The coronavirus pandemic has had a lasting impact on the UK economy.

Lockdown saw the country’s economy go into freefall, and even now the effects are still being felt.

This alone would make it a challenging time for UK businesses. But coronavirus isn’t the only factor that is creating economic difficulties.

In a letter to the Chancellor of the Exchequer, Bank of England Governor Andrew Bailey said the British economy was being hit by a “succession of global shocks”.

Brexit, the energy crisis, the war in Ukraine and other world events are all taking their toll on the UK economy.

As discussed in our Q2 Intelligence Report, GDP fell by 0.3% in April and inflation is expected to reach 11% later in the year. We expect the number of insolvencies to reach its highest given level since the financial crisis.

The difficult economy is making risk management harder than ever for firms. Even companies in good financial health are likely to face higher levels of business risk than usual.

To protect themselves, companies should review all of their business operations. They need to minimise financial and operational risks wherever possible.

This article explains how they can do this by tightening their financial risk management. This will help them survive the difficult economy and any future financial shocks that might come their way.

This article takes a deeper look at the post-pandemic challenges facing businesses.

Why Is Covid-19 Still Affecting Financial Institutions and Markets?

Although UK lockdown restrictions have been lifted, Covid-19 hasn’t gone away. Almost 100,000 people tested positive for the virus in the week commencing 22 July alone. Many more will have gone unreported.

These people are likely to either be off sick or will choose to self-isolate based on government advice.

Long covid is also having a lasting impact on financial markets. The Institute for Fiscal Studies (IFS) says employees are losing £1.5bn per month due to being off work with long Covid.

According to the think tank, nearly 7 million say they have long Covid. This is thought to be contributing to the labour shortage facing the UK.

These issues are increasing market volatility and making it more difficult for businesses to manage financial risk.

But it’s not just the virus itself that continues to contribute to market risk. Lockdown has also had a lasting impact. Here are some factors that still affect the economy:

Withdrawal of government support schemes

During the pandemic, the government introduced support measures for businesses.

These support measures enabled businesses to survive lockdown.

As a result, companies that would normally have gone out of business were able to survive too.

Now the support measures have been lifted, but the financial health of many of these businesses on the brink of insolvency hasn’t improved.

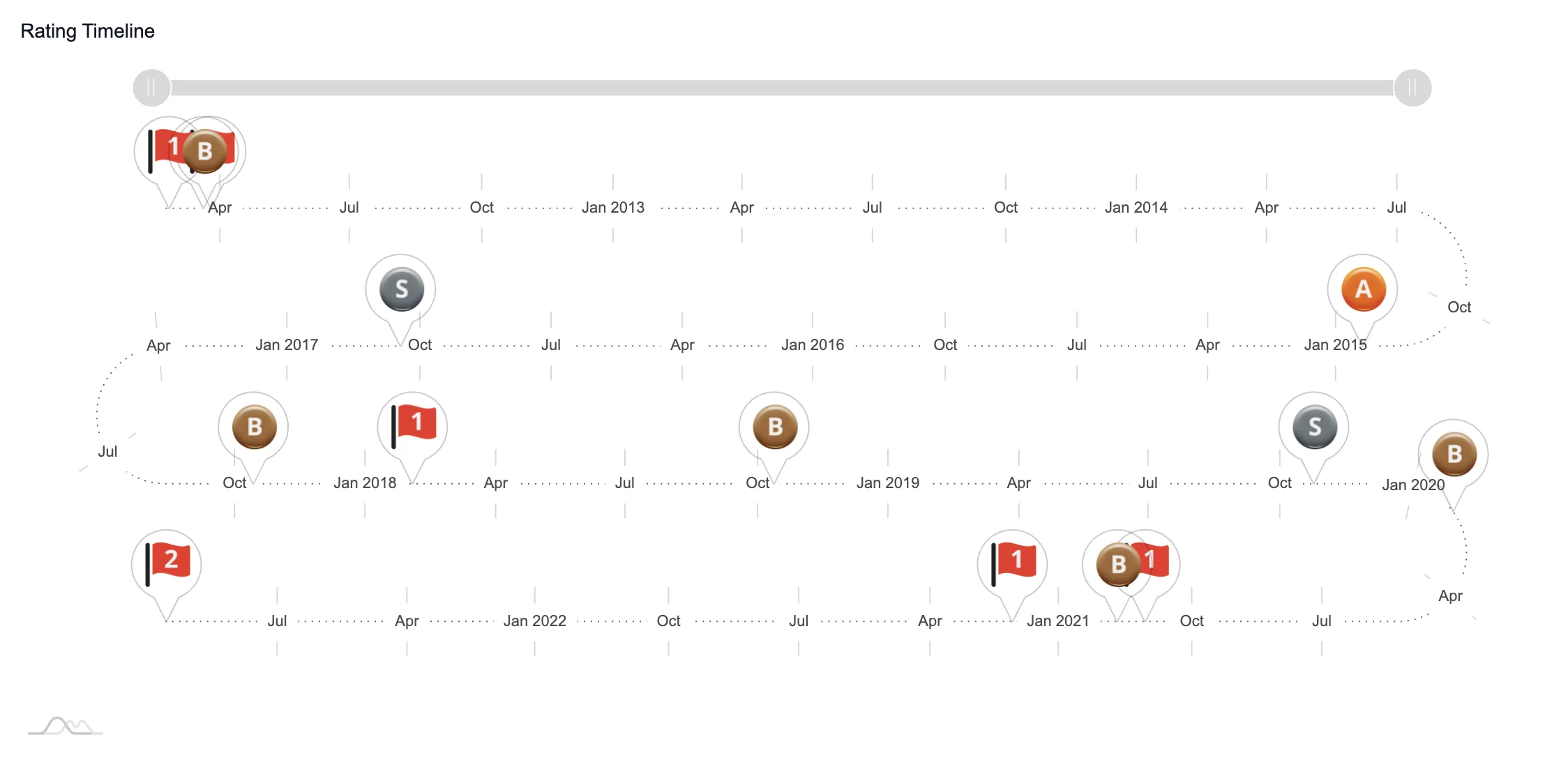

This makes the economy unstable. We have predicted there will be a spike in insolvencies during the next two years. This could see up to 29,500 companies enter insolvency.

Landlords enforcing rent

During the pandemic, the government passed legislation saying commercial landlords could not enforce rent collections.

This put many landlords in a tough financial situation. In fact, the country’s biggest shopping centre owner, Intu, fell into administration in August 2020.

Now that the stay on rent collections has been lifted, many hard-pressed landlords will be keen to start collecting the money that is owed to them.

This could put pressure on sectors like retail and hospitality.

Some industries have yet to recover

Sectors like the hospitality, hotels and accommodation industry were amongst the worst hit during the pandemic.

Since restrictions have been lifted they have also been impacted by the UK’s shortage of workers.

This means that many businesses in these sectors continue to be weak.

Construction is also struggling and has seen the highest number of insolvencies of any market.

Poor investment

UK business investment stalled in 2016 after the EU referendum. It then dropped significantly during the pandemic. It still hasn’t recovered fully and was 9.1% below pre-pandemic levels at the beginning of the year.

Other Issues Contributing to Market Risk

As previously mentioned, coronavirus isn’t the only issue impacting UK businesses in the post-pandemic world. Here are some of the others:

Cost of living crisis

Food and energy prices are set to soar. This is likely to curtail consumer confidence and spending. Non-essential sectors like retail and hospitality are expected to be hit worst by these issues.

Energy crisis

Rapidly increasing energy prices have hit households hard. But businesses are not protected by the consumer price cap and so have experienced even higher costs. Further price increases later in the year will impact those businesses with high energy requirements.

Global supply chain disruptions

High shipping costs, low equipment availability, raw material shortages and global bottlenecks have made global supply chains inefficient. This is a key driver of costs and delays in all sectors. Businesses must choose whether to absorb these costs or pass them on to consumers.

Lockdowns in China

China is a major global manufacturer and is also an important consumer of British goods and services. The country’s zero-Covid policy has resulted in lockdowns across the country. This means reduced demand for western products and services.

The war in Ukraine

The war in Ukraine has led to shortages of some products. This has additional costs for certain industries. There are also 18,000 UK companies that have a Russian person with significant control (PSC). These companies could be affected by the conflict, sanctions or reduced demand for Russian products and services.

Employment crisis

In June 2022 there were 1.3 million job vacancies in the UK and not enough people in the job market to fill them. There are two reasons for this. First, Brexit has seen 200,000 EU nationals leave the country. Second, 450,000 people have simply left the job market. These are mostly older people who probably did not want to return to work after lockdown. The UK has experienced the worst drop in employment of any G7 country.

Brexit

Brexit has made the pandemic recovery more difficult. It has led to a 14% fall in exports and a 25% drop in imports. It has also created confusion over the border between the Republic of Ireland and Northern Ireland.

This is contributing to the UK’s trade deficit, which widened by £14.9 billion to £25.2 billion in Q1 2022.

P&O is one high-profile company that has faced serious financial difficulties due to the pandemic and Brexit.

It sacked around 20% of its workforce due to lockdown, and the amount of freight the company deals with has steadily declined thanks to Brexit.

Interest rates

The Bank of England has increased interest rates to 1.75%, up from 0.25% before the pandemic.

Further interest rate increases are likely throughout the year. In our February Intelligence Report, we explained that a 1.75% rise in interest rates would push 10,000 businesses into insolvency.

Improve Your Post-Pandemic Financial Risk Management

The list of challenges facing businesses can seem overwhelming. The best way to protect your business is to be proactive with your financial risk management. Listed below are some of the steps you can take to do this.

Target sales at financially healthy customers

Losing customers to insolvency is always bad for business. Not only does it reduce your revenues, but you could also take on insolvent debt if the client can’t pay your outstanding invoices.

That’s why company credit checks at onboarding are vital (we’ll explain more about this later). Customers that fail these tests stop you from losing money at a later stage, but it’s still bad news.

Your sales team will have spent huge amounts of time and resources winning the customer’s business. If they are rejected during onboarding then all this work is wasted. Your team could have spent that time finding more financially secure businesses.

The solution is to assess the financial health of customers during the prospecting phase. This way, your sales team will only approach companies that they know are in good financial shape.

Of course, assessing each company individually takes a lot of time. A good B2B data supplier will enable you to build financial risk management into your ideal customer profiles and instantly create lists of companies that match them.

Make onboarding more efficient

Onboarding sets the tone for your entire customer relationship. But it can also be time consuming and frustrating for customers.

They are often left waiting on the phone for a credit decision. This means that your customer experience will suffer.

If you can provide instant credit decisions, you’ll have happier customers. And satisfied customers are more likely to buy more and recommend your service, providing you with more sales opportunities—which in turn helps you survive a financial shock.

Get accurate real-time data

Another issue is that many credit risk checking companies don’t update their data quick enough and often miss vital changes to a company’s financial health.

For example, in January a company called PDR Construction entered administration. The following day, several companies were still recommending that it was safe to extend millions in credit to the company.

This makes it impossible for you to make reliable decisions about your customers’ financial health.

It’s therefore important to find a credit risk checking service that is based on accurate, real-time data.

Monitor your customers’ financial stability

You should check each client’s financial health at least once per year. This allows you to identify potential problems and manage them by taking relevant action.

But sifting through company reports and searching online for information about each business is hugely time consuming.

Some credit risk scoring agencies provide real-time financial health monitoring services—these are a great way to make your ongoing financial risk management more efficient.

You can set up alerts that immediately tell you if a client’s financial position begins to deteriorate.

You can then take preventative measures to safeguard your business.

Take action to protect your business

If a client’s financial health does start to deteriorate or they are failing to pay invoices, you may wish to consider taking proactive action to protect your business and avoid bad debt.

The steps you take depend on the severity of the financial decline, the state of the customer relationship and a myriad of other factors.

Some of the steps you could take include:

- Further monitoring

- Enhanced financial checks

- Discussing issues to see if you can help

- Agreeing a repayment schedule

- Calling in invoices

- Reducing credit

- Withdrawing credit

- Setting late fees

Remember, if your customer is having difficulties then punitive financial measures may just make their situation more difficult.

Find more customers, or get better ones

You can make your customer base more sustainable by finding new businesses to work with. This way, if a client does become insolvent the proportion of your customer base that you lose is smaller.

The pandemic affected certain areas or sectors disproportionately. The pandemic caused a disproportionate effect in certain areas and sectors. This means it may be worth expanding your client base into adjacent regions or industries.

For example, if you provide legal service to construction firms in Manchester you may choose to focus on similar companies in Lancashire. Or you could start selling to companies in the heavy plant market or construction supply.

Tighten up regulatory compliance

The post-pandemic economy is hard enough, without getting a fine for failing to meet regulatory requirements or losing a customer because they have been subject to sanctions.

It is illegal to work with companies where a PSC is on an international sanctions list.

The war in Ukraine and the resurgence of the Taliban in Afghanistan mean that the number of people on these lists has increased dramatically.

It’s therefore vital to have robust AML systems and procedures to ensure that the companies you invest in are not involved in fraud or money laundering.

9 Financial Risks to Watch Out For

Here are some of the factors that signal that your clients could be struggling in the post-pandemic economy.

Legal action: It is a bad sign when a company is being pursued to pay debts, either by you or other investors via the courts.

Problems meeting financial obligations: Watch out for companies that take an increasingly long time to meet their financial obligations. You may also find that the quality of their service dips and that they fall behind in their operations due to financial pressure.

Fixed charges: This means that directors get paid first in the event of company insolvency. It is a big warning sign. If directors are protected in the event of failure, they may run the business differently—or even take financial risks.

Suffering unsecured losses: Companies that experience bad debt are three times more likely to fail. The size of the debt needs to be placed within the context of the company.

Changes to accounting periods: Overdue accounts or changes to filing periods are indicators that a company is in trouble. It could reflect poor management practices or cash flow issues.

Poor liquidity: This can lead to a constant need to plug holes in cash flow, which is expensive, time consuming, and often fatal for a business. What constitutes a good liquidity level will depend on the market and the company’s current liabilities.

Little or no reserves: If a company has few assets/asset managers and poor cash flow it may have to delve into its reserves to survive. If it doesn’t have reserves it might need to turn to emergency borrowing, which will put it under further financial pressure.

Tight profit margins: Businesses typically managed with tight margins often have little room to manoeuvre when facing financial difficulties. These companies are exposed to sudden market shocks, like a global pandemic.

London Stock Exchange profit warnings: Every public company failure in the last two years was preceded by at least two profit warnings. This will likely see stock prices tumble as investors’ confidence plummets.

Protect Your Business from Insolvency with Red Flag Alert

The post-pandemic economy is challenging, but you can give your business the best chance of surviving by tightening up your company credit checks, finding the best clients, creating strong links, monitoring customers and improving your compliance.

Red Flag Alert’s data helps you to process and address your problems, and ultimately achieve your goals

Using our expert skills, we provide and enrich data on every UK business. Book a free demo for further information.