Get customisable daily alerts on companies that could affect your business

Be Alerted of Risks and Optimise Your Operations Today

Finally, a company monitoring tool that fits your needs

Segment companies to monitor events

Easily track and monitor businesses of interest

With a diverse & unique range of events on businesses, monitoring companies that could affect your business is as simple as a few clicks

- Portfolio Analysis & Dashboard

- Real-time Alerts

- Financial Data

- Global Monitoring

- Locations

And much more...

6m+

Active businesses

9000

users worldwide

120000

updates per day

25

years’ experience

Every client presents your company with the potential for financial risk and top-level information on customers financials is not enough to work with in the current climate.

- 5 Million+ Businesses

- 120,000+ updates per day

- Over 9,000 UK Business Users

- 25 years' experience in business intelligence

Protect

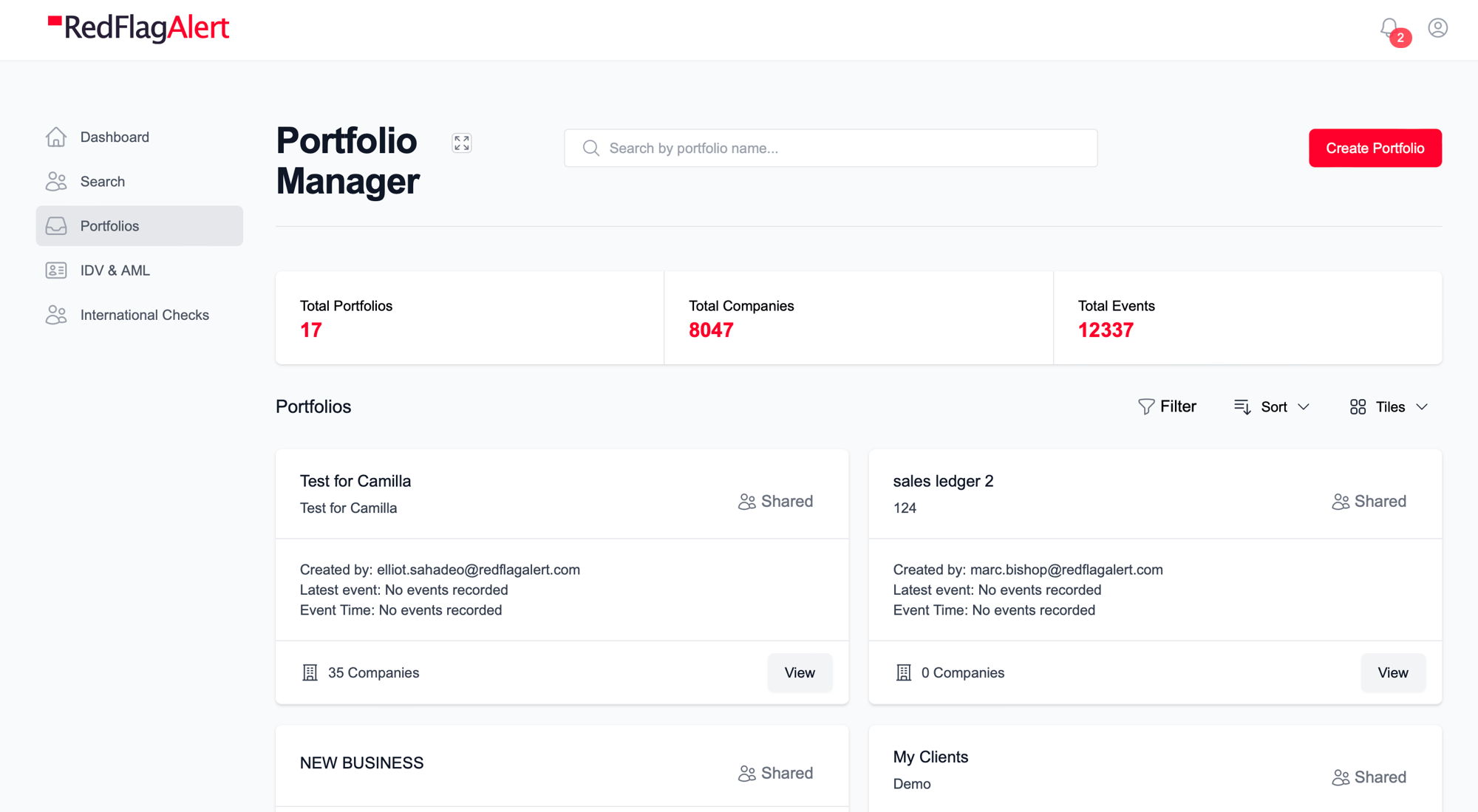

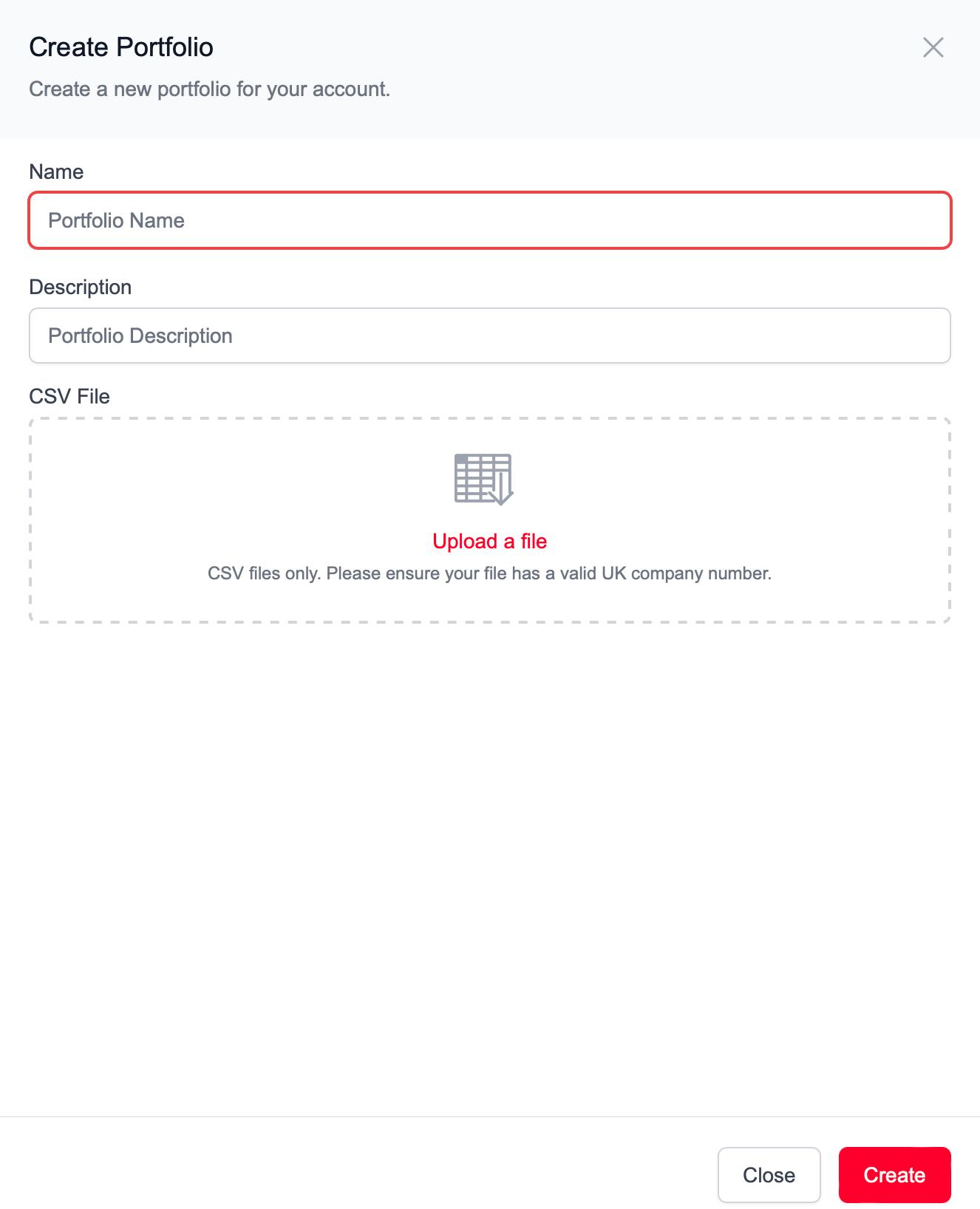

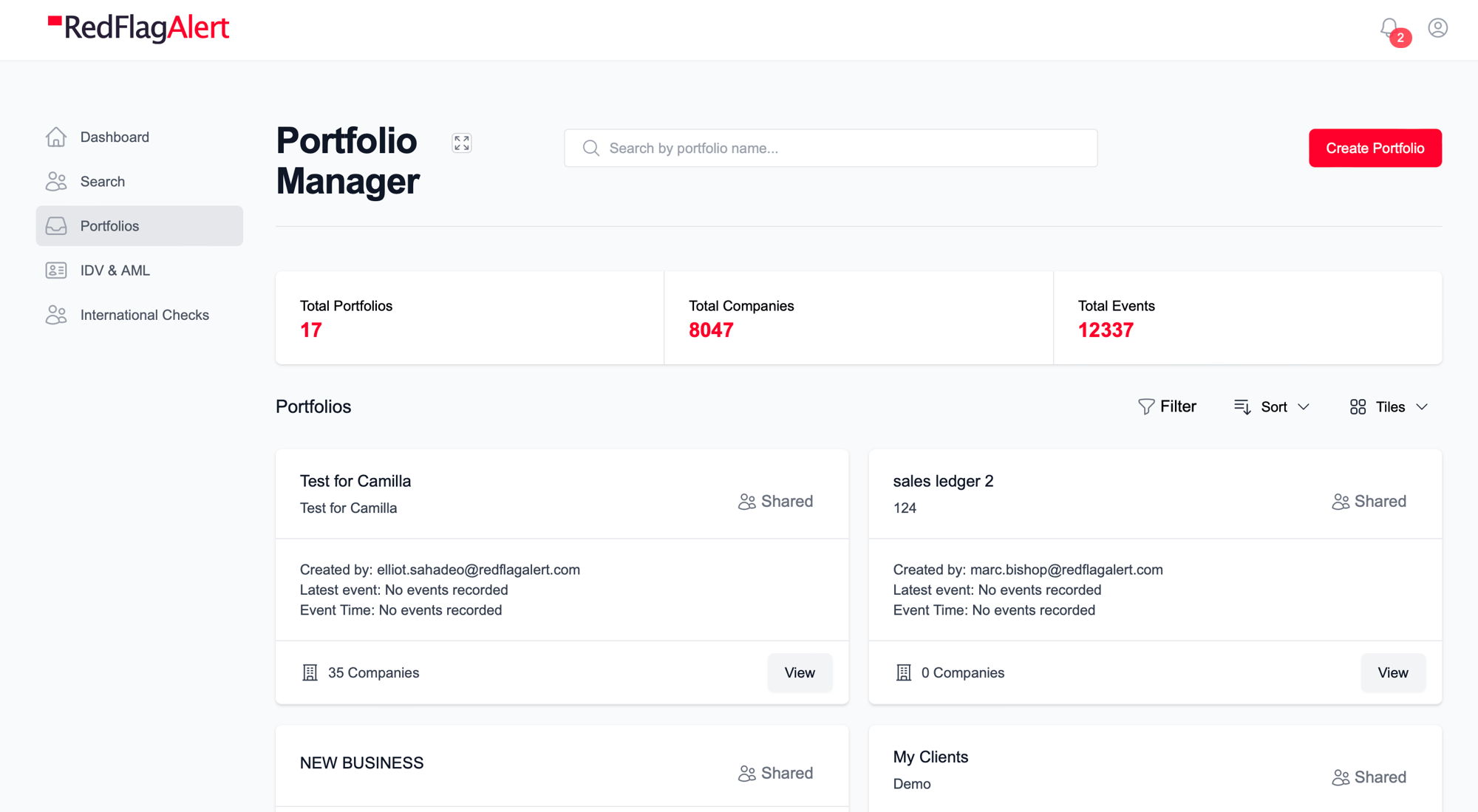

Create portfolios in just a few clicks

Protect your business by making more informed decisions in a timeless manner. Migrate your customers and supply-chain with our bulk CSV feature.

- 5 Million+ Businesses

- 120,000+ updates per day

- Over 9,000 UK Business Users

- 25 years' experience in business intelligence

Over 1000+ UK businesses

trust in Red Flag Alert including:

Get Started

Protect

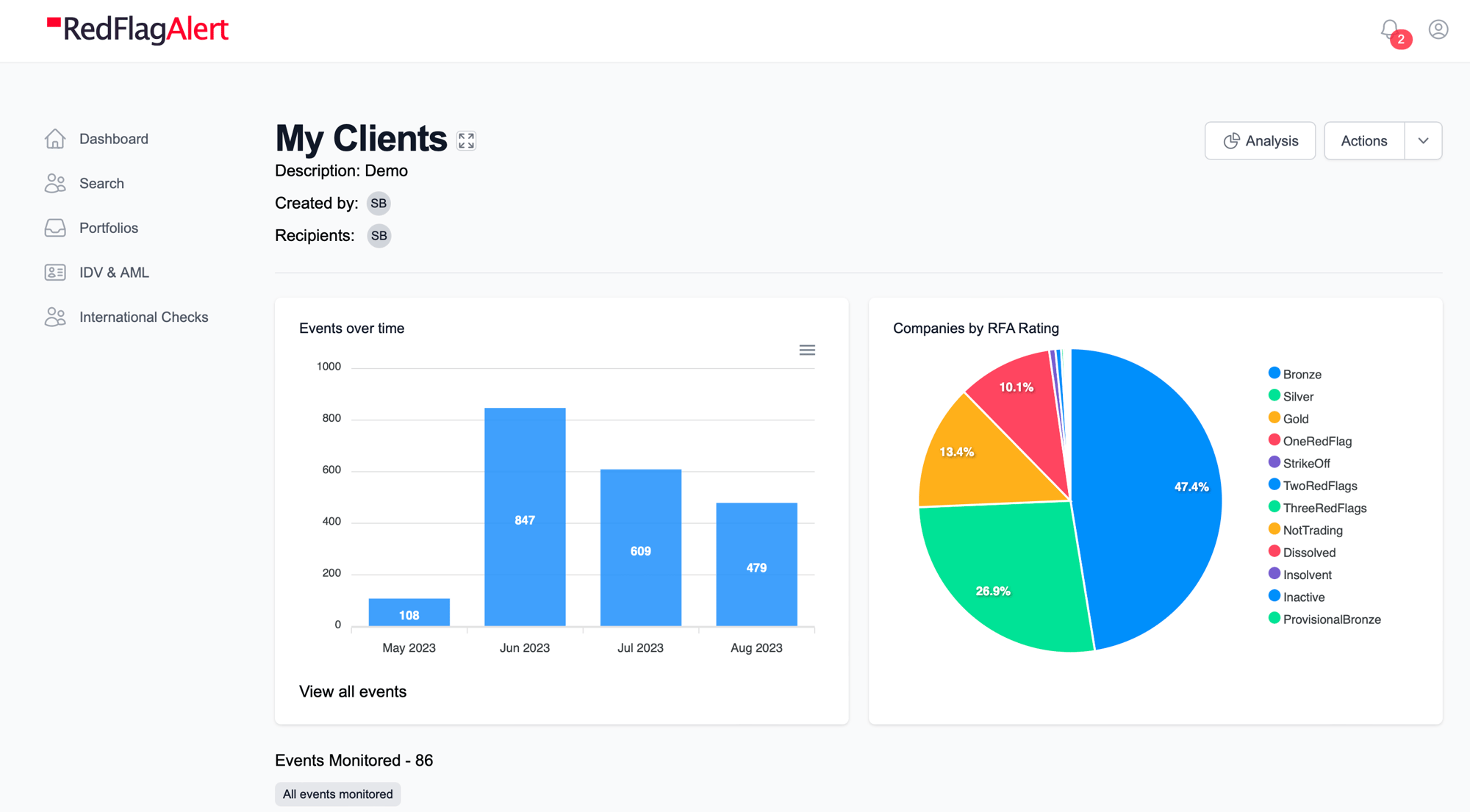

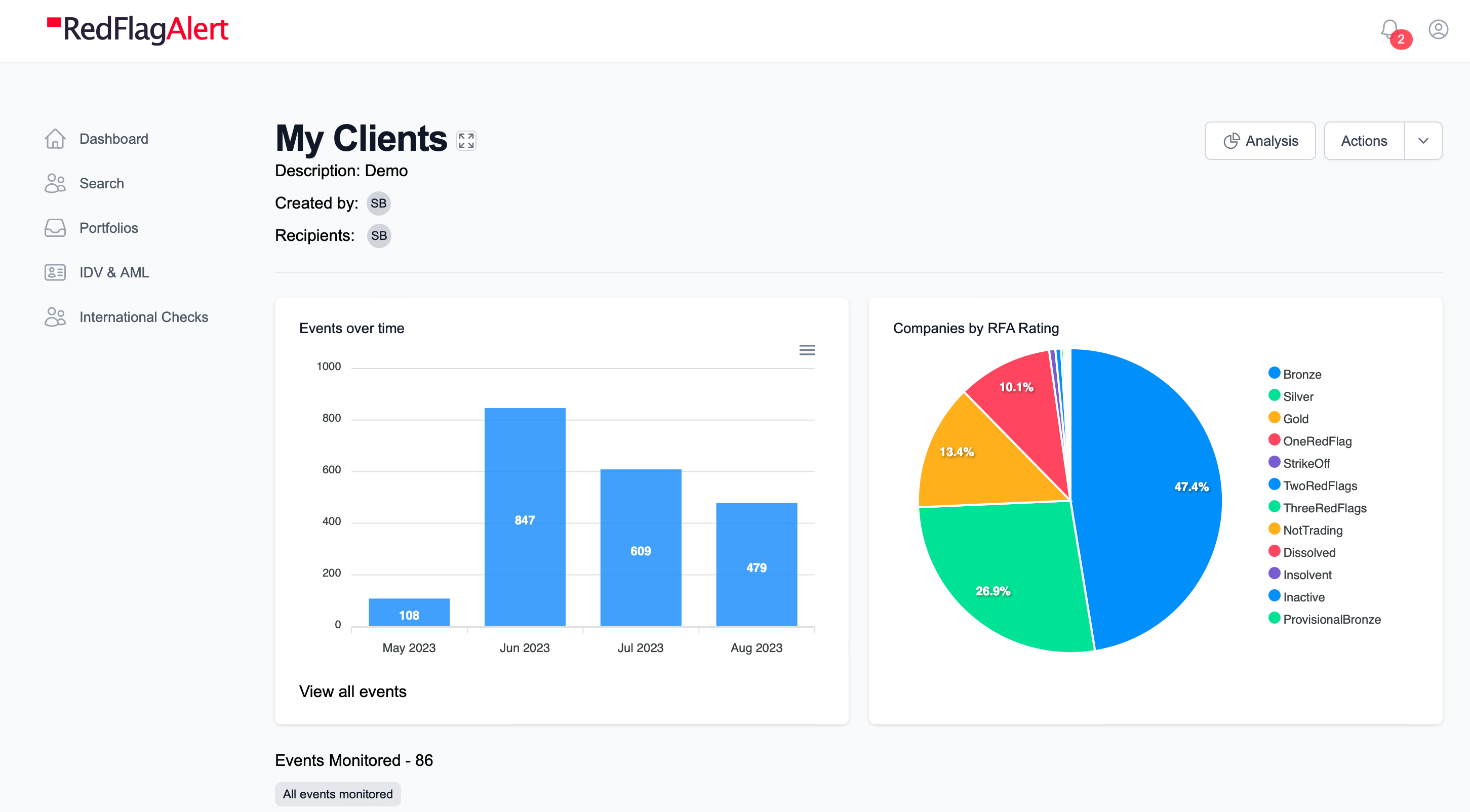

Real-Time monitoring & portfolio management

Our AI-powered algorithm enriches the data to provide unique insights into turnover, SIC-code, employee numbers and more.

- 5 Million+ Businesses

- 120,000+ updates per day

- Over 70 events updated in real-time

- 25 years' experience in business intelligence

Next generation credit risk monitoring

In a normal year £4bn of bad debt is written off by UK companies – but last financial year it was £5.8bn - a 46% rise, with a prediction of £16bn in 2022. The predicted increase for the year to come will represent a 175% increase in bad debt being written off. Having a platform to monitor risk with your clients and suppliers, can help you avoid bad debt and losses.

CCJ – UK’s Fastest Alert

Insolvent Bad Debt

Payment Trend Change

London Stock Exchange- Profit Warning

Shareholder Added

Red Flag Alert rating change

Imminent Court Hearing

70+ more events alert

Find out what the rest are by booking demoGet Started

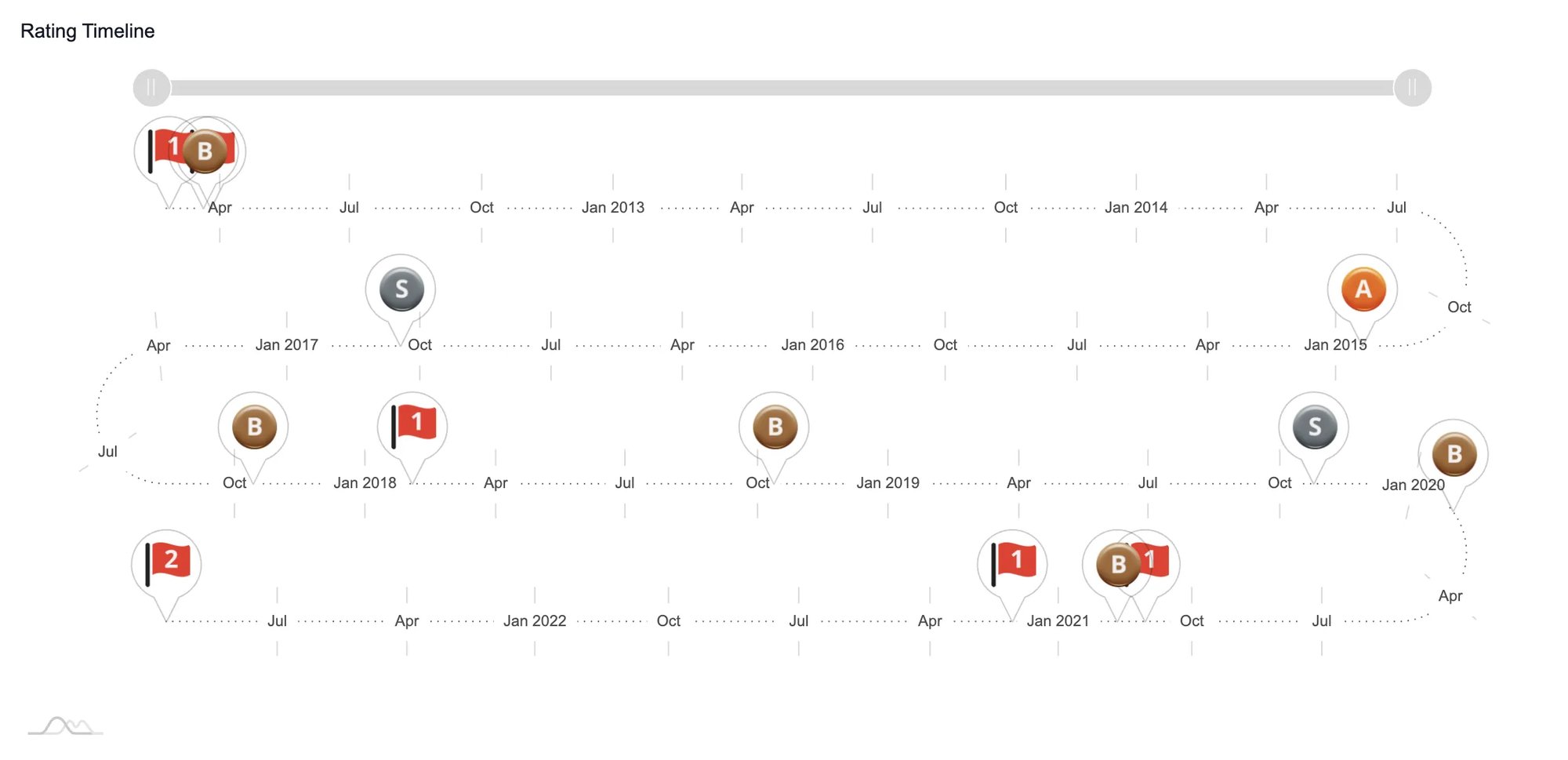

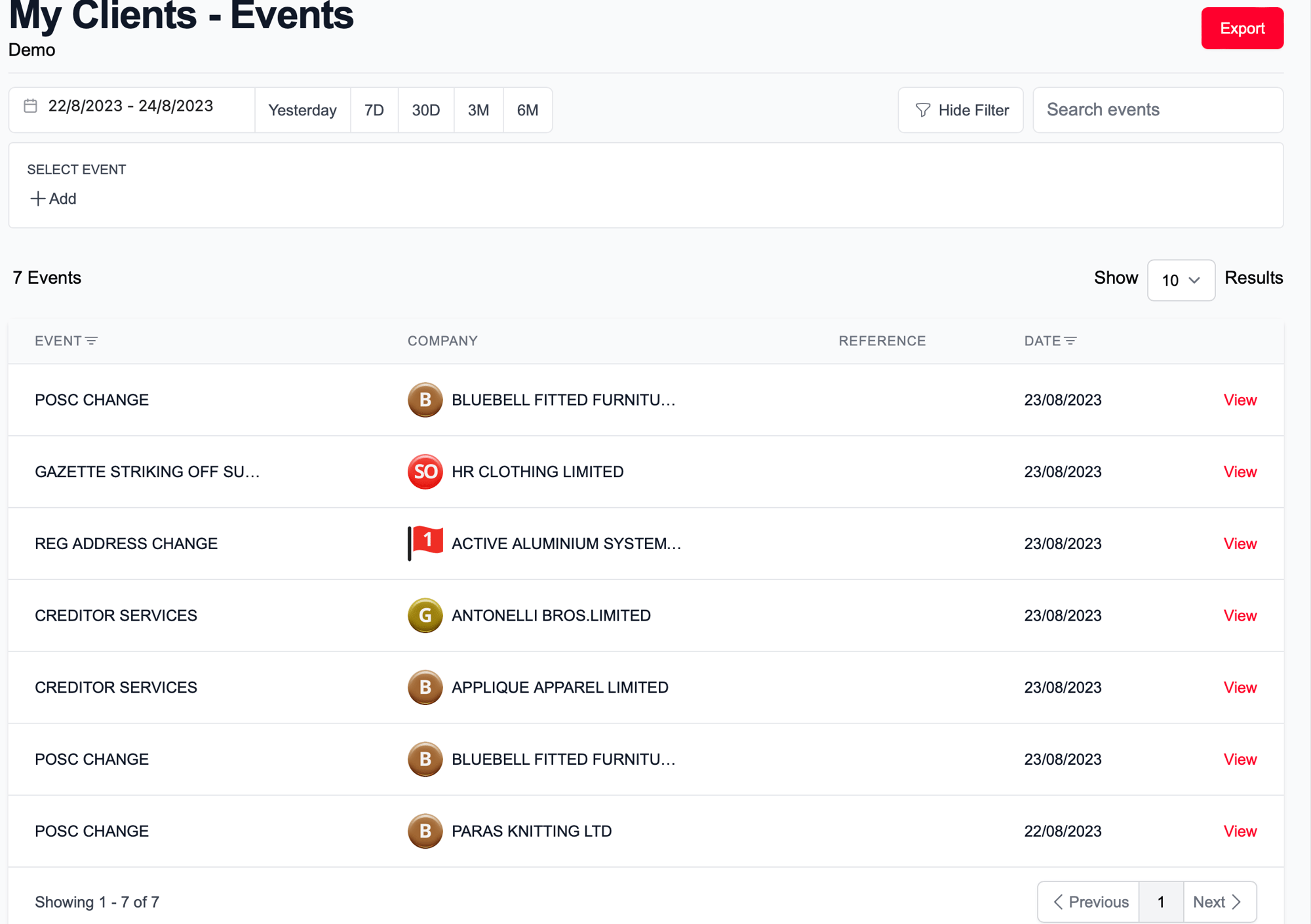

Event Deep Dives

Search and analyse events within your portfolio

Red Flag Alert provides the capability to keep up to date by offering real-time alerts when there is any significant changes to the businesses in your portfolio.

- 5 Million+ Businesses

- 120,000+ updates per day

- Over 70 real time events

- 25 years' experience in business intelligence

Why Red Flag Alert

Detailed Financial Health Ratings

Red Flag Alert allocates every business with a financial health score that accurately predicts insolvency. Our clients use the freshly introduced monitoring system to perform due diligence, monitoring their clients and to ensure onboarding of prospects is the correct decision.

Unique Expert Insights

Red Flag Alert’s experts are constantly adding new data points to the platform, giving you a better overall understanding of a business’ financial situation. This gives you every angle from accounting period changes to bad debt exposure. We use firm-level microdata to ensure the safety of your business.

Global Data

We pull data from over 10 reliable sources, with both UK and international company data available information ultimate beneficial ownership information, director information, key financials and more.

Why Is Company Bad Debt Increasing?

As a pandemic measure, the suspension of serving statutory demand was put in place by the UK government to prevent insolvencies. But even with this active policy the figure for bad debt has rapidly risen. With pandemic measure phasing out, the number of insolvencies is sky rocketing.

Using our unique algorithms, we predict 28,000 insolvencies will come in the next 12 months, making our monitoring system crucial in protecting your business from supply-chain and customer risk.

Ways to create a portfolio:

Mass upload of your personal CSV in order to create a portfolio.

Using the “find” function you can complete a search on 166 data points to filter and create your ideal portfolio for monitoring.

Creating a portfolio can be done on an individual basis using the “check function” where you can add individual businesses to a portfolio and monitor them in real-time.

From Our Customers

Listen to how we have helped our customers

"We were looking for a partner to enhance the data offering to our clients, and Red Flag Alert have done just that. They understood our business, our culture, and our aspirations for the future. We’ve seen some great feedback on our integration, and we are very happy with both the solution and team at Red Flag Alert."

Rob Mead

Strategic Software Projects Director

"We use the search tool to identify businesses in specific geographic areas, with the right number of staff, the right turnover, and a low risk of non-payment. Now we have experienced the benefits of Red Flag Alert, we could not be without it."

Mark Bryan

NSL Telecoms

"From a business development perspective, our brokers are benefiting greatly from the additional information that Red Flag Alert supplies – we’re able to zero in on ideal prospects and build effective marketing lists."

Ben Robert-Shaw

Power Solutions UK

Protect your business with fully customisable real time monitoring

Monitoring your debtors and suppliers is essential to protect your business from bad debt or supply interruptions.

But traditional monitoring software can be cumbersome and does not let you choose which events you wish to be alerted on. This leads to staff inboxes being clogged with irrelevant alerts, leaving business critical events to be lost amongst the white noise.

Red Flag Alert solves this problem with our revolutionary fully customisable monitoring tool.

- Create fully customisable separate monitoring lists and choose which events trigger alerts

- Never miss a business critical event by eliminating irrelevant alerts

- Protect your business from bad debt

- Protect your supply chain

- Share monitoring lists and alerts between staff members

- In list analysis

- Powered by Red Flag Alert data

- Designed to be easy to use and business friendly

Get Started

redflagalert.com needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.

Knowledge Base

Topics covering Sales and Marketing, Risk Management, Data, AML and Compliance, and more

Free Company Report

Just looking for a Company Snapshot?

Enter a company name and click Free Report to see:

- Credit Rating

- Accounts

- Key Financials

- Key Contacts