- 509,000 UK companies are in significant financial distress—the highest number ever measured by our research.

- The coronavirus lockdown has seen the largest quarterly increase in the number of businesses in significant distress since the end of 2017, growing by 15,000 companies (+3%).

- This figure is expected to increase throughout Q2 as COVID-19 restrictions continue.

- The number of critically distressed businesses increased by 10% in the last quarter alone.

Our latest figures show a 3% quarterly increase in the number of companies that are unable to meet their debts—that’s 15,000 businesses, representing the largest increase since the end of 2017.

The leading cause of this is the coronavirus restrictions and our data shows that SMEs have been worst hit, representing over 99% of all businesses in distress.

Companies with less than 250 employees are particularly vulnerable at this time as many have struggled to access government support schemes.

Even more concerning is that our data shows a 10% jump in the number of businesses in critical distress in the last quarter—this is usually a precursor to insolvency.

This figure is likely to rise even higher. However, the government has suspended court action and provided a number of financial support schemes that are artificially keeping businesses afloat.

There has been a significant increase in businesses experiencing critical distress; 2,289 companies are now in this category. Between Q4 2019 and Q1 2020, the increases in certain sectors have been dramatic:

- Bars and restaurants: +37%

- Real estate and property: +21%

- Construction: +11%

- Retail: +8%

- Manufacturing: +8%

The sectors that have been hardest hit by significant financial distress in the last quarter are:

- Real estate and property: +6%

- Hotels and accommodation: +5%

- Construction: +4%

- Health and education: +4%

Since 2014, several sectors have had huge increases in the number of businesses in distress. These sectors include:

- Utilities: +132%

- Real estate and property services: +104%

- Sport and health clubs: +86%

Year-on-year, all but one (printing and packaging) of the 22 sectors monitored by Red Flag Alert have seen increases in the number of companies in significant distress over the past 12 months, with the worst affected being:

- Real estate and property: +17%

- Sport and health: +8%

- Food and beverage: +7%

Mark Halstead, Partner at Red Flag Alert, said:

“Our research shows that UK businesses are suffering landmark levels of financial distress and with no end to lockdown in sight, things could get much worse.

“Cash flow is likely to be the biggest challenge for most businesses, as many are unable to access government funding and may still owe pay to furloughed staff.

“We were already seeing that many businesses were being cut close to the root before this crisis. These additional factors mean that many companies would be unable to pay back a loan no matter what the terms and leave many with little option but to cut their losses.

“This will result in a bad debt crisis that will trigger waves of insolvencies over the next couple of years and do untold damage to the UK economy.”

Bad Debt to Double to £8.6bn

As explained above, the true number of businesses in critical financial distress is likely to be higher. We can also expect the number of companies in distress to grow.

This is because government support schemes and the suspension of court action has stopped many businesses from failing immediately. However, this will only be a short-term solution.

Many of these businesses will be vulnerable to insolvency not because of coronavirus restrictions, but because of poor fiscal management or because they were already at high risk of failure from any short-term drop in revenue and cash flow.

Normally, it would be expected that 4.3% of these companies will fail each year. However, the impact of COVID-19 will see this figure double and leave the UK economy with insolvent debts totalling £8.6bn this year.

The bad debt generated by this will result in an insolvency crisis that will ripple throughout supply chains, leaving even well-managed companies with vulnerable cash reserves.

This will see companies affected by the pandemic continue to go out of business over the next 18 months, with bad corporate debt peaking again at £15bn in 2021.

Ric Traynor, Executive Chairman of Begbies Traynor, said:

“This crisis has taken all business owners by complete surprise. They weren’t ever expecting to face such a drop off in activity or footfall, and few can be prepared for such a cliff edge in revenue.

“Those businesses with strong balance sheets and access to funding will be able to reorganise their operations and survive the financial shock of this pandemic, while others will unfortunately not have the resources to carry them through this emergency and the uncertainty to follow.

“With finite resources to bail out companies, the government has difficult choices to make concerning which companies to save based on which have the strongest footing to thrive long-term.

As with the collapse of Flybe and Thomas Cook, there are going to be tough decisions ahead which must be based on sound economic principals if the money is to be recovered.”

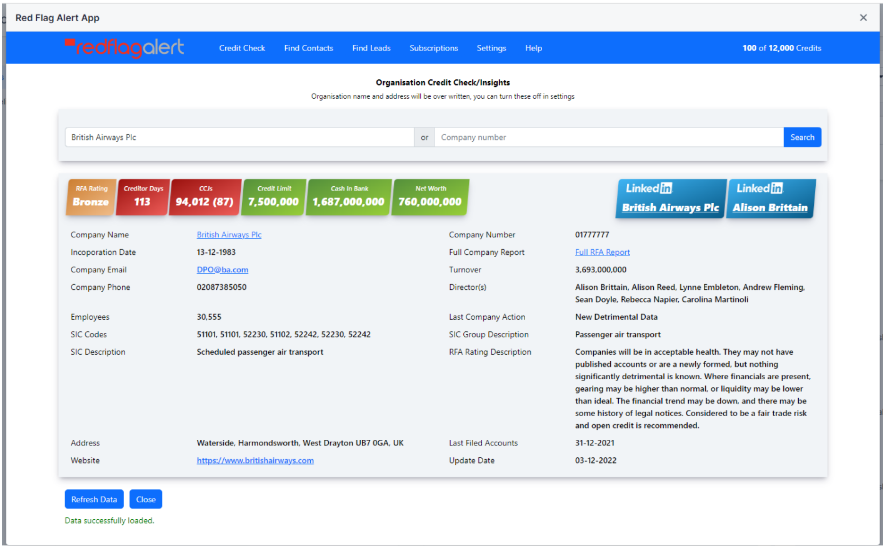

Request a free trial today to find out how Red Flag Alert’s company credit checking solution can help your business.