The insolvency register is a public list of people who have used a debt relief solution in England and Wales. But can you use it to protect your business against financial risk and loss? To understand how the insolvency register works, you need to understand what it means to be insolvent. Insolvency is a term that describes when a person is unable to repay their debts.

People typically become insolvent as a last resort to write off some or all of their debt.

They do this by using a debt relief solution, like:

● Bankruptcy

● Individual voluntary arrangements (IVAs)

● Debt Relief Order

Taking one of these steps to clear debt is often a positive move. However, if you’re hoping to onboard a new client or customer, you won’t want them to be insolvent. It suggests they’re not in the right financial position to set up a new contract with you.

The insolvency register publicly lists people who are insolvent. For example, if an individual has used a debt relief solution, like bankruptcy, their name will appear on the insolvency register. This is an online search tool on GOV.UK. You can also search for names in The Gazette, which is accessible online or as a weekly newspaper. Essentially, the insolvency register flags up whether anyone has serious issues with repaying debt. So before you sign a contract with a new supplier or business partner, it's a good reason why to check the insolvency register. This gives you greater confidence that you won’t run into financial losses during your contract.

Who can check the insolvency register?

Anybody can check the insolvency register. It’s open to the public and free to use. However, there are certain people who find it more useful than others. Many people use the information to make a more informed choice about entering into a financial contract with an individual or business. For example, landlords check the insolvency register before renting out their property. If the landlord found that their potential tenant had recently declared bankruptcy, they might worry whether they’d receive their rent payments on time. If you’re a business owner, you might also use the insolvency register to check the financial health of a potential client, supplier, or partner. It helps you rule out risk before entering into a contract with a director who might be unable to commit to a financial agreement. However, by the time their name appears on the insolvency register, you’ve likely already had issues with their payments.

I’ve found out my client is bankrupt - what can I do?

So you’ve checked the insolvency register and it’s bad news: your current client is insolvent. Not only will this damage your retention rates, but you may lose out on existing payments in their current contract. To avoid this loss, you’ll need to check the terms and conditions of your agreement with the customer. You should ideally have the right to vary payment terms, like requiring payment to order. To prevent this from happening again, it’s good to know the warning signs. Look out for signs of financial distress, like employee layoffs - or get an automated CRM tool that automatically tracks subtle red flags for you. But ideally, you should avoid this situation entirely - by making sure your entire client base is 100% financially robust from the offset.

What does the insolvency register show?

If you look at the insolvency register, you’ll find details of people who have used a debt relief solution, like bankruptcy or an IVA. You’ll see which debt relief solution they used, and how long the agreement will last. Along with these details, you’ll see their personal details, including:

● Full name

● Address

● Date of birth

● Gender

It’s enough information if you want to rule out whether someone is currently dealing with debt. However, the information on the insolvency register won’t be enough if you’re looking for a complete picture of an individual’s financial health.

Before you sign any new contract, you’ll want to gain a deeper understanding of the other party’s finances. If your potential business partner is insolvent, that’s an obvious sign that your partnership will run into issues. But often, a director will start to have issues long before their name appears on the insolvency register. And often, you won’t discover they’ve been struggling with finances until it’s too late.

It’s why Red Flag Alert uses a live algorithm to constantly score the overall financial health of any UK company. And it’s why thousands of business owners check this platform before entering into a financial contract. Plus, with extra growth tools, you can target companies that are growing by +20% over the next 3-4 years. So, you won’t just rule out the risk of insolvency. You’ll also have the most financially healthy contacts at your fingertips, who have the resources to invest in new services - like yours.

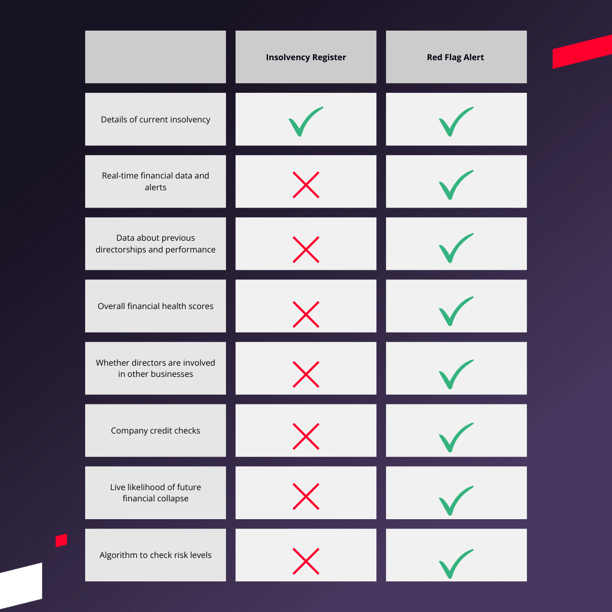

What will Red Flag Alert show me that the insolvency register won’t?

While the insolvency register only shows whether someone is currently insolvent, Red Flag Alert will show you information about any previous directorships and their success - along with any other companies they are currently involved with. Plus, you’ll see how likely it is that your potential client could become insolvent in the future. It gives you a full 360-degree view of your next business deal.

Here’s a side-by-side look at what the Red Flag Alert and the insolvency register show:

Red Flag Alert is your perfect risk and credit referencing partner, with over 20 years of experience accurately and successfully predicting company financial health and spotting the early signs of business failure and success, we allow you to base all your customer due diligence on the most accurate and reliable data on the market. Our platform includes:

- Detailed and easy-to-understand reports on all UK businesses and over 350 million international companies

- Live data feeds and unadvertised petitions

- Customisable monitoring list; create monitoring lists where you choose the alerts and can share them with others at your company

- Seamless CRM tie in; including automatic data cleanses and enrichment

- Fully compliant and digital AML and enhanced due diligence check suite that takes just 30 seconds of staff time to send out

Get a free trial today and start protecting your business today!