Company accounts are an interesting piece of the jigsaw when evaluating the solvency of your clients.

If you have critical clients it is essential that you collect as much information about their financial affairs as possible: the bigger the client the more pertinent the assessment of their financial affairs. There are many ways of assessing their ability to pay and this article will concentrate on their company accounts.

Company accounts can offer interesting insights into a business, especially when evaluating its financial health.

It’s especially important to monitor your business partners (e.g., suppliers, critical clients) as if they become insolvent, and you have not had the chance to seek a suitable replacement for them it will damage your cash flow as well as potentially giving you bad debt for any credit you had extended.

You should also review the financials of any company as part of your due diligence process prior to entering a business relationship, as the best way to avoid bad debt is to not extend credit to financially weak companies in the first place.

In this article, we will look at the many ways of assessing a business’s financial health and concentrate on what you should be looking for in company accounts.

Where Can You Find Company Accounts?

All limited companies must file their annual accounts at Companies House, and it is possible to download them from their website. However, this will come as a PDF of a photocopy that does not offer any analytics and is inconvenient. Also, companies with a turnover of less than £10 million a year only must file abbreviated accounts, which will not give you a full picture of their financial state.

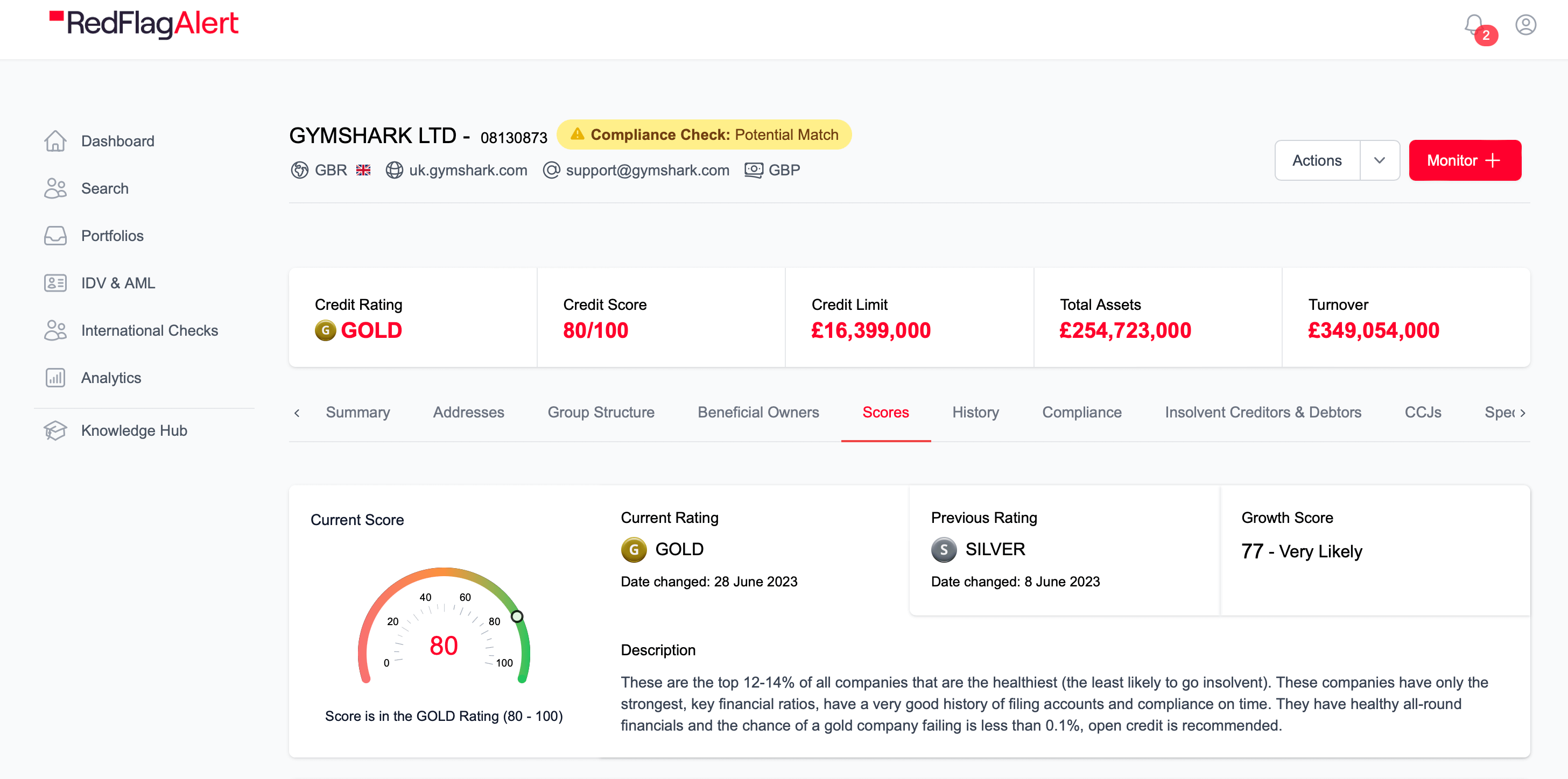

As such, most businesses prefer to use specialist platform, such as Red Flag Alert, to help provide clarity. On the Red Flag Alert platform company accounts are easily accessible, provides easy to understand analysis and a wealth of other information about a company’s financial health.

Before you start looking into the accounts take a look at whether they have been filed on time. Late filing is well known to be correlated with later insolvency and you can also look at changes in directorship as this can show instability. As with all measures they should be viewed as part of a wider picture.

What’s The First Thing to Look for In a Set of Company Accounts?

The first thing to look at on a company’s accounts is its profits. Doing business with a company that is losing money or just scraping by, is inherently at risk of leading to bed debt. You can also compare these profits to previous years to see if a company’s fortunes are improving or declining.

A set of accounts will show both gross and net profit. Gross profits are profits before any of the company’s expenses have been deducted and net profits are the profits left after these expenses have been considered. Net profits are therefore the best indicator of the profitability of a business.

Current economic strains have led to a sharp increase in the expenses of businesses across the UK and it is likely that we will see a large decrease in businesses’ profits.

It is recommended not to view this in isolation when making a decision whether to do business with a company but it is a factor that should be taken into account.

What to Look for on a Business Balance Sheet

In the accounts, when you shift your focus to a business’s balance sheet you should pay special attention to three things: cashflow, leverage, profit, and loss.

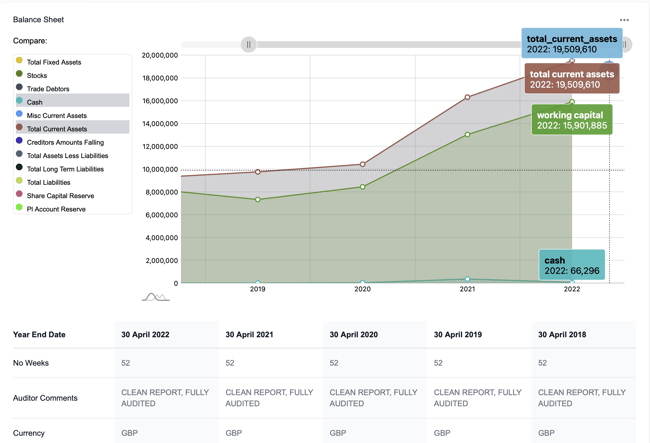

Below is the perfect example of Red Flag Alert's financial data on companies with the option of filtering financial data to your preference:

Cashflow

You can get a view on the company’s ability to pay their short-term debts by employing the current ratio, calculated by dividing your current assets by your current liabilities. The higher the number the greater liquidity the company has.

Cash is the best current asset, and then the strength of debtors and stock will depend on the industry. For example, debtors in the construction industry are notoriously unreliable so consider whether this is likely.

The value of stock can also be misleading, but this will vary depending on industry, and some stock is worth less than recorded on the balance sheet or very hard to sell.

Leverage

Again, this is looking at the balance sheet but taking a view on how the company is funded, so its long-term liabilities.

Looking at whether the company is funded by debt or equity allows you to see whether they are tied into repayments which can put a strain on the business. You can also see if there are other types of long-term debt, typically mortgages, where repayments can be burdensome. In abbreviated accounts it’s not always clear what everything is but it’s a good starting point.

Profit & Loss

It’s worth looking at the revenue and profit figures on the P&L to look at trends over a period. What is happening to revenue is important: steadily growing or stable revenue over many years indicates the safest proposition. Variable, declining or spikes in revenue can mean the company is inconsistent, struggling or expanding quickly. Expansion sounds good but a lot of companies can run into problems by overtrading and getting into financial difficulties trying to grow too fast.

Looking at accounts is one part if the picture which should feature in your due diligence. Remember, don’t take the numbers at face value – contextualise them with the type of business you are assessing.

What could a Red Flag Alert Report Provide?

Red Flag Alert provides vital information to help your company spot potential clients, as well as spot risk in your existing ones.

Aside from looking at company accounts, there is plenty of other information to consider before making any decisions regarding other businesses.

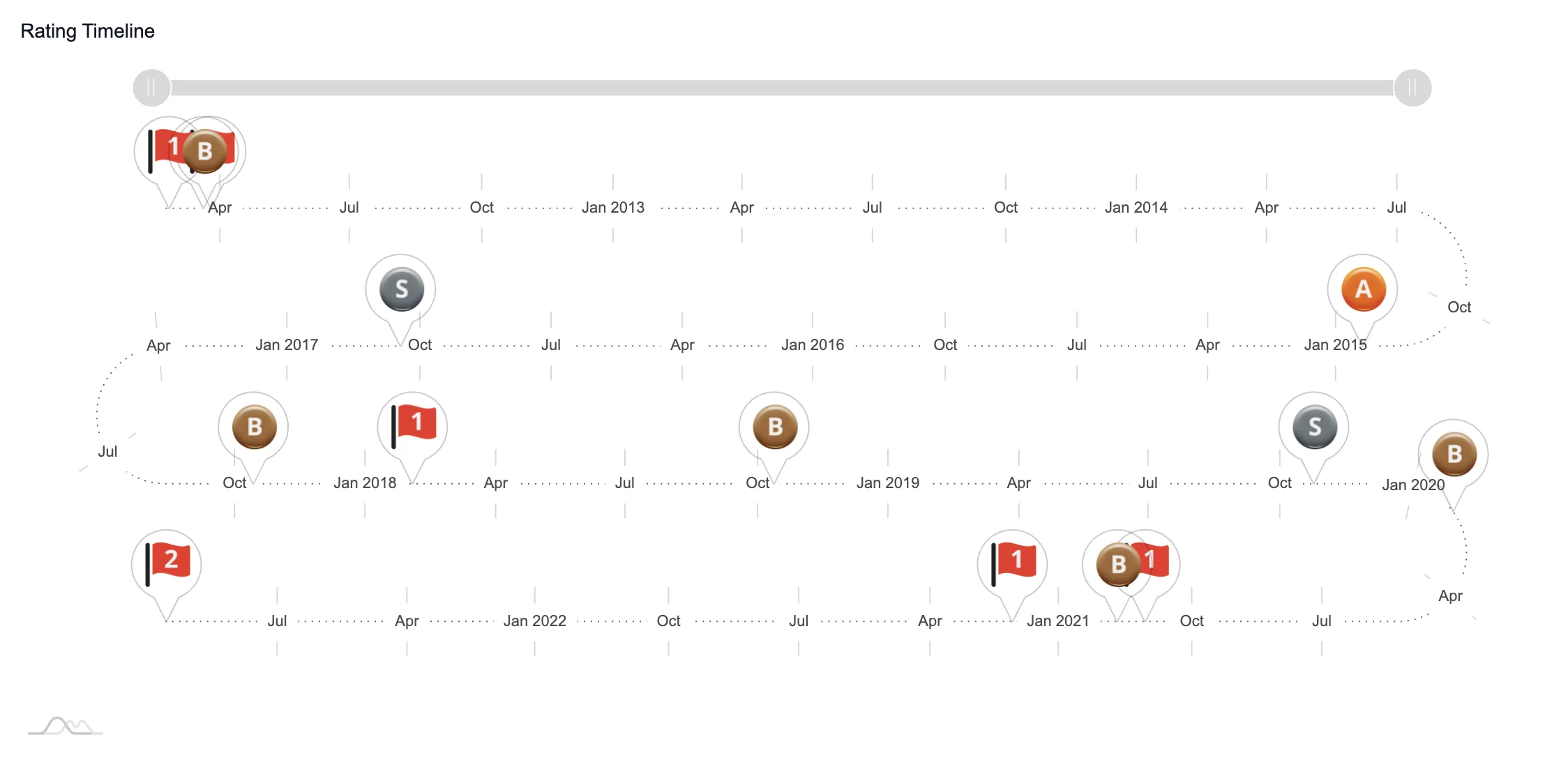

This includes looking into a history of events and financial situation of the company. This gives you an overview of everything that has impacted the business both positively and negatively. These key events will provide you with a better idea into their stability and dealings.

If in this history you can recently see a lot of directors/other important employees have left and been replaced recently, this is a huge sign of a failing company; especially if these roles have not been rehired. This is a warning to all partners that this business is failing, and its likely directors are leaving before they’re associated with it, as this could give them a bad reputation.

Another sign to look out for is creditors/debtors associated with the company that have recently gone insolvent. If a business has gone insolvent that owed or was a source of money for the company you’re investigating, it can have a deadly ripple effect. If any of these companies owed the business millions or hundreds of thousands and has gone insolvent before repaying, and the debt cannot be absorbed, this has serious implications generally leading to the business closing.

Aside from this you should also look for:

- Special events

- Does the company have a petition from the Gazette?

- Have they previously survived a winding-up petition etc.?

- Persons of significant control

- Who is the major player of this company (PSC and directors)?

- How are any other businesses these people are associated with rated?

- Liabilities

- Does the company have any significant liabilities to pay off?

- Any mortgages etc.?

Next to consider the number of creditor days a company has. Creditor days are the number of days after the agreed payment date it takes for a company to repay creditors. A company with a small number of creditor days can be seen as reliable to creditors, whereas a company with a higher number of creditor days can be seen as unreliable and a risk as it can be an early sign of insolvency. More creditor days usually indicates poor financial health in a company.

Indicators of a Company’s Financial Health

Things to look out for within the company report include:

- Have the accounts been filed on time?

- Late filing has a strong correlation with later insolvency.

- Have there been any recent sudden changes in directorship?

- This can show instability within the business.

- Are there any CCJs issued against them?

- This can indicate the business may not have enough money to meet their debts.

- What is the current director’s history?

- Is the director involved, or been involved, with any other companies? If a director has a history of insolvent/poorly rated companies associated with them, chances are this company won’t be any different in the long run.

Manage Credit Risk and Limits with Red Flag Alert

Red Flag Alert not only gives an in-depth look into the financial health of UK companies but also allows you to actively monitor your business partners or potential clients for any adverse events. Our cutting edge algorithm and award winning platform gives you the best chance of avoiding bad debt.

Red Flag Alert offers:

- Financial health on businesses in almost every country in the world.

- Detailed rating system that is predictive of future problems.

- Sophisticated scorecards that include a wide range of weighted factors.

- Information integrated into your CRM.

- Monitoring updates provided in real time.

- Helps you fulfil regulatory requirements like AML and GDPR.

Learn more about how Red Flag Alert helps your credit control function protect your business from financial risk while remaining compliant. Why not get a free trial today?