There are many reasons why one company would acquire another – gaining market share, growing profitability and increasing control of the supply chain are all common reasons.

Other benefits include obtaining skilled employees, diversifying the products or services offered, or acquiring technology.

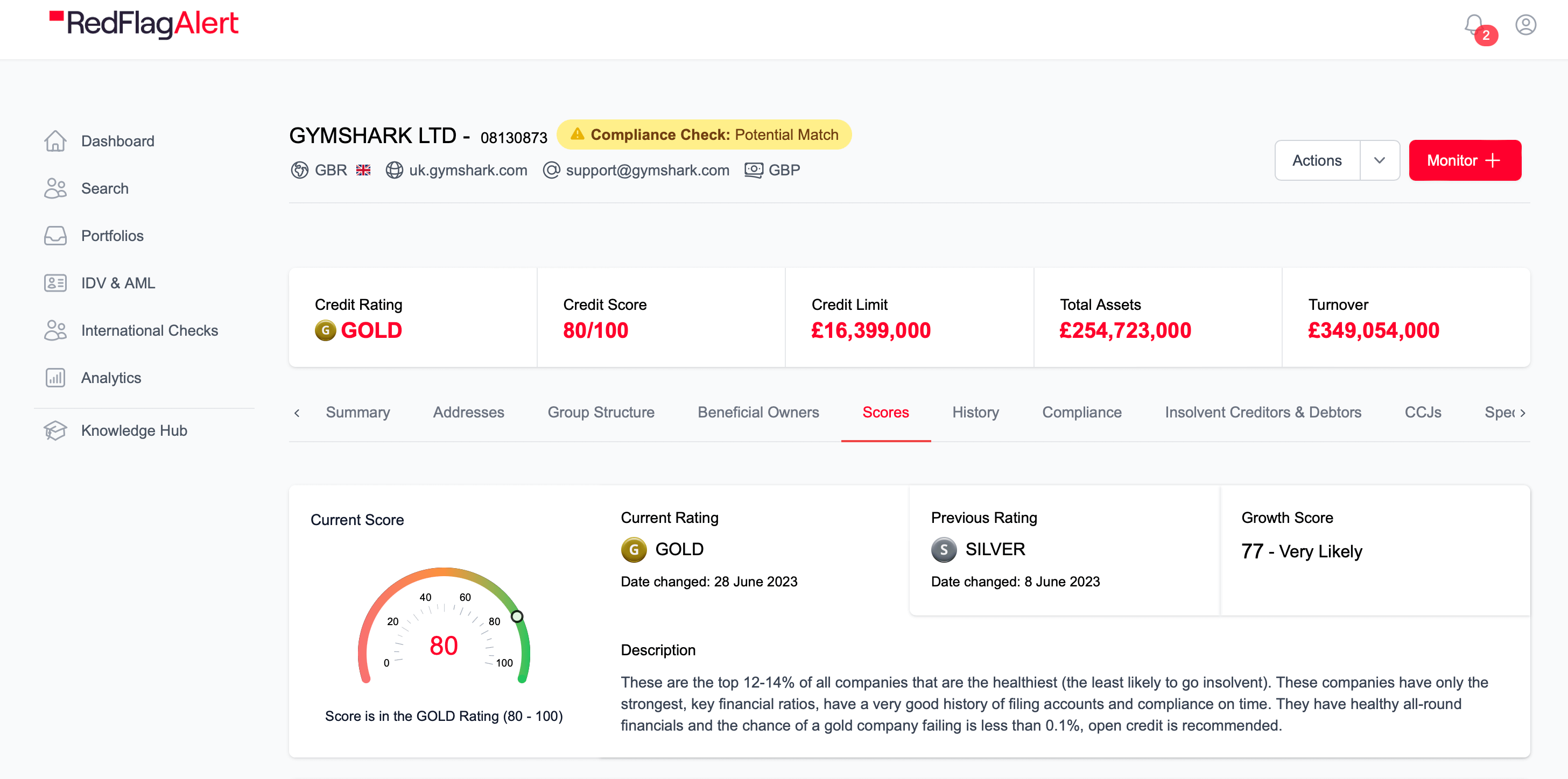

It is important that those looking to acquire a business have access to the information they need to make an informed decision on where to find acquisition targets. Red Flag Alert is a tool that provides detailed business intelligence on every business in the UK, making it the perfect partner for those looking to acquire.

Specifically, Red Flag Alert provides:

- Detailed information on every business in the UK, including financial information and contact details of key decision-makers.

- Historical data that shows how a business has performed and provides insight into trends over time.

- Data that is automatically updated daily based on information from ten market-leading data sources – that’s 100,000 data changes every day.

- An easy to read financial health rating that predicts how likely it is a company will go bust in the next 12 months.

- Ownership structures to determine the best people to approach regarding an acquisition.

- Detailed financial performance that provides insight into performance, potential and value.

This data can be used at all stages of the acquisition process, from helping companies find suitable targets, to performing in-depth due diligence once targets have been identified. Here is a further look at how Red Flag Alert can help with business acquisition.

Six Ways Red Flag Alert Can Help with Business Acquisition

1. Find Businesses That May Be Open to Acquisition

Red Flag Alert’s data set provides in-depth and filterable information on every business in the UK. This detailed data covers ownership, sector, size, location and detailed financial data.

Businesses looking to make an acquisition can build highly targeted searches to find companies that fit their acquisition profile. For example, businesses that are struggling financially may be more open to acquisition and at a preferable rate.

A business could be performing well from a sales and revenue point of view, but struggling to make debt payments. If the acquiring business has the capital needed to reduce debt payments, this could be a good investment.

2. Easily Create a List of Targets That Fit Your Profile

Businesses can use Red Flag Alert’s data to find businesses that fit the profile they are looking to acquire. For example, a manufacturer looking to save costs on supplies could search for a company that supplies the materials they need. They could then narrow these suppliers down by the area they operate in, and search for those within certain revenue parameters.

Red Flag Alert’s data is updated daily, which means decision-makers can make their choices based on the most relevant information.

3. Identify Businesses with Consistent or Improving Performance

Red Flag Alert’s financial data can also be used to reveal businesses with consistent or improving performance.

Businesses can use this to spot companies that are growing and have the potential to be worth more than they currently are. Perhaps a target company has grown to a certain level and plateaued – suggesting management may be unable to take the business to the next level.

As well as information about a specific business, Red Flag Alert users can look at other businesses within a sector to understand industry trends. They might deduce, for example, if the whole sector is growing, or if the company’s performance is bucking industry trends – critical data for an acquirer, especially if they are moving into a sector they are less familiar with.

A wider search of the industry could also reveal up-and-coming competitors that may have access to disruptive technology or potential issues that could appear within the supply chain.

4. Check Acquisition Targets are Financially Healthy

Red Flag Alert’s data gives businesses access to financial metrics that show whether or not a company is financially healthy. Data includes information on accounts and financial ratios. Business leaders can then use this to inform their acquisition decisions.

Additionally, Red Flag Alert gives every business in the UK an easy to understand flag rating that shows how healthy a company is and how likely it is to go bust in the next 12 months. This unique rating system is based on an algorithm that we have developed over 13 years. It is derived from dozens of indicators of financial health.

5. Search for Businesses with Directors Nearing Retirement

For business owners nearing retirement, selling their business is often an attractive way for them to see both a continuation of their work and receive a lump sum.

Searching for businesses with directors nearing retirement age may, therefore, be a good way to find companies open to an acquisition.

These businesses are often perfectly healthy and the only issue is that the director doesn’t want to continue to work.

Red Flag Alert makes finding this type of company easy as the data contains information about all company directors. It is possible to filter them based on age, revealing a list of possible acquisition targets.

6. Evaluate a Business’s Financial Profile

Red Flag Alert allows businesses to evaluate a company’s financial profile, including the level of debt it has taken on, its liquidity, and its profitability. This can help potential buyers identify risks or opportunities.

For example, a company with low profitability but good revenues may benefit from the economies of scale brought about by combining with an existing business, or save money due to the acquirers’ better technology.

7. Provide Data for Use During Due Diligence

Red Flag Alert can also be used by companies who have settled on a target as they begin to perform due-diligence to decide whether the company is worth acquiring.

The data can help companies decide if the business is financially secure and ensure it is headed in the right direction. It can also give important information about the management team and wider industry trends.

Red Flag Alert is the Perfect Tool for Businesses Looking to Buy

Red Flag Alert’s in-depth data makes it the perfect tool for businesses looking to make acquisitions. It can be used to search for companies that fit their target profile, check the finances of potential targets, and even spot those companies that may be open to investment.

Let us help you find and match your ideal customer profile, get a free 7 day trial today.