There are few industries that don’t require robust and thorough onboarding processes for new clients and customers. From the legally required Know Your Customer and Anti-Money Laundering checks, to the steps required for businesses to engage with other enterprises confidently.

These steps are essential and are often significant in determining a business’s growth trajectory.

However, if these onboarding processes are not rigorous enough, unstable organisations can slip through the net and potentially leave the business at risk. In order to succeed, businesses must be able to expand their connections, whilst expertly mitigating risk.

To manage these concerns, financial health checklists are often used in background checks of prospective clients, customers, and suppliers. Nevertheless, with insolvency numbers on the rise its ripple effect is being felt further than ever, are the standard financial health checklists of a high enough quality to keep businesses protected?

What Does A Standard Financial Health Checklist Cover?

- Identity Verification and KYC Compliance

Initiate a thorough identity verification process, adhering to Know Your Customer (KYC) regulations to ensure the legitimacy of clients.

- Creditworthiness Assessment

Conduct business credit checks and analyse financial statements to evaluate the client's creditworthiness and identify potential risks.

- Payment History Evaluation

Scrutinise the client's payment history to gauge their reliability in meeting financial obligations.

- VAT Number Confirmation

VAT number Confirmation validates tax compliance and business legitimacy, verifying, revenue accuracy, legal standing, and fiscal responsibility.

- Financial Monitoring

Implement regular financial monitoring to remain aware of any changes in the client's financial status.

- Periodic Reviews

Conduct periodic reviews of the client's financial health to identify emerging risks or opportunities.

The Limitations of Basic Financial Health Checklists and the Urgent Need for Advanced Solutions

Basic financial health checklists, while essential, may fall short of capturing nuanced insolvency or bad debt risk indicators due to several factors.

Firstly, these checklists often rely on static data and periodic reviews, potentially overlooking real-time changes in a client's financial situation.

Market dynamics, economic shifts, or sudden changes in a client's industry can also be missed in traditional assessments, increasing the risk of companies being unaware of risk within their supply chain, or across their client base.

Also, basic financial health checklists may not incorporate advanced analytics needed to predict potential insolvency accurately. As such, human biases or oversights may impact the thoroughness of evaluations, particularly when dealing with larger, more complex datasets.

Moreover, these manual processes can be an incredible drain on resources, taking long periods to source, verify, analyse, and consolidate the necessary data both during onboarding and throughout the relationship.

Automating financial health checks is an effective solution for businesses that want to mitigate risk accurately and swiftly.

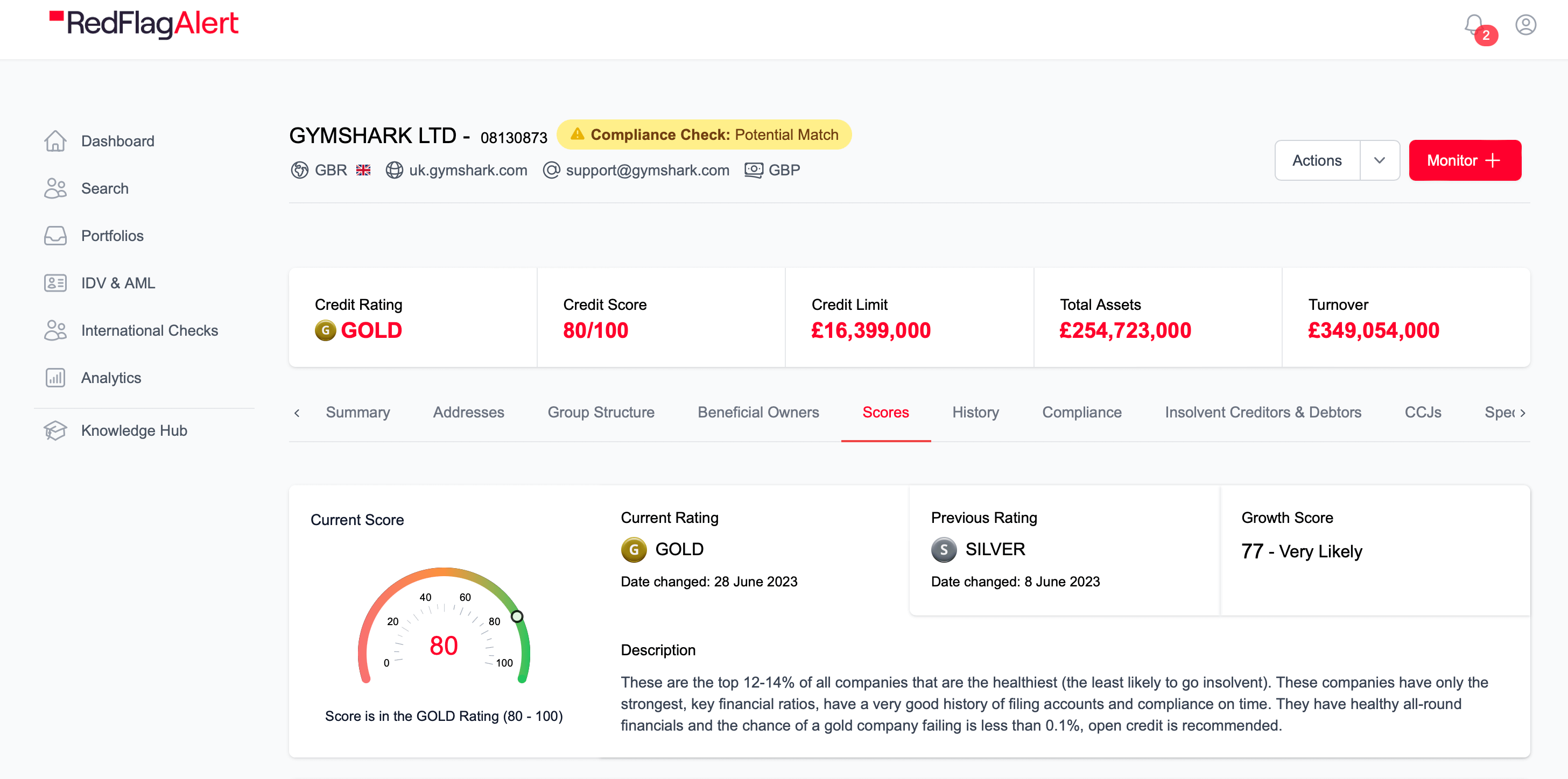

Having access to Red Flag Alert’s comprehensive business data and automation tools, identifying evolving risks optimises the benefits of financial health checklists whilst improving the efficiency of teams and their risk mitigation processes.

Enhancing Risk Management with Red Flag Alert’s Automation and AI

Whilst basic financial health checklists form a foundation, the dynamic nature of business environments necessitates the integration of automation and data services.

Red Flag Alert’s expertly designed services offer a proactive and comprehensive approach to risk management, safeguarding businesses against insolvency and bad debt risks more effectively in today's rapidly evolving economic environment.

When a business analyses data within reports, it can take an excessive amount of time to secure the required information needed to aid decision-making processes. Red Flag’s database reduces the time it takes to get the value out of data analysis. With quick and easy-to-understand reports, businesses can access essential information promptly without the need for extensive experience with data, enabling faster responses to potential risks or opportunities.

Providing accessible data is what motivates us at Red Flag Alert, as many businesses lack the specialised expertise required to assess complex financial data accurately.

To hand power back to those who need it, our health rating system was created to offer a simplified overview of a company’s financial status, allowing even non-specialists to grasp its health quickly.

These instant insights reduce reliance on specialists and enables broader teams to participate in analysis when building improved risk assessment processes.

Beyond the overview, the health rating system also breaks down the finer details, turning entry-level analysts into proficient experts.

Improving confidence in data interpretations has also been incorporated into the continuous monitoring tools within Red Flag Alert’s services. With financial landscapes constantly evolving, market dynamics, economic conditions, and industry trends can lead to drastic changes occurring at a moment’s notice.

Continuous monitoring capabilities ensure that businesses stay updated on their partners' financial health in real-time, enabling proactive risk management and timely interventions.

Tied into this is the automation of the monitoring process, as manually sourcing, verifying, and analysing data is a huge drain on resources, and leaves businesses vulnerable to human error.

As a package, businesses can benefit from tailormade alerts that are sharable across relevant departments and staff members. These alerts provide a daily snapshot of key changes across selected portfolios, alongside instant notifications of immediate concerns.

Without this, a constant influx of information will eventually become overwhelming, leading to a higher chance of alerts being ignored, immediately putting the business at risk.

Red Flag Alert eliminates these issues with automated monitoring and relevant insights that are clearly communicated however a business prefers to receive them, immediately increasing the value of monitoring efforts, whilst improving efficiency across teams.

Regulatory compliance is a critical aspect of risk management. Integration of Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, along with Identity Verification (IDV) checks if necessary, ensures that businesses engage only with verified and legitimate entities.

However, these procedures can create a bumpier onboarding process, causing delays and potential errors. By having access to comprehensive, reliable data, businesses can reduce their risk of exposure to financial crime and regulatory penalties.

This is also key when completing PEPs and sanctions screening, as well as adverse media coverage. These screenings help to identify potential red flags associated with counterparties.

At Red Flag Alert, we have created the necessary tools needed to flag these entities that have questionable backgrounds or associations. Using real-time data that digs deep across various sources, businesses can immediately see a clear and complete picture, removing all the guesswork.

Whilst sanctions are legally enforceable, PEPs and adverse media coverage is still desirable, as these entities can present a higher risk for businesses who are safeguarding their reputation and financial integrity.

Predict insolvencies and protect your business from bad debt with a free trial with Red Flag Alert – simply get in touch, today.