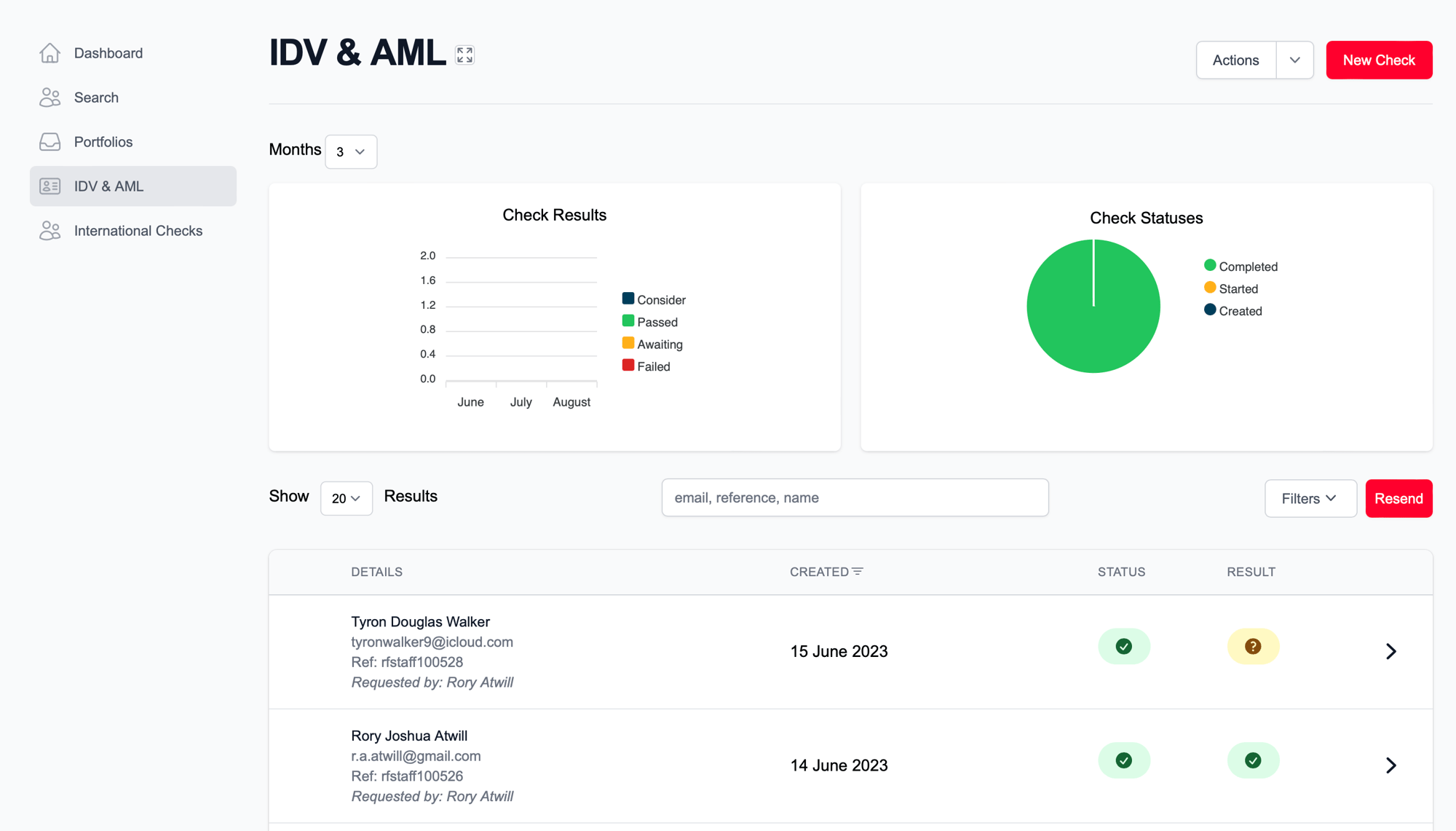

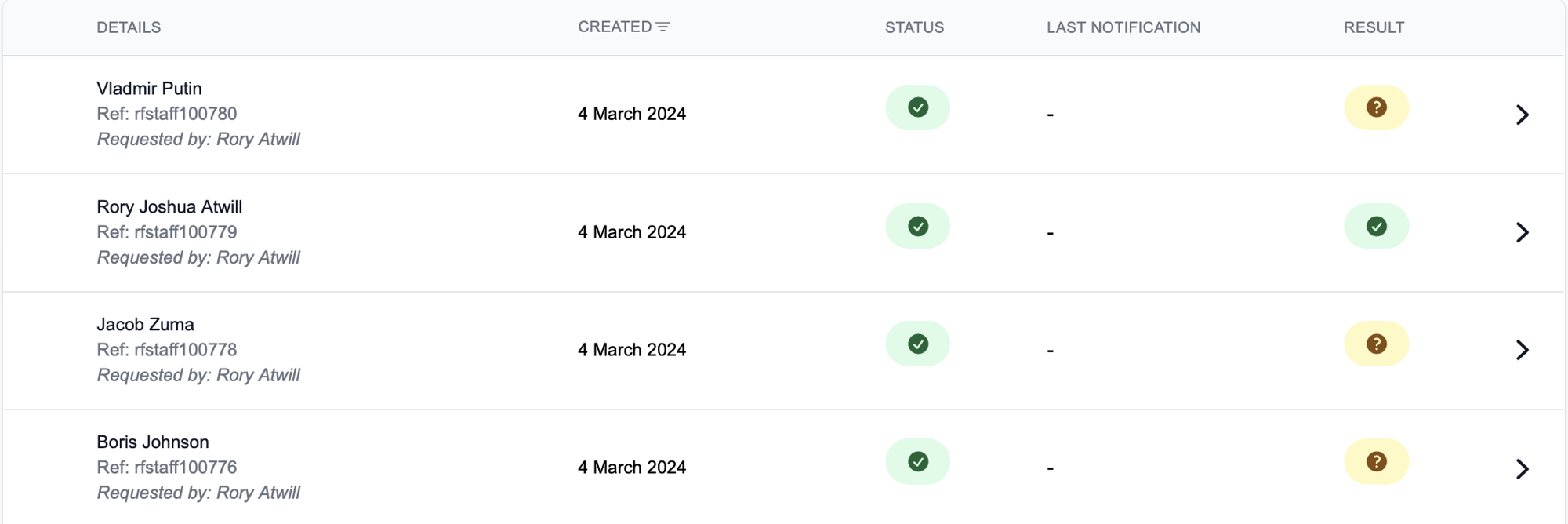

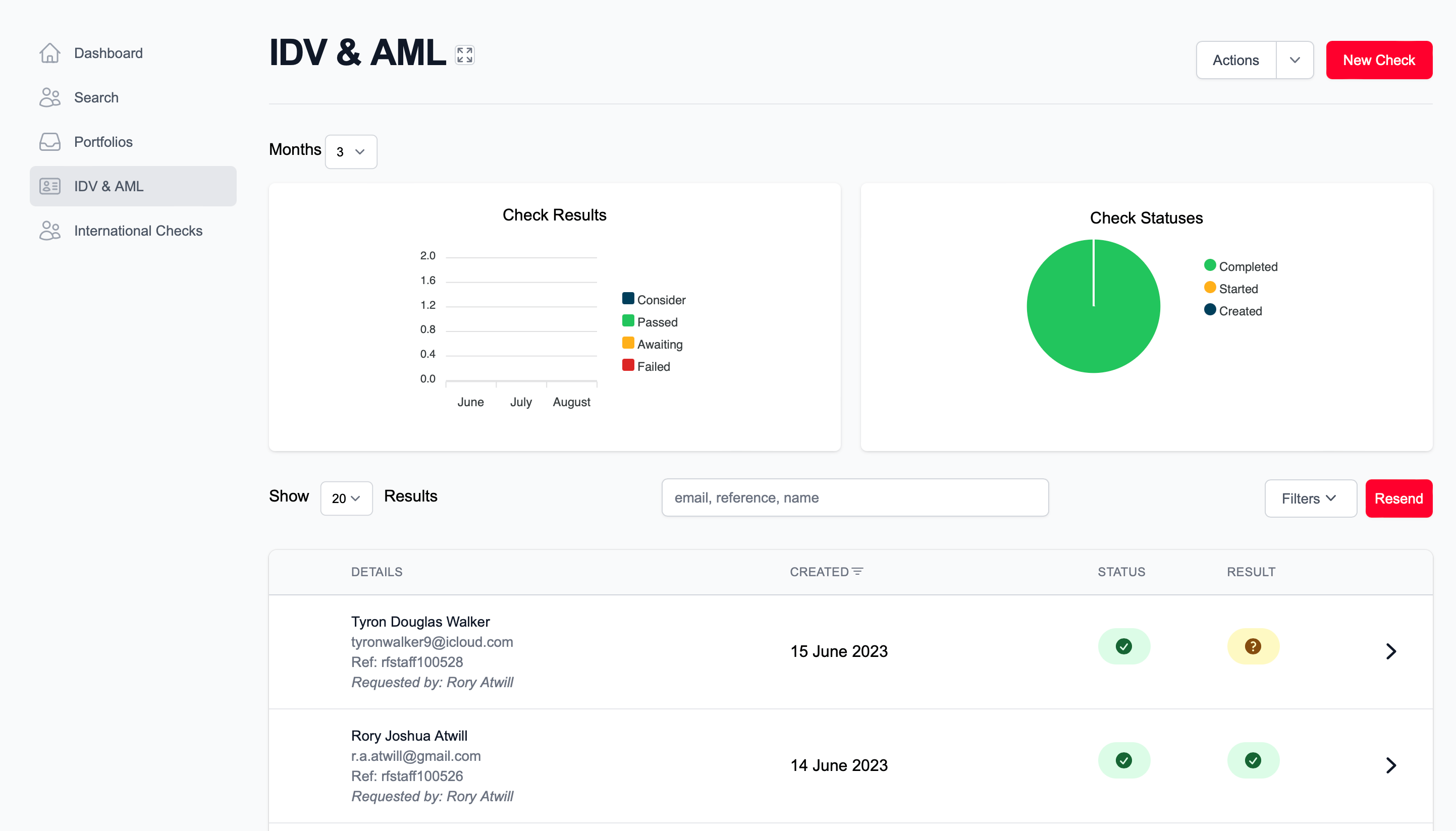

Ensure a secure audit trail

Evidencing your compliance process is as important as carrying it out but keeping your compliance audit trail up to date and inline with regulations can be an admin nightmare and presents a serious exposure to risk.

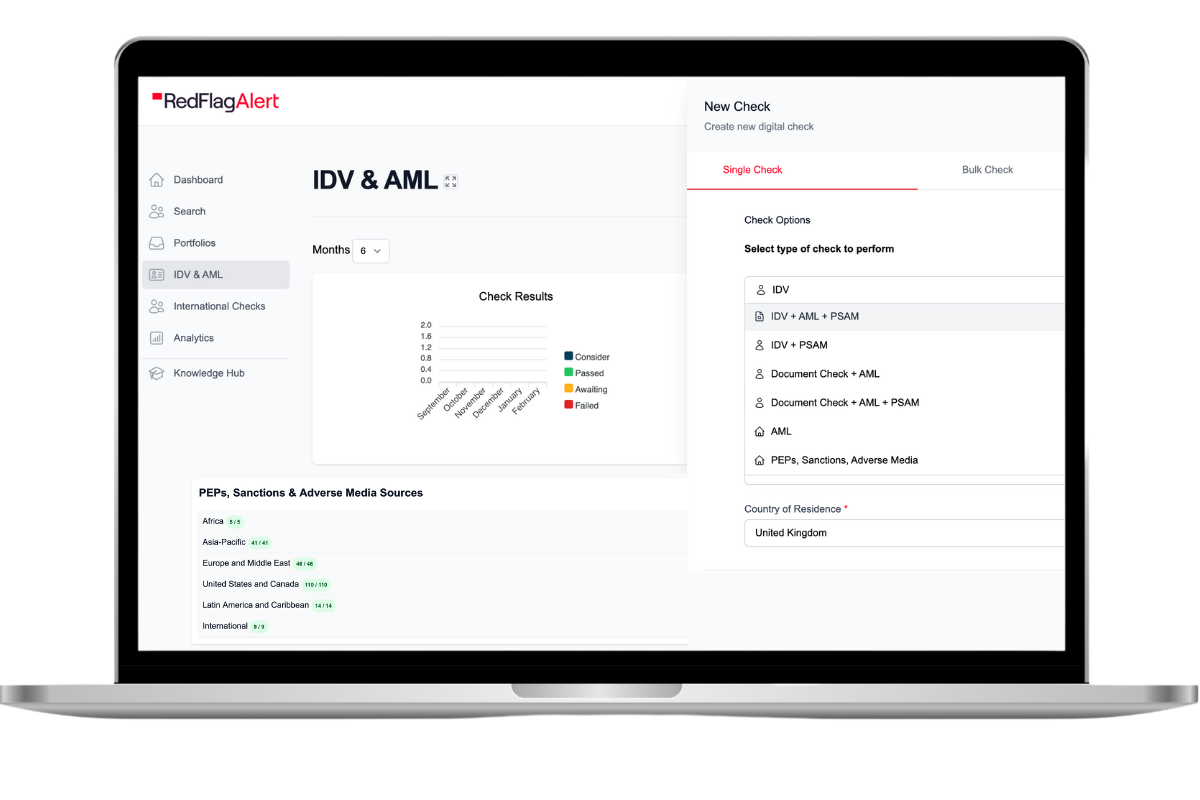

Our system allows you to track, monitor and store all your checks and associated documents in one convenient platform.

Giving you a secure and easily evidenced audit trail, that you can access from anywhere. Meaning you can have confidence that your records are compliant whilst reducing the time needed to be spent on admin.

Delve further with Red Flag Alert’s Enhanced Due Diligence & live monitoring

Ongoing Screening & Monitoring

Automated screening & monitoring

Red Flag Alert empowers you to seamlessly automate your screening and monitoring process, so you can focus on strategic decision making rather than time-consuming data entry. Reduce operational costs, manage your risk and ensure a consistent approach to compliance.

AML Compliance

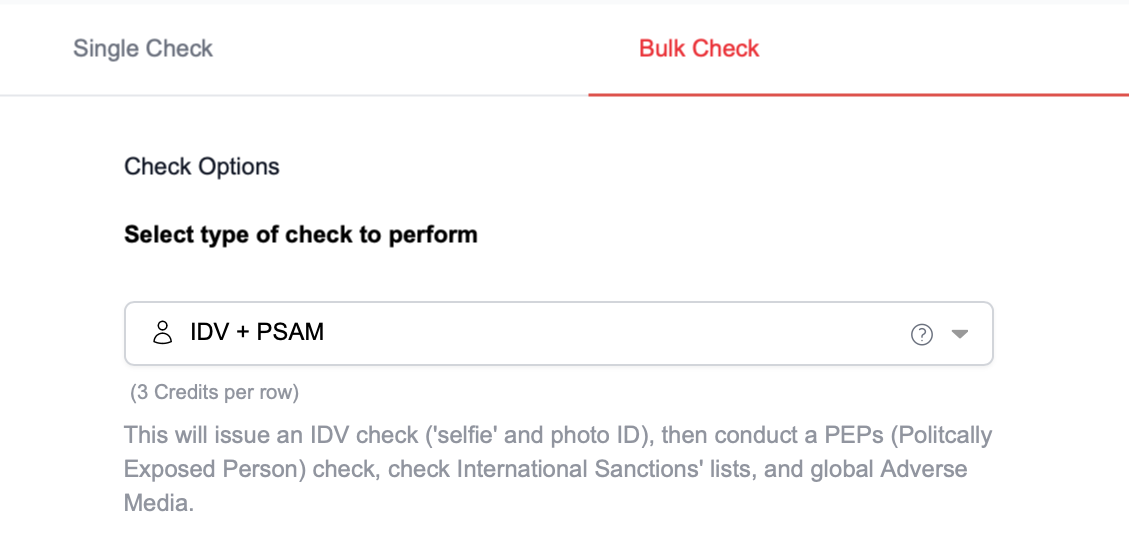

Don’t let high sales numbers hold you back with bulk check

Every company wants to sell as much as possible but a high velocity of new clients to onboard can create a compliance bottleneck which overwhelms your processes, gives a bad customer experience and can hurt your reputation.

Our platform keeps your onboarding process flowing smoothly and your customers happy by allowing you to send checks in bulk. So whether you need to onboard one client or one hundred it just takes a click of a button.

AML & KYC Compliance Solutions

Reduce referrals with our 98% match rate

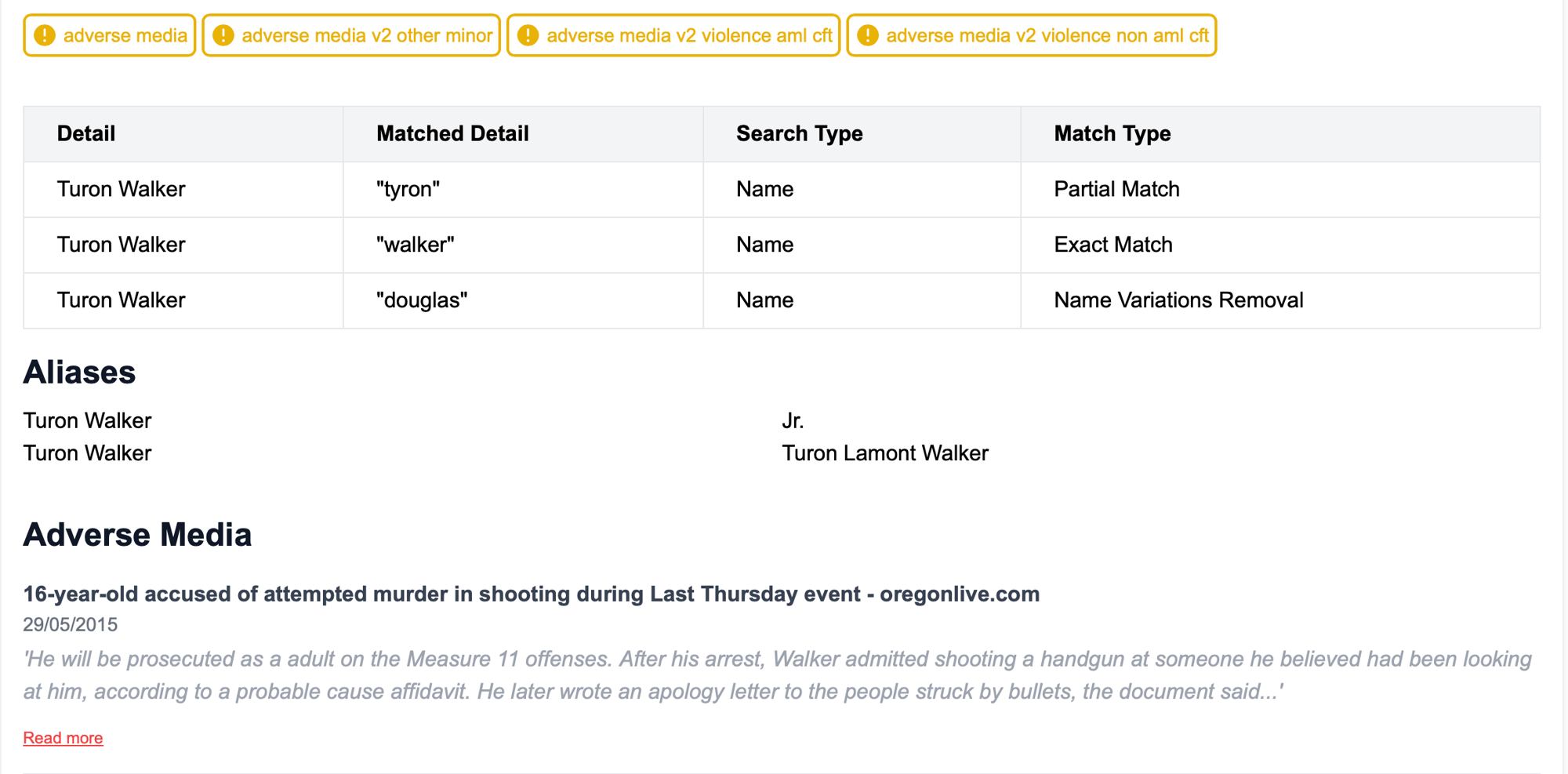

Our platform reduces human error, your number of referrals and your compliance risk by leveraging the most advanced technology on the market and multibureau analysis. Our checks use advanced facial and document recognition technology that scans for dozens of datapoints on your clients image and documents to confirm their identity and the authenticity of their documents. We then run these against thousands of global databases across multiple bureaus to provide a 98% match rate and dramatically reduce your number of referrals.

Reduce your cost of acquisition with checks sent in seconds

Our platform has been designed to reduce the pain point of staff time needed on and delays caused by compliance processes. By reducing the need for human data entry and analysis we both dramatically reduce your risk exposure to human error and slash the amount of staff time spent on a check to seconds. Making your compliance processes more secure whilst freeing your staff up for other duties and reducing the wage costs of your AML processes.

Real-time updates & live monitoring

Not only are our checks the most accurate available but they are also the most up to date. We check global databases in real-time and live monitor your PEPs, sanctions and adverse media checks to provide instant updates should a client become a compliance risk

White labelling: our tech, your name

Your clients want to deal with you not your AML check provider. Our service is fully white label enabled, so check are delivered in your branding and under your name. Giving your client a seamless and painless onboarding experience that gives the best first impression

Get Started

Discover how our platform works by booking a demo with our team.

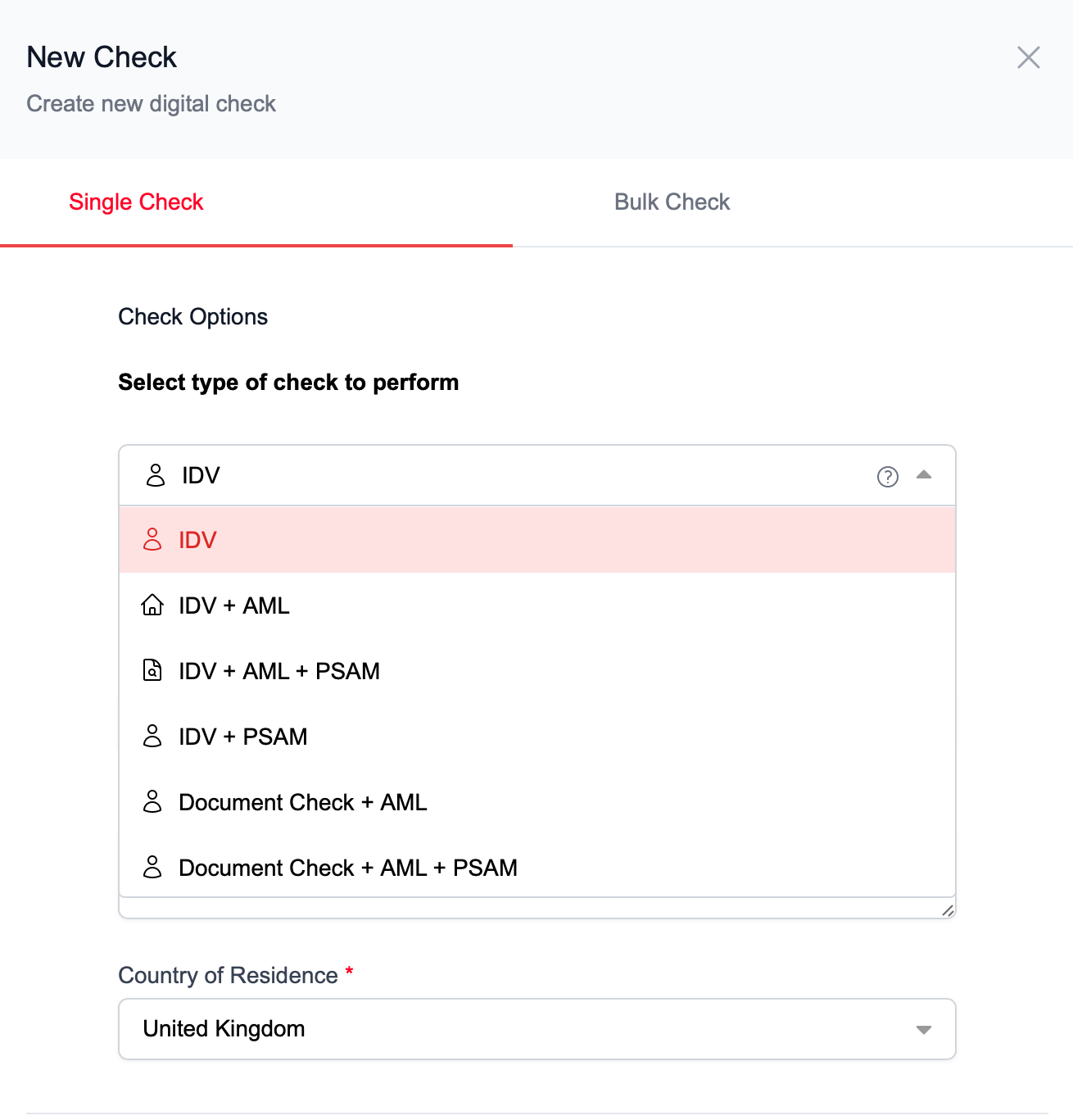

AML & KYC checks to suit your business

Data is updated daily, and recommended fraud and sanctions checks are also included in the Reg Flag Alert AML standard and enhanced checks for peace of mind.

Identification and AML checks can be carried out on our AML KYC Platform at three levels, depending on your business’ requirements:

- KYC (standard ID verification check)

- AML standard (address verification)

- AML Advanced (enhanced verification including screening for peps and sanctions)

The RFA anti-money laundering solution meets the Joint Money Laundering Steering Groups standard requirements of a match on an individual's full name and current address and a second match on an individual's full name and either his current address or his date of birth.

Enhanced User Experience

Our checks include cross checking documents and information including:

- UK Credit Header

- Edited Electoral Roll

- UK Land Telephone

- UK National ID Register

- UK Driving Licence

- UK Passport

- International Passport

- UK Mortality

- National Change of Address

- International Sanctions & Enforcements

- PEP Intelligence

Integrations & Apps with Leading CRMs

PLUS many more

Make your compliance work for you with AML checks in less than a minute

AML and enhanced due diligence procedures are a necessary and unavoidable part of doing business.

With £88 billion laundered through the UK each year and the FCA targeting companies who do not meet regulations, it has never been more important for businesses in the regulated sector to have best in class AML processes.

The issue facing companies is that these traditionally slow down business, inconvenience customers and interrupt revenue.

Red Flag Alert recognised this problem and designed our our fully digital AML platform to provide a fully compliant suite of AML and EDD checks that can be sent out in less than a minute.

- Make your compliance processes work for you with checks that take less than a minute of staff time to send out

- Fully compliant suite of AML & EDD checks, including: adverse media, PEPs sanctions

- EIDV facial recognition technology and document verification technology

- 98% match rate with multi-bureau analysis

- Send up to 100 checks with the click of a button with batch check feature

- Send, track, manage and store your compliance checks in one platform

- Your client completes checks directly from their device without the need to download an app

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

From Our Customers

Listen to how we have helped our customers

"We were looking for a partner to enhance the data offering to our clients, and Red Flag Alert have done just that. They understood our business, our culture, and our aspirations for the future. We’ve seen some great feedback on our integration, and we are very happy with both the solution and team at Red Flag Alert."

Rob Mead

Strategic Software Projects Director

"We use the search tool to identify businesses in specific geographic areas, with the right number of staff, the right turnover, and a low risk of non-payment. Now we have experienced the benefits of Red Flag Alert, we could not be without it."

Mark Bryan

NSL Telecoms

"From a business development perspective, our brokers are benefiting greatly from the additional information that Red Flag Alert supplies – we’re able to zero in on ideal prospects and build effective marketing lists."

Ben Robert-Shaw

Power Solutions UK

AML Checker

Create new digital check

Red Flag Alert doesn’t just do business data, we also have a full suite of anti-money laundering and enhanced due diligence checks.

We understand that AML compliance, whilst important, is not only inconvenient for you and your clients but also costs you money in the staff hours spent performing the checks and delays business as you wait for ID documents to be sent to you. This tool enables you to preview how easy it would be to use the full AML tool available at Red Flag Alert.

With our AML check tool we wanted to provide our clients with best-in-class match rates and a full suite of checks but also offer a solution that ensures AML compliance was no longer a time and money sink for them.

If you are happy with how easy and straightforward this tool is, then you are in luck. Our fully digital tool uses EIDV software to read ID documents and allows your customer to quickly and conveniently complete a check directly from their device without the need to download an app. Meaning your staff can send a check out in less than a minute. We also provide a bulk check feature, so whether you are sending out one check or one hundred, it won’t slow down business.

Red Flag Alert AML and enhanced due diligence checks use a multi-bureau checking system for unbeatable match rates, provides a full suite of risk checks, lets you manage your checks in the platform and provides real time PEPs, sanctions and adverse media monitoring.

Check Options

Select type of check to perform

Personal information

Enter the personal information of the applicant

Request a trial

Discover our AML compliance platform in full by requesting a free 7 day trial.

Knowledge Expertise

Knowledge Base Hub

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more