With talks of recession, stagflation, and low GDP growth, you’d be forgiven for thinking that everyone in the UK is at a business stalemate. And whilst inflation remains stubbornly high, and it’s true that insolvencies are rampant throughout many industries, there is growth too – if you know where to look.

Using our own proprietary data, Red Flag Alert measured the propensity for growth within all of the main regions of the north, providing insight into the fastest-growing companies UK. Using this information, investors can undertake long-term decisions to accelerate their own sustainable growth and assess the ideal regions in the North to make their own financial planning. Remember, the city with the most growth isn’t always the best place to invest, as more growth also means more competition, so investors need to be savvy and adopt a growth mindset in order to find pivotal opportunities.

When looking for growth in general in the UK, it’s essential to look at newly formed and incorporated companies alongside those that are more established.

According to our data, there are at least 3 major Northern cities within the UK that reflect a high number of newly formed companies; Manchester, Leeds and Liverpool. Although there are many companies operating within the South, as expected, Wales and Scotland both make an appearance in the above chart too, with Cardiff and Glasgow City both featuring a larger number of newly formed companies when compared with the whole of the UK.

-2-1.png)

We found that 507,710 businesses in the UK have the propensity to grow at least 20% within the next twelve months, with total net assets of £597T, a significant number which is ensured to grow larger despite the ongoing economic issues and market turmoil.

Using Red Flag Alert's data insights, investors can build a foundation for future opportunities to support innovation within the UK. Short-term market fluctuations are unlikely to last forever, and as these high-growth companies have an average age of 11 years, it shows that UK businesses are stable and likely to last for another decade or more.

To keep our measurements and estimations fair and equal within this report, we measured each location within the same parameters. When searching for businesses with the opportunity to grow 20% or more, we looked for company addresses that were situated within 10 miles of the city centre of each location and examined their financial data over the past 3 years.

Renowned technology hub, and home to Red Flag Alert, Manchester is one of the fastest-growing cities in the UK. Between 2024 and 2026, the economy is expected to grow at an annual rate of around 2.5%, making it the third-fastest-growing city in the UK after London and Reading, and the fastest-growing city in the North of England.

The city centre is booming, recording the fastest employment growth of any UK city, and job numbers rising by nearly 2% per year. Manchester is expected to create more jobs than any other region in the UK, recording the fastest rate of employment growth of any UK city during this period, with job numbers forecast to grow by 1.8% per year.

The growth is primarily driven by the strength of individual sectors within the city, such as solid activity within the scientific and technology sectors, and an influx of younger people leaving the capital city for a more cost-effective solution to inner-city living.

By 2026, experts predict that Manchester’s economy will be at least £2bn larger than it is today.

When examining the Manchester data, we found nearly 20,000 businesses that had the propensity to grow over the next twelve months.

The average company age was at least 10 years, so whilst there are some newer businesses creating a buzz, there are a lot of established organisations still operating successfully within the region.

The total assets for these growth companies specifically was £94bn, a substantial number that is clearly a huge contributor to Manchester’s ever-growing popularity and success.

These growing Manchester businesses had an average of 20 employees, although some will be much larger, and the average age for their directors was 48.

As mentioned above, the scientific and technical sectors make up a huge number of businesses operating successfully within Manchester. However, as a growing city, the construction sector has also found significant opportunities within the city, alongside the motor trade.

Sitting almost exactly halfway between London and Edinburgh, Leeds is another fast-growing city in the North. With an economy worth £64.6bn economy, and strong opportunities within the financial services and business sectors, Leeds is forecast to grow 21% over the next 10 years.

Leeds has a diverse economy, with a strong presence in the creative and digital industries, and a business community that features several large companies, and many SME-level enterprises.

Like Manchester, Leeds has attracted many younger workers and has a high student population. To support this, they have invested heavily in development projects and infrastructure, to keep everything accessible and their residents well-connected. As a result of these investments, Leeds sits in a prominent position to continue to economically expand within the next twelve months and is a strong contender for the fastest-growing company in the North.

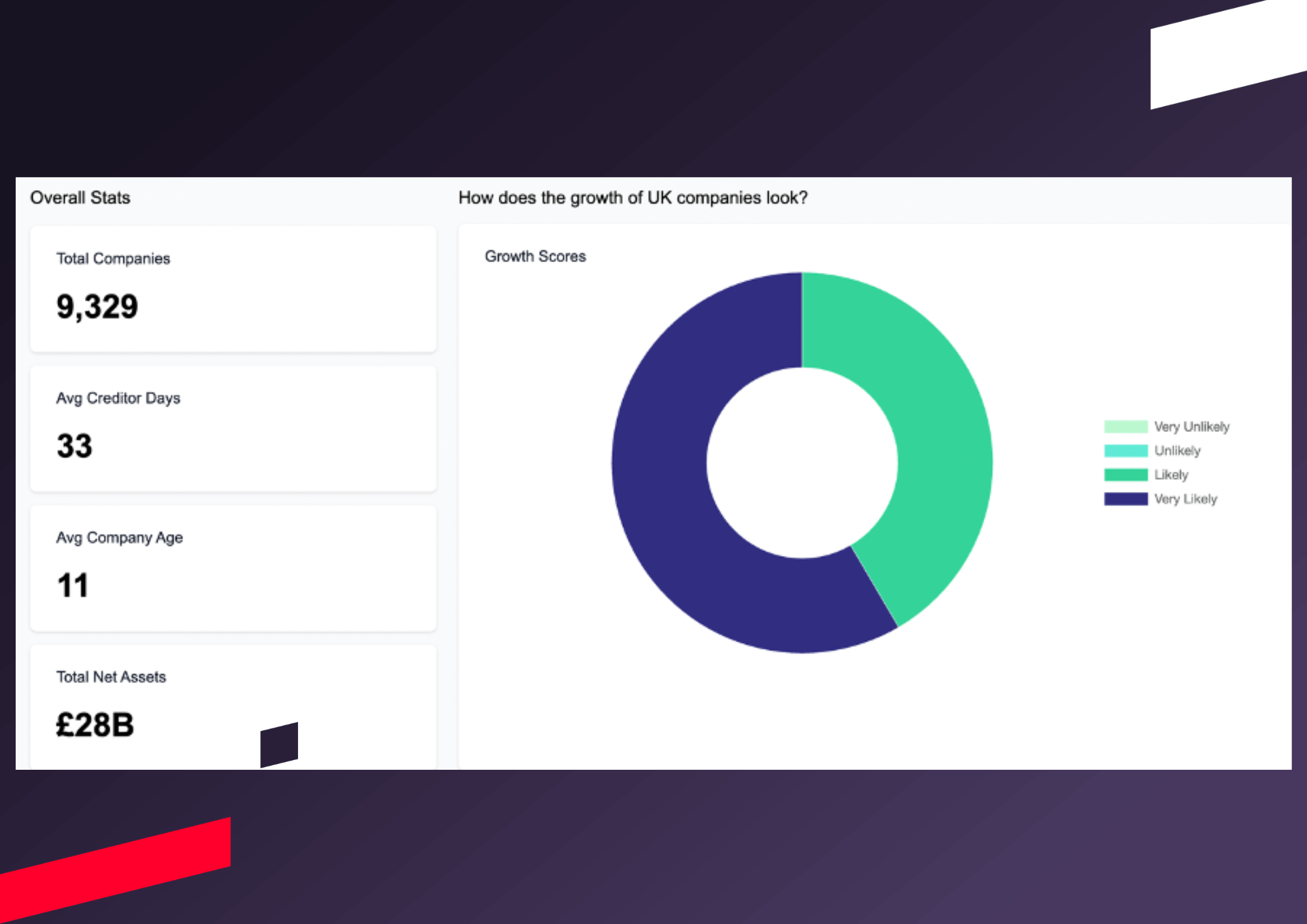

We studied the data around growth in Leeds and found that 9,329 companies were either ‘likely’ or ‘very likely’ to grow. Similar to Manchester and the rest of the UK, the average age of a growing company was 11 years old. In Leeds, the total new assets for all of these growing companies was £28bn, a respectable sum, but less than a third of the assets documented for Manchester’s total.

We noted that company directors in Leeds, whilst a similar age, were on average two years older than their Mancunian counterparts, and the companies were slightly smaller at 18 employees on average.

The highest-growth companies within Leeds are made up of a higher level of businesses from within the motor trade. Manufacturing also appeared within the top five, and as with any growing city, construction companies also contributed a large amount of activity.

In recent years, Liverpool has been a strong economic contender, particularly in the north. Growth in the region tends to outpace the UK average, driven by an increased output across a number of sectors. Key areas include manufacturing, construction, wholesale and retail, and education.

The city’s economic growth is attributed to a variety of factors, but it’s worth remembering that Liverpool is incredibly well placed geographically, both historically and in modern times. Their commitment to students provides a young and skilled workforce, creating an environment that is innovative, strong and conducive to economic growth despite external pressures. With a lower cost of living on average, but still a number of exciting opportunities, both new businesses and top talent continue to flock to Liverpool to grow and succeed.

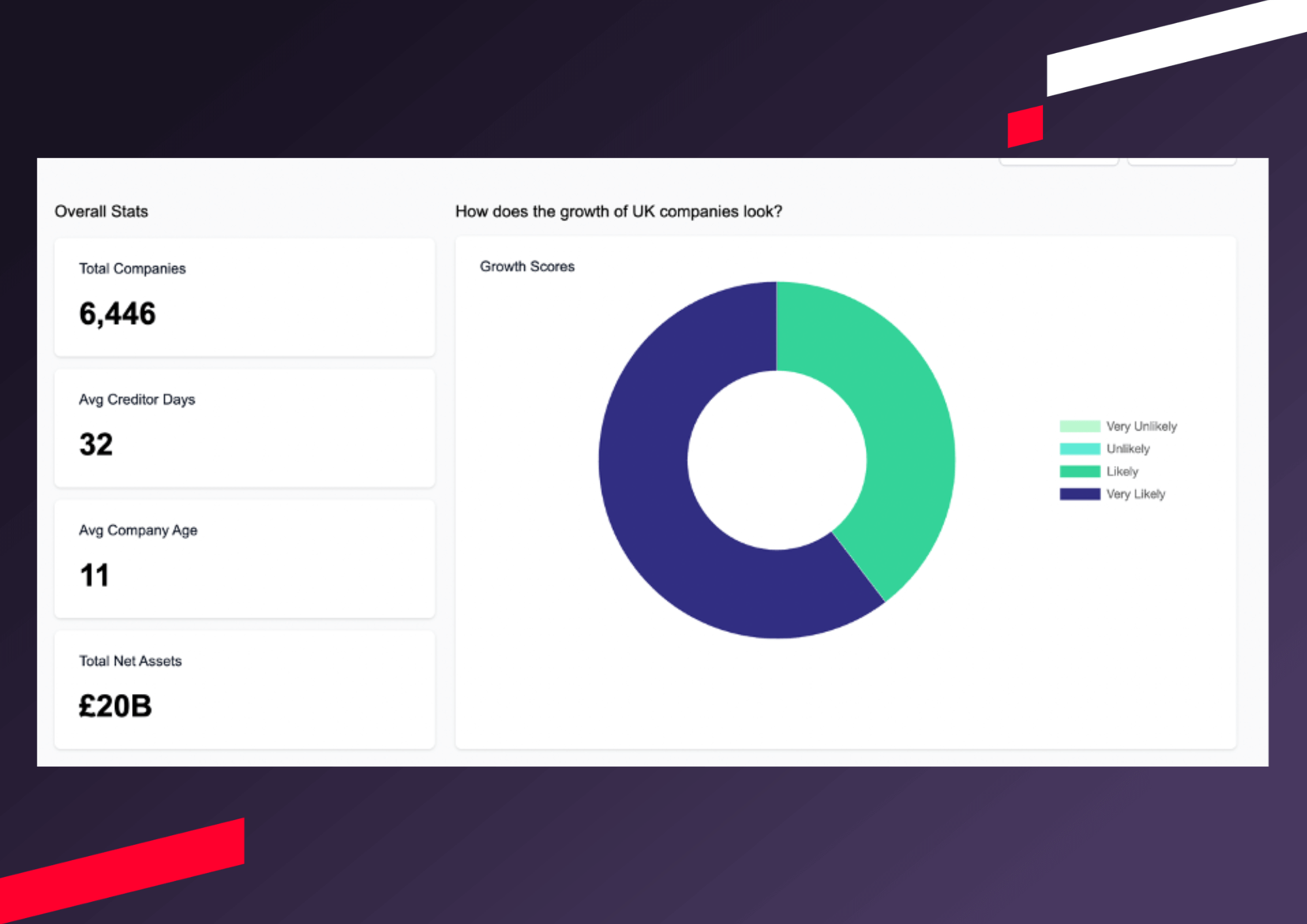

In Liverpool, the number of companies that our data predicts to grow is 6,446, so not far off the total we found in Leeds. Again, the average age of a growing company was just over a decade old, a common feature in the northern companies that we reviewed in this report. For this region, the total new assets for all of these growing companies was £20bn, slightly less than the total in Leeds but overall on a very similar financial level to the growth experienced in that city.

The average age of a director working at a Liverpool-based company was just over 50, and the average employee number stayed pretty similar to the UK average of 20.

In Liverpool, the sector that makes up the highest growth is professional, scientific and technical activities. Interestingly, construction is the sector experiencing the second largest growth, which is higher up in the top 5 than businesses in both Manchester and Leeds.

Newcastle is a city that is continuing to grow its economy despite a challenging economic outlook for the overall Northeast. The city looks on track to grow its economy by around 2% until 2026, only slightly behind the UK’s overall national growth rate.

With a strong business community, and a large-scale investment targeting infrastructure and development, Newcastle continues to grow as a region, with improving connectivity and a stable economy. Experts predict that Newcastle’s economy will be worth an additional £0.5bn by the end of 2026.

It’s these multiple factors that make Newcastle one of the fastest-growing cities in the North.

For the city of Newcastle and the surrounding area, there are 5,475 new companies that are predicted to grow within the next twelve months. Interestingly, Newcastle companies have the highest level of assets out of all five regions that we reviewed, at £121bn.

Similar to Liverpool, Newcastle’s director age is over 50, with average employee levels hitting around 20.

Manufacturing makes an appearance in Newcastle’s top five growing company sectors, with the top sector for growth being professional, scientific and technical activities – similar to both Manchester and Liverpool.

York is the smallest of the five cities that we examined during this report, but it still managed to hold its own against some of the larger northern cities. Despite its petite size, the population is rising annually, driven by a strong economy, historic location, and strong cultural heritage.

A popular tourist destination, York attracts over 3 million visitors each year and is home to many vibrant businesses that support its ongoing growth. There is also a strong student population within York that provides a young talent pool and many economic opportunities.

Although there may not be quite as many growing businesses in York when compared to other regions, at 1,430, the total assets of £46bn is a similar number to Liverpool and Leeds combined. This shows that growing businesses in York have strong financial backing and are potentially more secure than companies in other regions.

Directors in York are the oldest in all five of our examined northern regions, and the companies are slightly larger at an average of 21 employees.

Whilst construction and professional, scientific and technical activities make another appearance in the top five, administrative and support services and real estate are both other growing sectors within York.

“It’s great to evaluate these cities and notice so much growth within areas outside of London,” said Rich West, MD at Red Flag Alert. “What we’d like to see now is more money flowing in these companies, and spreading across the UK, so they can become even more successful. Using a tool like Red Flag Alert allows investors to pinpoint the exact specifications they would like for an investment, including location, director age, and financial health - so they can tailor the opportunity specifically to their business portfolio.”

Dr Nicola Headlam, Chief Economist at Red Flag Alert, said, “The North represents one of the best investment opportunities currently within the UK. The costs are cheaper than in the South, but the talent is thriving and businesses are growing. With this report, Red Flag Alert aims to drive investment into a more country-wide strategic approach, rather than all of the money being centralised in the capital city, as it has been for so long.”

Learn how to stay compliant and avoid costly mistakes, to prepare your business for the new Construction Industry Scheme 2026 rules.

Clear answers to the most common ACSP and ECCTA questions, including identity verification, Companies House obligations and practical compliance steps

For our quickest response simply call us on 0330 460 9877 and speak to an expert now!