Back in 2017, a now-infamous article in the Economist stated that the world’s most valuable resource is no longer oil but data.

Since then the demand for high-quality business data has grown.

Today, the way that data providers collect, analyse and supply B2B data has become more and more sophisticated.

But not all are created equal and there is a huge gap in capabilities between these different companies.

Finding the right one can be tough. That’s why we’ve put together this guide to explain exactly what B2B data is and how to assess data quality and data providers.

Who needs a B2B data supplier?

B2B data differs from consumer data in that it is information on companies and not people. This information is used by:

- Sales and marketing teams

- Businesses that conduct credit checks and monitor client financial health

- Companies that conduct anti-money laundering (AML) and know your customer (KYC) checks

These companies use it to make their business activities more efficient and effective. Let’s take a look at how each group uses data:

Your marketing and sales teams

B2B data helps sales and marketing campaigns in a variety of ways. They are:

Develop ideal customer profiles

An ideal customer profile (ICP) is a hypothetical representation of a company’s most profitable customer. Identifying your ICP is important because it’s easier to:

- Win their business

- Satisfy them

- Make a profit from them

An ICP is created using real-world company data on your best (and worst) customers. Sales teams begin by grouping their customers based on how profitable they are. They then analyse the data for each group and look for common features that the businesses within it share. They then collate this information to create the ideal customer profile.

Prospecting

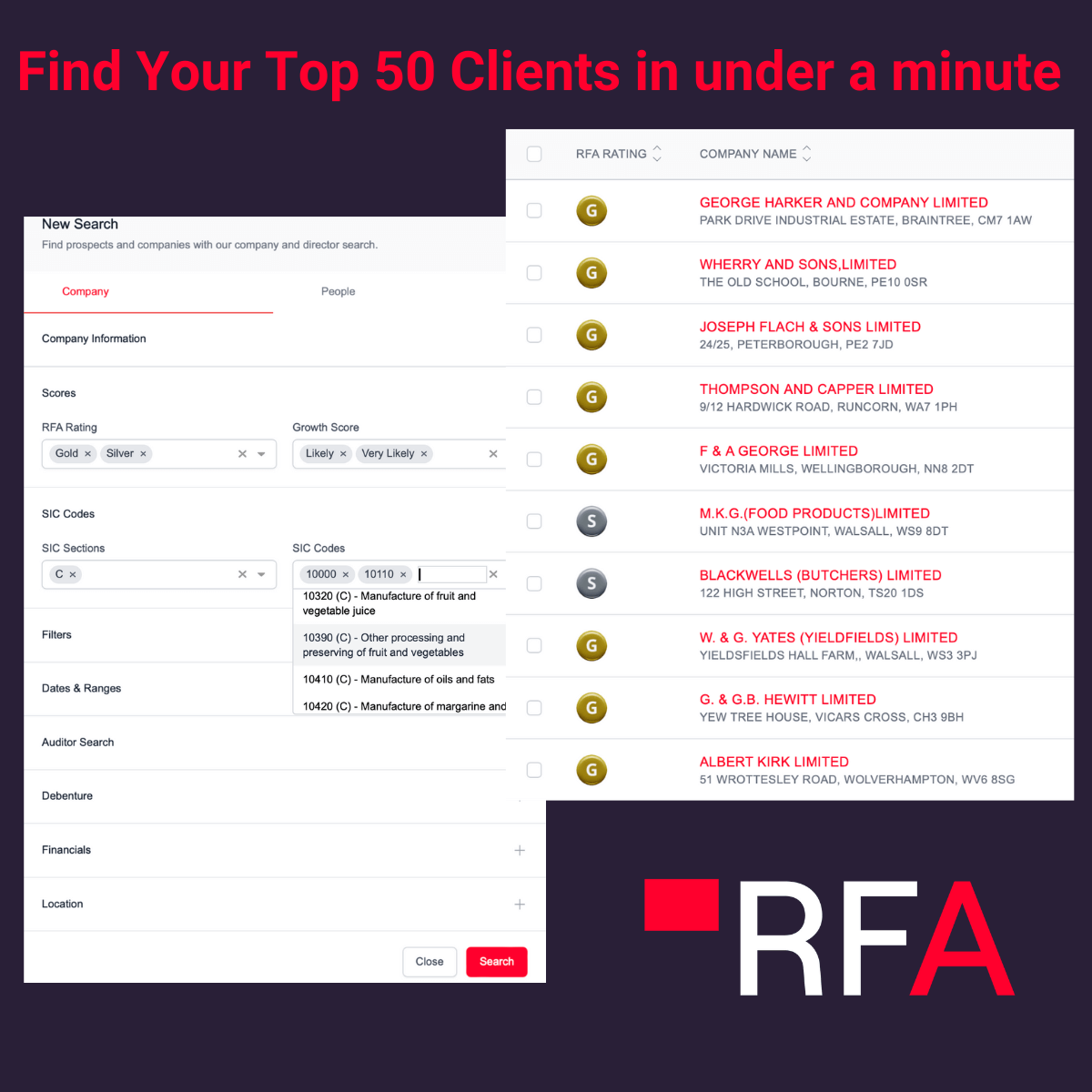

Once sales teams know who their ICP is, they can then begin finding companies that match it.

In the past, this was a manual process. Sales teams would have to phone a business and ask qualification questions, just to check if the company was worth pursuing.

Data has changed this. Sales teams armed with a database can see a list of every company in the UK and filter it so that it only shows those companies with the characteristics outlined in their ICP. This instantly gives them a list of perfect customers that they can begin contacting. There are solutions that automate the production of data, like Red Flag Alert's b2b prospecting tool.

This is particularly useful for email marketing, as it allows you to aim marketing campaigns specifically at your target audience. These campaigns are more likely to be successful than cold email campaigns, providing you with more qualified leads and a greater return on investment for your marketing efforts.

Informing sales calls and content

High quality data allows sales teams to understand the challenges that a company might be experiencing. This can be used to inform their calls, meetings and presentations.

Say you sold accountancy services, for example. You can see that the company you are targeting keeps failing to submit accounts on time, even though it appears financially healthy. This could be a sign that the company’s management team is busy and struggling to stay on top of its accounting—this assumption would need to be qualified.

If correct, your sales pitch could highlight that you’d take the hassle off the management team and guarantee they meet their accounting requirements.

Businesses that conduct credit checks

If your business extends credit to its customers you need to make sure that the companies you work with are financially sound. If they go out of business owing you money you are unlikely to get any of it back.

Good B2B data lists will provide a financial health score for every UK business. You simply choose the minimum score that you are willing to work with and then make sure that your potential customers meet this requirement.

There are three times when you should conduct credit checks:

At the prospecting stage

This ensures that your sales reps only approach clients that are financially robust. This stops them wasting time and resources pursuing a customer that eventually goes out of business.

[DOWNLOAD OUR GUIDE TO FINDING CLIENTS THAT ARE LOW RISK]

During onboarding

We always recommend running credit checks during prospecting. If you don’t, credit checking during onboarding becomes risky—if the customer is rejected then both parties have wasted their time getting to this stage.

Data-based health scores help speed up the onboarding process by giving the customer an instant pass or fail. This saves the customer a frustrating wait while their credit check is processed.

Regular monitoring

You should regularly check your customers’ credit scores. This allows you to take proactive steps, should a company’s financial health begin to deteriorate.

There are a range of steps you can take depending on the severity of the customer’s situation. For example, if the customer has suffered a mild financial setback then you may decide that further monitoring will suffice. On the other hand, if they have suffered a major financial shock you may wish to take stronger measures, like withdrawing credit or calling in invoices.

Regulated industries

Professional services and other regulated industries need to have processes in place to run anti-money laundering (AML) and know your customer (KYC) checks. They also need to be able to store this information and access it quickly when asked by a regulator.

The best B2B databases allow customers to do this quickly, accurately and securely. They will also provide other services, like digital identification verification and checks for politically exposed persons (PEPs) and sanctions.

What is B2B data?

B2B data includes qualitative and quantitative information, such as:

Information on the physical company

This can include its location, the number of employees, what the business does and the different assets that it owns.

Financial information

This includes information like company turnover, liquidity ratios, cash flow, asset value, stock valuation and more.

Director contact data

Contact data includes the names and details of company directors and anyone with a major stake in the company. It can also include their job title, history and other business interests. For example, you’ll be able to see if a company director has experienced insolvency.

Legal history

This includes anything that is filed against the company in the UK courts system. Good examples are county court judgements (CCJs) and winding-up petitions (WUPs).

Where does B2B data come from?

There is a wealth of information that is publicly available to companies from different sources. These sources include:

- Companies House

- The Land Registry

- The Gazette

- The Registry Trust

- The London Stock Exchange

Why use a B2B data supplier?

The question is: why use a B2B data provider company if all of this information is publicly available?

There are three main reasons:

They have the infrastructure

Collecting this existing data from so many different places and making it usable isn’t easy. B2B data providers have the infrastructure in place to automatically collect data from different sources. They also make it easy for users to access and analyse it. Setting this up for yourself and maintaining it would be time consuming and expensive.

They have the expertise

B2B data companies don’t just collect data. They also know how to use it effectively. Good data vendors will take the time to understand what you want to achieve and explain how you can use data to do that. They’ll also make sure that you and your staff know how to analyse data.

They enrich data

Sometimes, publicly available data won’t tell you the full story about a business on its own. In these cases, the B2B data provider does some complex modelling and calculations to reveal deeper insights. To better explain this, here are some of the ways our experts at Red Flag Alert enrich our data:

Micro-entities

Micro-entities are companies with at least two of the following features:

- A turnover of £632,000 or less

- £316,000 or less on its balance sheet

- Ten employees or fewer

Micro-entities make fewer disclosures to Companies House and so there is less publicly available data on them. This makes them harder to assess.

We’ve created a process that evaluates micro-entities and allows users to make reliable conclusions about them.

Over the last 13 years we’ve recorded daily changes in the data of the UK’s 6.5 million companies. We’ve used this information to develop complex algorithms that put business events into context.

This means that we can accurately assess what risk implications or sales opportunities a micro-entity may present, even though the available information is limited. Read our article on micro-entities to find out more.

Growth propensity

Most data providers measure growth by a business’s ability to ingest debt—known as the loan propensity score. That means that unless a company has received venture capital or a similar investment, it won’t show up in their data. This means they overlook a large portion of the UK’s economic growth.

We use the OECD’s definition of a fast-growing company to identify companies with high growth potential. We then looked at our historical data and identified common characteristics of companies that experienced high growth. We applied these calculations to every UK company and gave them a growth score from 0-100. The pass mark for a high-growth company is 56.

Predictive financial health scores

Knowing the financial health of a company is useful information. But knowing how its health will change in the near future is critical.

That’s why we created our predictive financial health scores. Like with our micro-entities modelling, we took 13 years of company information changes and programmed it into a machine learning algorithm. This allows the algorithm to accurately predict how a company’s financial health will change over time. Each business is given a rating. Healthy companies are rated gold, silver and bronze, while companies at risk of insolvency are rated one, two and three red flags.

Here are some of the financial health indicators our algorithm considers when assessing a business:

Fixed charges

This is when company owners or shareholders are the first to be repaid in administration. Companies with a fixed charge over assets are three times more likely to go insolvent than those that don’t.

Accounting period changes

Businesses in financial turmoil often change their accounting periods to avoid filing accounts that reveal their troubles. This can be a precursor to administration.

Liquidity ratios

Liquidity ratios are different ways of looking at the amount of cash a company has access to. At Red Flag Alert we use one that discounts stock value, giving a more balanced picture of the company’s financial situation.

London Stock Exchange profit warnings

If a company is on the London Stock Exchange, profit warnings are often a sign of trouble. Most public company insolvencies are preceded by at least two profit warnings.

Unadvertised petitions (UAPs)

If a creditor is owed money by a company and they think that the business can’t afford to repay because it might be insolvent, they can petition the court to wind up the company. The company wind up is then advertised in the London Gazette. However, the petition isn’t advertised while the company is still winding up—this means many creditors don’t find out about it as early as they could. A supplier of accurate data will source it directly from the courts and warn about these unadvertised petitions.

CCJs

A county court judgement (CCJ) is when a court orders a business to make a payment. They are often a sign that the business is struggling to repay its debts. The right data provider will be able to tell you immediately if a company has a CCJ and what impact that will have on its future financial health.

How to choose a B2B data supplier

Every B2B data provider claims to be the best, but how can you be sure? Below we’ve provided a list of what makes a great B2B data provider.

Real-time data

The ability to provide real-time data has been the most important development of the last 10 years in the B2B data sector.

In the past, companies purchased static databases with a limited number of contacts. This was added to their hard drive or CRM. If they wanted to update this information or get new contacts they would have to pay again.

The problem with using static data is that it begins to deteriorate almost immediately. Directors and decision-makers leave, someone’s job title might change, companies move premises, and financial situations change.

Before long, your team is making decisions using inaccurate information and wasting time filling in gaps in your database.

Worst still, a static database can’t tell you if your client’s financial situation starts to decline. You would most likely find out when they enter administration—and at that point it’s too late.

Today, many providers collect new information and update their database regularly. At Red Flag Alert, we go a step further. If a single datapoint changes we update it immediately. We don’t wait for the end of the month. And, using our monitoring tool, you can be alerted as soon as these changes happen so you can take action.

We also provide an API that connects to your CRM. This means that you constantly have access to the very latest data.

Lead generation for marketing campaigns

Real-time data gives sales and marketing teams an additional capability: lead generation. By setting up monitoring alerts they can find out as soon as a new company is launched that matches their ICP.

Alternatively, it might be that an existing company’s position changes so that it now fits their ICP.

Imagine your ICP is a company with a turnover of £2 million, which is based in the North West and provides financial services.

It’s unlikely that a new company would suddenly appear with that level of turnover. However, a good lead generation technique is to look for existing companies that grow to reach that level. Or a company of that size could move into new offices in the North West.

Alternatively, imagine you provide administration services. By monitoring a company’s asset value and cash flow, you can spot business leads by identifying companies that become technically insolvent. You can then offer them services such as restructuring, which might help them to save their business.

Ultimately, a real-time data provider can help you create a lead generation machine. This will constantly connect you with companies in need of your services.

Up-to-date algorithms

Good B2B data providers should update their scoring algorithm to reflect today’s economy.

For example, the retail, hospitality, leisure and construction industries have all been hit hard by the pandemic. If a business’s financial stability depends on one of these sectors they are likely to struggle in future.

However, many data providers still use pre-pandemic financial health models, meaning that their predictions are unreliable.

Financial issues at PDR Construction and P&O Ferries were both missed by major B2B data providers due to out-of-date modelling.

Compliant with data protection laws

A key part of data protection laws like GDPR is being able to prove that your B2B data lists contain up to date information and have been acquired through legitimate sources.

A good B2B data vendor should therefore be able to help you remain compliant.

At Red Flag Alert, our data is sourced from publicly available databases and is updated in real time. You can stay compliant by connecting our API to your CRM.

The ultimate B2B data provider for your sales and marketing team

B2B data is becoming more and more sophisticated, but finding a good B2B data provider shouldn’t be difficult.

In this article we’ve highlighted the most important aspects to look out for when choosing one.

Red Flag Alert offers rich financial B2B data that gives your business powerful capabilities.

We provide:

- Detailed information on every UK business

- Data on 50,000 new companies added every month

- 100,000 real-time updates per day

- Crucial information and opportunities are sent straight to your inbox daily

- Contact data on 2.4 million key decision-makers, including 900,000 GDPR-compliant email addresses

- Instant access to data via your CRM using our API

To find out how Red Flag Alert’s data can help your business, book a demo today.