Shell companies are an important tool in a money launderers arsenal and are integral to any significant money laundering scheme. Whilst most people will have heard of them, they truly came under the spotlight following the 2016 Panama Papers publication. The extent of their use for illegal or immoral purposes, largely for money laundering or tax avoidance, caused public outrage and a ripple of legislative changes around the world.

But shell companies do have legitimate uses and and it is not uncommon for larger companies to include a few in their larger group structure.

But what is a shell company? How do they operate and when are they used?

This article will explore both of these questions.

What is a Shell Company?

A shell company is one that primarily or solely exits on paper only, effectively meaning it is not a 'real' operating business. This means that there will be no significant assets linked to the shell company and it will deliver no goods, services or other business functions to generate revenue for itself and will employ no staff.

It will have no functional physical office and if it has a registered address this will most likely be a mailbox or an address that is shared by up to hundreds of other shell companies.

Primarily shell companies are used to move or hold assets in a manor where it is not immediately obvious who the ultimate beneficiary is. To further obscure this, shell companies are often set up by a third party, be it a lawyer, accountant or a private citizen.

Money laundering schemes often include several complex business group structures made up of shell companies and will transfer funds many times between them with the aim of creating a such a complex chain of transactions that investigating authorities lose track of the money or are overwhelmed.

Shell corporations can exist in any country but are very popular in those that are considered tax havens or have low regulatory standards; such as: The Cayman Islands, British Virgin Islands, Bermuda or The Channel Islands are examples of High Risk Countries.

It is common for group structures created for money laundering to include shell companies based in different countries which are subject to different banking regulations and legal systems. This is again to make any investigations more difficult as investigators will have to collaborate with overseas police forces, which may be in a jurisdiction more prone to bribery, as well as navigate foreign banking regulations and legal systems that may be much laxer or even be tolerant of money laundering.

However, it is important to note that shell companies can be set up and used by legitimate businesses as well as criminal enterprises and can be used by individuals as well as organisations.

Why would a legitimate company use a Shell Company?

There are numerous reasons that legitimate companies would use a shell company and they very commonly do, this is especially true of larger and more developed corporate group structures.

If a company wants to do business or invest in a foreign market, they may set up a shell company in that country so transactions take place within one regulatory space and are not complicated by going across borders and regulatory systems. In this case legitimate business would be done by individuals in the home country but it would be as if they operated out of the shell company in the second country.

Many businesses start life as shell companies before they are fully operational. This can be to secure naming rights or help in securing funding or assets.

Companies operating in volatile economies can use shell companies to store money abroad where economic conditions are more stable and the value of the currency less at risk of rapid devaluation. Companies that regularly deal in a specific foreign market may also set up a shell company there to facilitate trade and transactions.

An extremely popular use for shell companies by legitimate enterprises is tax and regulatory avoidance; whilst this is often viewed as immoral, so long as it is done in the correct manner, it is completely legal.

A common example of shell companies being used for UK tax avoidance is companies using shell companies in Ireland, which has a lower corporate tax rate than the UK, and attributing their profits from UK operations to this shell company; thus paying less tax.

Should a company wish to avoid the costs and impediments of complying to high standards of regulations they in some cases can set up a shell company in a country that has lower standards to avoid these. For example, a UK company performing activities abroad may be held to certain environmental standards by UK regulations, they can set up a shell company in a suitably poorly regulated country and attribute the activities to this shell company in an effort to avoid tax law enforcement.

Shell Companies and Criminal Enterprise

Shell corporations play a pivotal role in money laundering schemes, both in the washing of illicit funds and in obfuscating ownership of financial assets held in their name.

Money laundering has three distinct stages: placement, layering and integration.

-

Placement – illegally gained cash is placed into the banking system. Turning the physical notes into digital money in a bank account. Not only does this mean money can be transferred but it eliminates the problem of storing, hiding and defending large amounts of physical wealth.

-

Layering – the money is then sent through a complex series of transactions between individuals and organisations, often crossing international borders, to hide the original source of the funds.

-

Integration – the money can no longer be easily attributed to illegal activity and is essentially clean. It can then be used as if it were legitimate funds. These washed funds are often stored in shell company bank accounts or invested in traditionally appreciating assets, eg property or gold, which are then listed as owned by a shell company.

Shell businesses are integral to the layering stage of money laundering. The aim is to create a chain of as many transactions as possible, essentially to make it as confusing as possible for investigating authorities to trace the source or destination of funds. These chains may contain dozens or even hundreds of shell companies across multiple countries.

The advantage of money laundering schemes crossing international borders is that an authority investigating a money laundering scheme will only have jurisdiction in its own country and cross border collaboration between police forces slows or even halts investigations.

Also, the countries that are popular for laundered money to be routed through tend to have low or no financial regulations which would mean their authorities would not aid in the investigation as no crime had been committed on their soil. Often corruption is more common in these territories, which further aids money launderers and hinders investigators.

Many such countries also have a vested interest in allowing these schemes to prosper as they collect tax on these funds whilst not having to provide anything in return, save their lack of regulations.

To add further complexity, shell companies will not be set up in the name of the ultimate owner of the illicit funds and frequently will be listed under a false name. Surprisingly, it is incredibly easy to do this and there is rarely any form of identity verification involved in creating a company, let alone confirming it is being created for legitimate purposes.

Even in the UK it takes a matter of minutes to create a shell company attributed to a fake identity, which can be used for illegal transactions and then abandoned with little chance of ever being traced to who initially created it.

Shell companies are also used in the placement stage of money laundering schemes. Once the washed funds have made their way back to the destination economy, they can be stored anonymously in the accounts of shell companies or used to purchase assets, such as property and real estate, which are then held under said shell companies name.

Can business be done with Shell Companies?

As Shell companies are not illegal in and of themselves and do have legitimate uses, business can be done with them in certain instances. However, if you suspect you are dealing with a shell company or a company that has shell companies in their group structure it is important you place the individuals you are dealing with under increased scrutiny and ensure you identify the ultimate beneficial owner of the shell company and funds.

It will almost always be appropriate to carry out your most thorough enhanced due diligence process in these instances.

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 makes it a legal requirement for companies in the regulated sector to adopt a risk-based approach for all business dealings. This includes confirming who the ultimate beneficiary is for any given transaction.

Considering Shell companies do not conduct business activities for themselves there will always be an ultimate beneficiary to identify. This not being freely given is a recognised sign of illicit activity, as is a party seeking undue secrecy.

Should a shell company be easily linked to a legitimate company or individual, and all other anti-money laundering requirements be met, then it may be appropriate to do business with them. If you do so, ensure that all your AML efforts are meticulously recorded along with your justification for dealing with them.

Why Should I Be Concerned about Shell Companies?

A shell company is not inherently a concern but you should be concerned if you are dealing with one until you have thoroughly vetted them and they have passed your most stringent compliance checks. In and of themselves, they are legal and in many cases they are used for legitimate reasons. However, shell corporations are also commonly used as vessels for committing financial crimes, such as:

Money laundering

Money laundering is a form of financial crime worth trillions annually, that allows criminals to hide the profits of crime, or disguise the illicit sources of their wealth. Essentially it takes physical dirty money/assets which are easily attributed to criminal activity, transfers it into digital funds in a banking system and sends it through a series of complex transactions until it can no longer be so.

Shell corporations are useful tools for money launderers because they are easy to set up and their ownership can be made difficult to determine.

Illegal Business

Shell companies can also be used by people who want to engage in illegal business without revealing their identity.

For example, a company or individual can use a shell company to fund terrorist activities without this funding being traced back to them.

Shell corporations can also be used to conceal one’s identity when doing business with an unpopular client—for example, if a company wants to profit from a region or industry while giving the outward appearance of boycotting it to please the public. Although this is not illegal, this kind of activity is misleading and likely to garner negative media attention if discovered.

Concealing assets

Shell companies are commonly used to conceal assets during divorces, court cases, mergers, or acquisitions.

People do this to avoid having to share their financial assets when they divorce, having their significant assets seized during litigation, or having them taken over during a corporate merger or acquisition.

Deliberately hiding assets in this way is a form of fraud, and is illegal.

Tax Evasion

Shell corporations are also frequently used by companies or high-earning individuals to avoid or evade tax.

Tax avoidance involves avoiding paying while obeying the letter of the law, while tax evasion is unlawful avoidance of tax Shell companies are frequently used for both.

Shell corporations are frequently used to evade tax because they are relatively easy to set up and difficult to trace. One of the main ways people use shell companies for tax evasion is by hiding taxable income and financial assets in a shell corporation in a different country.

Certain countries are such popular locations for tax avoidance and evasion through shell companies that they are commonly referred to as tax havens, because they have low tax rates and little tax regulation.

The world’s five most popular tax havens—measured by the amount of money they hold versus how much they should hold based on their local economies—are the British Virgin Islands, Taiwan, Jersey, Bermuda, and the Cayman Islands.

How to protect yourself from illegal Shell Companies.

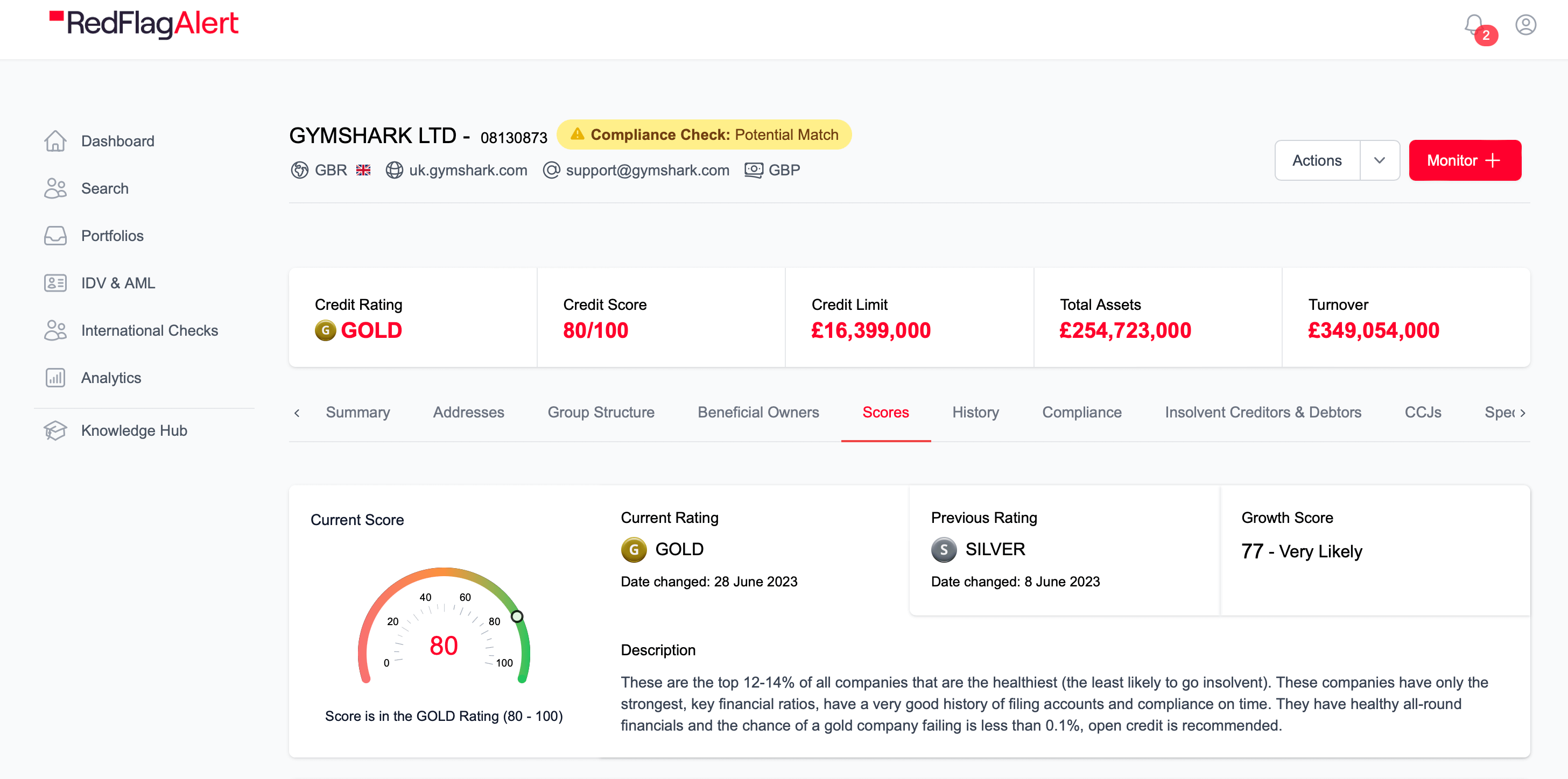

Red Flag Alert can protect you against the adverse legal, professional, and reputational damage from being found to have facilitated illegal activity via doing business with an illicit shell company.

Search every UK company and their financial details with Red Flag Alert company search and reports.

Red Flag Alert AML check software offers:

- Unbeatable match rates with a referral rate if just 2%

- Document verification

- Digital platform takes just 30 seconds to send a check

- Real time PEPs, sanctions checks and adverse media checks with live monitoring

- Director Search capability

- AI powered IDV checks

- Checks delivered in your branding

- Full and easy to understand UBO structures

Find out more about how Red Flag Alert’s KYC AML platform could improve your AML compliance programme and safeguard your business from financial crimes and reduce AML risk, Try Red Flag Alert today.

.