Credit control refers to overseeing and regulating the credit transactions between a company and its customers.

One of the biggest reasons for effective credit control procedures is minimising the risk of non-payment from customers. This presents huge threats to the health of a business, especially in the current economic climate, where taking on bad debt usually results in a swift journey to insolvency for your business and your supply chain.

Here at Red Flag Alert, we want to help guide your business in enhancing your credit control procedures, and ultimately strengthen your financial stability.

Credit Control Procedures

The first step to improving your credit control procedures is to do an assessment of your current process.

Evaluating your existing credit control procedures highlights common issues or weaknesses that you may encounter. This gives you a roadmap for which parts of your procedures need the most focus.

Broadly, there are two approaches to refining your process: proactive and reactive.

- Reactive is the most widely documented and involves chasing up debt efficiently.

- Proactive is less well documented but is equally, if not more, important. In practice, it means building and managing a portfolio of the right types of customers who are less likely to default.

Let’s look at best practices for both credit management approaches.

Reactive

Chasing payment effectively whilst maintaining positive relationships with clients is a core component of credit control.

Communication and customer relations

The value of clear communication with customers cannot be understated when it comes to credit control procedures.

It’s easy to see businesses that haven’t paid you back on time as enemies, but most of the time they’re either experiencing cash flow issues or are badly organised, rather than a more sinister reason such as fraud.

Don’t be afraid to pick up the phone to these businesses to find out their situation. If there is a financial issue within the business it can help to be empathetic, whilst also reminding them that their invoice is due.

Here are our top five tips on handling overdue accounts diplomatically:

- Maintain open lines of communication with the customer, send polite reminders and follow-up emails or letters. Clearly state the outstanding balance and payment due.

- Maintain a professional and polite tone in all interactions with the customer. Avoid using aggressive language or making threats as this often exacerbates the situation and could even harm your reputation.

- Keep thorough records of all communications, including phone calls, emails, and letters. This documentation can be valuable if the situation escalates, or legal action becomes necessary.

- Implement an automated reminder system to send payment reminders and invoices before and after the due date.

- Escalate gradually, if diplomatic efforts fail, consult with legal professionals or debt collection agencies experienced in UK regulations.

Credit monitoring and reporting

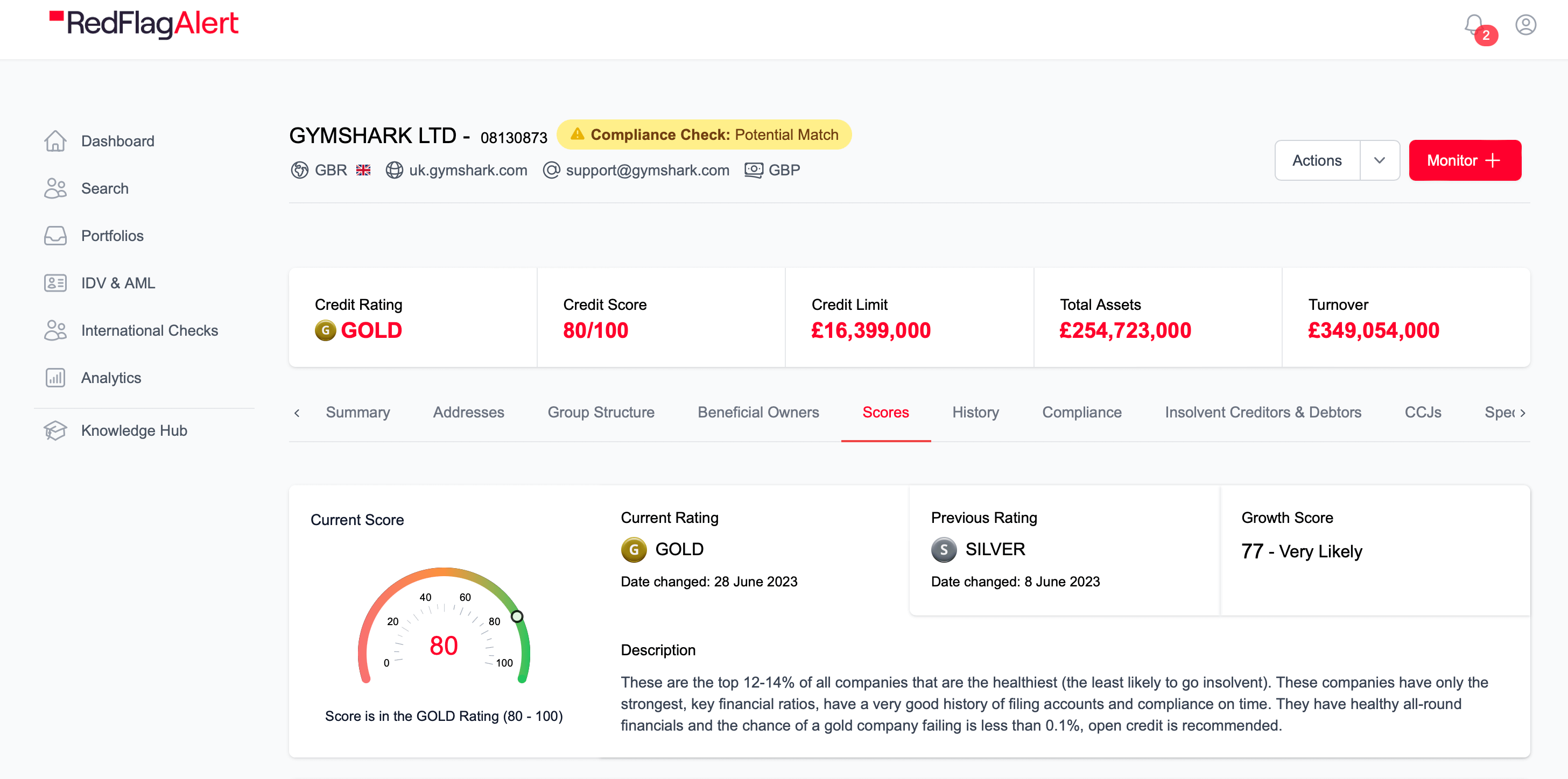

Using our Credit Monitoring tool, you can get real-time alerts the second something changes for a monitored company.

This allows you to identify potential credit risks early, reducing the likelihood of late or non-payments and bad debt. You can adjust credit limits and payment terms for customers, tailored to their evolving financial circumstances.

By monitoring prospective and existing customers, you can gain insight into their payment behaviour and creditworthiness. This supports strategic decision making regarding extending credit, setting credit limits, or adjusting pricing.

Using Red Flag Alert to track customer’s financial activities gives your business a competitive advantage by allowing you to extend credit to reliable customers and avoid risky ones. Along with our AML and IDV tools, businesses can protect themselves and detect fraud early, avoiding involvement with any potential illegal activity.

Save on costs and reduce the need for expensive borrowing to cover cash flow gaps caused by late payments or bad debt.

Effective invoicing

Accurate and timely invoices are a crucial step in your process; customers receiving bills promptly increases the likelihood of on-time payments. Clear payment terms help avoid confusion and disputes regarding when and how much should be paid.

In the UK, businesses are legally required to provide accurate invoices for tax and accounting purposes. Making sure they’re clear and on time not only helps with legal compliance but also can serve as an important document which can be crucial for resolving disputes.

Consistent and timely invoices set customer expectations for payment. It also demonstrates that your business is organised and values its customers, which will help you build trust.

Debt collection strategies

It’s very important to have a structured approach to collecting outstanding debts using customer segmentation. Categorising customers based on their payment history, current financial standing, and potential risk level means you can focus more resources on higher-risk accounts and potentially set up monitoring alerts for them.

It can also be useful to use data analytics to identify trends in payment behaviour and customer risk. Data-driven insights can inform your collection strategies, as well as seek feedback from customers on your credit control and debt collection processes which can provide insights into areas for improvement.

Using a combination of these suggestions should help your business avoid a situation involving bad debt and allow you to deal with outstanding debts quickly and easily.

Legal considerations

It’s important to be legally compliant, and for you to also understand the different pieces of legislation in place for you to utilise in the event of non-payment.

The main legislation for you to know includes:

- Consumer Credit Act 1974 (as amended)

- Financial Conduct Authority (FCA) regulations

- data protection act 2018, general data protection (GDPR)

- The late payment of commercial debts (Interest Act 1988 and the Late Payment of Commercial Debts Regulation 2013

- Consumer Rights Act 2015

- Bankruptcy and insolvency laws

- Statute of limitations

- Financial ombudsman service (FOS)

- Anti-money laundering regulations

- Competition and market authority (CMA) rules

- Unfair terms in consumer contract regulations

- Consumer credit (credit reference agency) regulations 2000

We strongly encourage you to seek legal advice when necessary.

Proactive

Get your procedures right before any problems crop up, to ensure that your business is out in front of any upcoming or unexpected issues.

Clear credit policies

There is a clear need for well-defined credit policies and terms to help set expectations for customers.

Your credit policies help you assess and manage risk effectively, ensure consistency in credit decisions and practices so your organisation is aligned. This significantly helps with risk mitigation e.g., shorter payment terms for higher-risk customers to protect against potential losses.

It also ensures that customers understand what’s expected of them, so you’re paid on time and customers are treated fairly and consistently. This fosters a positive relationship and trust, as customers can rely on transparent and predictable credit terms.

Credit application and screening

It’s crucial to perform thorough credit application processes, as company credit checks and customer screening can help identify potential risks.

Screening and credit checks assess creditworthiness by evaluating a customer’s financial history, credit score, and payment behaviour. This identifies high-risk customers such as those with a history of late payments.

By implementing a thorough check before extending credit, you can mitigate risk and tailor payment terms to higher or lower-risk clients.

Credit limits and terms

Setting appropriate credit limits is a critical aspect of credit control procedures. In the interest of fairness, but to make sure you protect your business from any losses, you must understand a customer’s creditworthiness after receiving a credit application form. It’s vital to research a company to establish favourable payment terms and look into industry benchmarks.

Automation and technology

Using automation streamlines your credit control processes, making them more efficient, accurate, and responsive.

Red Flag Alert provides in-depth company reports and ratings to help you make informed decisions using all available information. This makes your customer onboarding and credit limit management processes easy when used in partnership with our other tools.

Training and staff awareness

Ensuring all staff are informed and trained in your credit control procedures can contribute to successful credit control by mitigating risk, regulatory compliance, and alignment for accurate credit decision-making.

Final advice

There are lots of benefits to effective credit control procedures for a business’s financial health, the main one being improved cash flow management.

Timely payments from customers provide a predictable and steady stream of cash into the business which reduces the need for borrowing. In addition, this enhances financial planning, minimises bad debt risk, and supports growth.

After you’ve improved your credit control procedures, make sure to regularly review and adapt them. Risks are always changing so credit controls are constantly evolving, stay on top of them to protect your business

Why not find out how to manage credit risk?

To see for yourself how Red Flag Alert can help you efficiently manage your credit control procesdures, start your seven-day free trial today to protect your business from risk and see how we can help enhance your business activities.